5 New Year's Resolutions All Retirement Savers Should Have

Key Points

- Some of the most rewarding New Year’s resolutions are those that benefit your financial future.

- Each year, it’s important to reassess your retirement goals, boost your contributions, reevaluate your asset allocation, and understand any rule changes.

- Madison Trust’s Self-Directed IRA Specialists can answer any questions you have along your retirement saving journey.

As we begin a new year, it’s nice to have the feeling of a fresh start and the promise of better days ahead. Many New Year’s resolutions are centered around physical and mental health goals such as going to the gym, eating more vegetables, drinking more water, reading more books, staying in touch with loved ones, and spending less time on social media.

It’s also important to consider how to improve your financial health this year. The American Psychological Association reported that concerns about inflation (83%), the economy (69%), and money in general (66%) were significant sources of stress for Americans last year. So, what can you do to better ensure your financial future?

Here are five popular New Year’s resolutions to help grow your Self-Directed IRA and reach your savings goals for retirement.

1. Reassess Your Financial Goals and Priorities

The last few years have taught us to expect the unexpected. The mix of the global pandemic, volatile stock market, inflation, and potential recession caused some to alter their strategy and goals for retirement.

The savviest investors do not solely rely on the stock market but add alternative assets like real estate or precious metals to their portfolio. This year, consider investing in assets that can provide a more reliable revenue stream.

Fun Fact:

Having a mix of standard Wall Street products and alternative assets can possibly mitigate any adverse effect the market can have on your retirement savings.

2. Review Your Retirement Saving Options

To encourage Americans to save for retirement, Congress passed the Employee Retirement Income Security Act of 1974 (ERISA), which helped establish a variety of tax-advantaged retirement accounts. Here are some of your options:

- Employer Plan (401(k), 403(b), or 457 plan) - These accounts are offered by your employer. Often, employers will match a certain percentage of the funds you contribute to incentivize retirement saving.

- Self-Employed Plan - Depending on your self-employed income, you can contribute to a Solo 401(k), SEP IRA, or profit-sharing plan.

- IRA (Individual Retirement Account) - In addition to contributing to a retirement plan at work, you can contribute to an IRA to boost your retirement savings.

- Self-Directed IRA - This type of IRA allows you to invest in alternative assets such as real estate, private equity, and precious metals that are not offered by standard IRAs.

Fun Fact:

For each of these accounts, you can select to save for retirement with tax-free growth (Roth IRA) or on a tax-deferred basis (Traditional IRA).

3. Boost Your 401(k) and IRA Contributions

If you were fortunate to receive a raise or bonus this year, you may be tempted to use the extra cash to buy the latest and greatest product. However, consider it an opportunity to boost your contributions to a tax-advantaged retirement account.

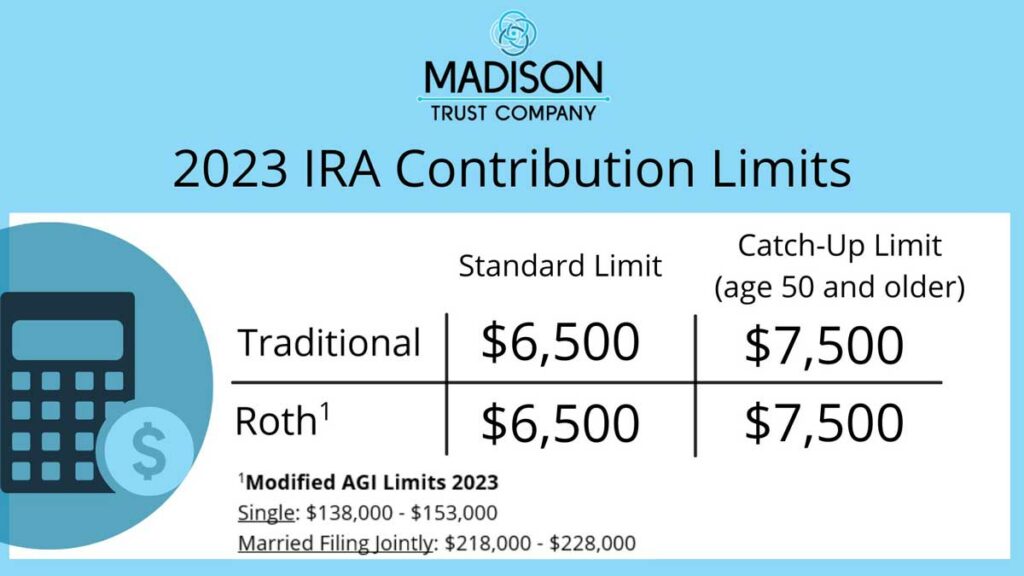

This year, the IRS increased the maximum amount that savers can contribute to their retirement accounts. In 2023, retirement savers can contribute up to $6,500 ($7,500 aged 50+) to an IRA and $22,500 ($30,000 aged 50+) to a 401(k).

If you cannot contribute the maximum, the goal should be to contribute as much as you can reasonably afford. The more time your money has to grow, the better you will be financially in your golden years.

Fun Fact:

You can set up automatic contributions that deduct funds from your paycheck and place them into your retirement account. This can relieve the stress of having to remember to keep up with your monthly contributions.

4. Reevaluate Your Asset Allocation

Just like going to a doctor for an annual checkup or getting your car’s oil changed, portfolio rebalancing is needed at least once a year to perform maintenance on your investments. Consider reevaluating your portfolio each year to ensure that your investments match your risk tolerance and that the level of return is on track to meet your savings goal for retirement.

Fun Fact:

Do not get hung up on buying or selling assets at the perfect time. This mindset can cause you to delay, which may cause you to lose out on investment growth that can be made over time.

5. Understand Retirement Plan Rule Changes

A new year often brings changes to the laws and regulations that govern retirement accounts and it’s important to stay up to date on any changes. Congress recently passed Secure Act 2.0, making several changes and updates to retirement plan rules and regulations.

Fun Fact:

In 2023 the age for required minimum distributions was raised from 72 to 73 years old. In addition, the penalties for failure to take RMDs was reduced from 50% of the withdrawal amount to 25%.

Staying on Track of Your Financial Resolutions

Conclusion: Let's Tie It All Up

Some of the most rewarding resolutions you can make are those that will benefit your financial future. Taking time each year to make resolutions and work towards them will keep you on the right track to a richer retirement. If you would like assistance, Madison Trust’s Specialists provide unparalleled client support and are ready to answer your questions as you plan for retirement. Best wishes as you embark on your retirement savings journey!

Disclaimer: All of the information contained on our website is a general discussion for informational purposes only. Madison Trust Company does not provide legal, tax or investment advice. Nothing of the foregoing, or of any other written, electronic, or oral statement or communication by Madison Trust Company or its representatives, is intended to be, or may be relied as, legal, tax, investment advice, statements, opinions, or predictions. Prior to making any investment decisions, please consult with the appropriate legal, tax, and investment professionals for advice.