- About

- Self-Directed IRA

- Sponsors Hub

- Assets

- Information Center

- Client Resources & Forms

- Contact Us

close

- About

- Self-Directed IRA

- Sponsors Hub

- Assets

- Information Center

- Client Resources & Forms

- Contact Us

close

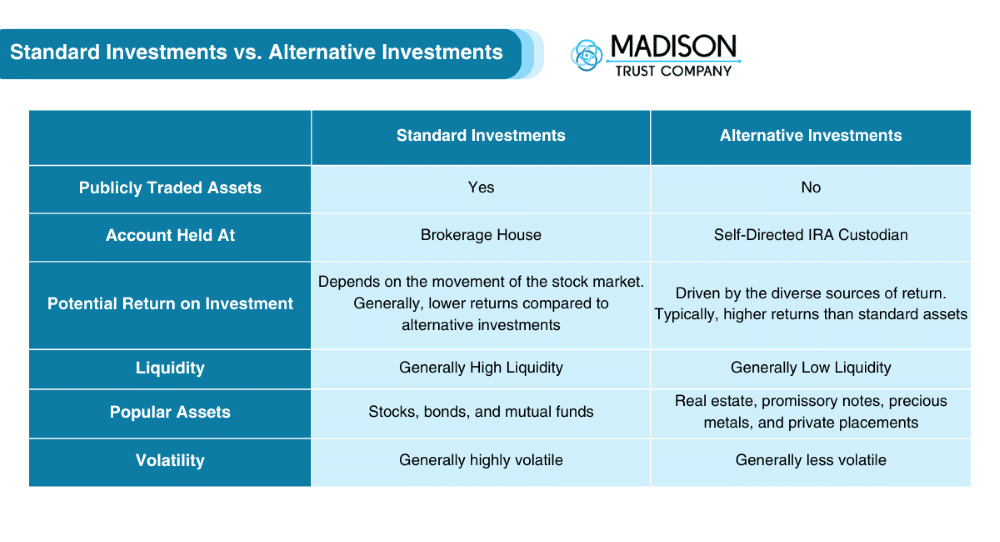

Alternative investments, also known as alternative assets, are financial assets that do not fall into the standard investment category of stocks, bonds, and mutual funds. Alternative investments can potentially complement your standard investments in your retirement portfolio. They can also hedge against inflation and potentially create higher returns.

There are a variety of exciting alternative investment opportunities that standard IRAs typically do not offer. Some alternative investments examples include real estate, precious metals, private equity, and promissory notes.

Alternative investments can complement your standard investments, diversify your retirement portfolio, and potentially reduce overall risk.

Historically, alternative investments tend to outperform standard Wall Street products and can provide a hedge against the stock market.

Utilize your expertise to invest in assets you understand and believe in, whether that be real estate, precious metals, or another alternative investment.

When you invest in alternative investments with your Self-Directed IRA (SDIRA) you can grow your retirement savings within a tax-advantaged account.

Diversification

A diversified retirement portfolio includes a wide range of assets, including both standard assets and alternative investments, to reduce overall risk.

Potential for

High Returns

Historically, alternative investments have generally provided larger and more stable returns than standard investment products.

Tax Advantages

When you invest in alternative investments through a Self-Directed IRA, you can receive tax-deferred (Self-Directed Traditional IRA) or tax-free (Self-Directed Roth IRA) growth.

Tangible

Many alternative investments are physical assets, which can potentially avoid the negative effects of market fluctuations by generally maintaining their value as tangible assets.

Greater Choice

Utilize your expertise to invest in an asset you understand, believe in, and can help achieve your retirement goals.

Hedge Against Inflation

Alternative investments typically have a low correlation with standard assets. Generally, if the value of stocks decreases, the value of alternative investments increases (and vice versa), providing likely insurance against inflation and economic crisis..

With an SDIRA, you can buy almost any alternative asset. The only assets that the IRS excludes are life insurance, collectibles, and S-corporations. Here are some types of alternative investments you can invest in with a Self-Directed IRA:

Self-Directed IRA account holders do not need to file an annual tax return for their IRA funds. However, you must provide your SDIRA custodian with the fair market value of your account each year.

Since the intended use for your SDIRA investments is to grow your retirement funds in the long-term, your SDIRA may be subject to taxes if it generates business or trade income that is not related to the tax-exempt purpose of the organization (Unrelated Business Income Tax) or if debt is leveraged to purchase an asset (Unrelated Debt Financed Income).

Besides investing in precious metals, you can also withdraw your bullion and take direct physical possession of it. If you take a distribution before age 59½, you will have to pay tax and early distribution penalties. The type of metal you receive at distribution depends on how you select to store your metals (segregated or non-segregated).

Segregated Storage – the exact metal you purchased is what you will receive if you sell them or do an in-kind distribution.

Non-Segregated Storage – When you sell metals or complete an in-kind distribution, you may receive "like" metals, which are not the exact metals you purchased. For example, you may purchase 2018 silver American eagles. When you take a distribution, you may receive different 2018 silver American eagles or silver American eagles from a different year.

Anyone can open a Self-Directed IRA. SDIRA contributions must be made with earned income. Some investments, such as specific private equity investments, may require you to be an accredited investor.

On the other hand, other alternative investments such as precious metals and promissory notes generally have an easier entry point.

In addition, there are investment opportunities like crowdfunding and private REITs that pool capital together from several investors to purchase typically larger, more costly alternative investments.

Like any investment, alternative investments may involve risk. However, savvy investors recognize that higher risks can lead to higher rewards. It is best practice to speak with a financial professional to determine if alternative investing is right for you. For more information regarding the risk associated with SDIRAs, visit Self-Directed IRA Investor Alert Response.

Complete a Distribution Request Form. If you are distributing an asset, please submit a third-party certified value (i.e., an appraisal, letter from an investment sponsor, CPA-certified valuation, etc.). Depending on the asset, additional documents may also need to be submitted.

After the documents are submitted and approved, Madison Trust will send you an Assignment of Interest. This documents the transfer of ownership from your IRA to your personal possession.