- About

- Self-Directed IRA

- Sponsors Hub

- Assets

- Information Center

- Client Resources & Forms

- Contact Us

close

- About

- Self-Directed IRA

- Sponsors Hub

- Assets

- Information Center

- Client Resources & Forms

- Contact Us

close

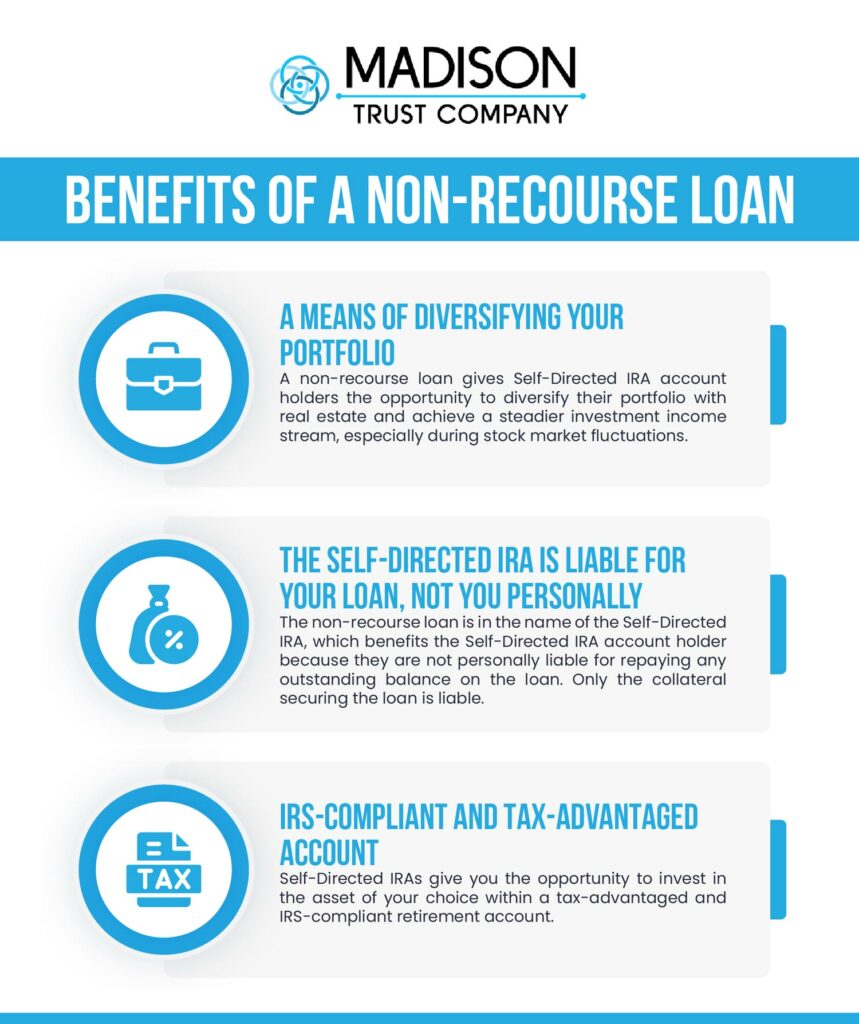

A non-recourse loan is a type of loan where the IRA account holder is not personally liable for repaying any outstanding balance on the loan. Instead, the loan is in the name of the Self-Directed IRA, not the account holder, and it is secured only by collateral, typically the property being purchased. A non-recourse loan provides many Self-Directed IRA account holders a way to further diversify their portfolio with real estate.

The non-recourse lending program gives you the opportunity to invest in a variety of property types including residential, commercial, industrial, and multi-family homes. Visit How To Invest in Real Estate with a Self-Directed IRA Non-Recourse Loan for further information regarding the non-recourse lending program and non-recourse loan options.

The processing time is typically 3 - 6 weeks from application to closing, depending on the title work. The approval for the loan takes place within 7 days.

The non-recourse lending program combines our expertise with Self-Directed IRAs, unmatched client support, and fixed rates so you can seamlessly invest in the property of your choice.

The details of the non-recourse lending program are as follows:

• Loan Amounts: $100,000 - $499,999 (will consider larger requests)

• Term:

• Loan Term: 3 - 5 years

• Amortization: Up to 25 years

• Loan Rate: Prime +

• Loan-to-Value: 65% ±

• Debt Service Coverage Ratio: 1.25% +

Below is an approximation of the fees for a non-recourse loan.

• Origination Fee: 2%

• Closing Costs (title, filings, etc.): Typically between $2,500 - $5,000

When an IRA uses leverage to purchase an investment, then the earnings attributable to the leveraged portion are subject to UDFI (Unrelated Debt Financed Income). The filing of Form 990-T is required.