Buying an Airbnb with your Self-Directed IRA

Written by: Daniel Gleich

Key Points

- Buying a short-term rental and renting it on platforms like Airbnb and Vrbo is possible with a Self-Directed IRA.

- Understanding the difference between a long-term and short-term rental can maximize your investment.

- Before investing in a short-term rental, it's important to do your own due diligence and speak to your tax advisor

One question that comes up when planning a vacation these days that was not a consideration 10 years ago is: Hotel or Airbnb?

Using short-term rental options like Airbnb, Vrbo and HomeAway is increasingly popular with travelers looking for different spaces, amenities, and price options.

Consequently, running short-term rentals through platforms like the aforementioned is a popular side hustle option for many investors.

Can You Invest in an Airbnb with Your Self-Directed IRA?

A Self-Directed IRA is a retirement account that allows you to invest in alternative investments that are not Wall Street-based. With a Self-Directed IRA you can invest in precious metals, private placements, and in this case, real estate.

Like all other transactions within a SDIRA, compliance is key, so knowing which regulations may be relevant is important to be aware of before you invest. Once you know what you are looking out for, invest away.

Let us explore the considerations and the process to invest in a short-term rental, Airbnb-style, property.

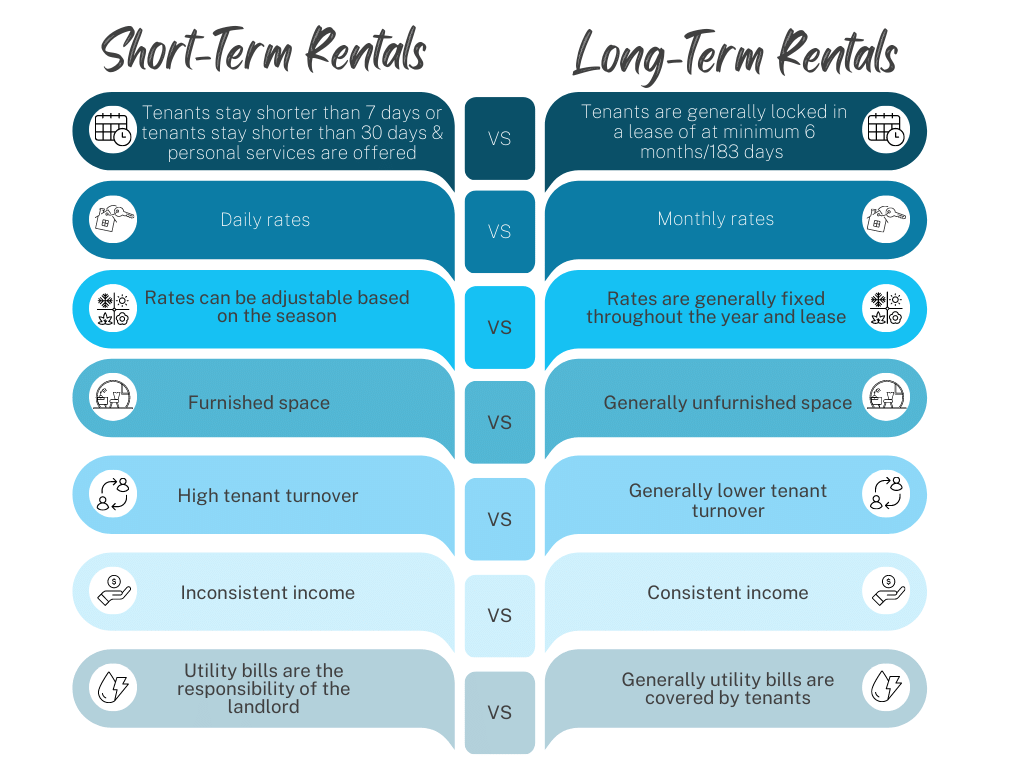

Short-Term Rentals versus Long-Term Rentals: What’s the Difference?

Short-term rentals can potentially demand significantly higher daily rates than long-term rentals do with their monthly rates, making short-term rentals potentially highly lucrative when occupancy rates are high.

Short-term rentals can also charge higher rates based on seasonality. While long-term rental rates tend to remain consistent throughout the year and lease period.

The obvious next question is, can you do it with your Self-Directed IRA

The short answer is, YES!

Short-Term Rentals: Things to Consider Before Investing

There are two ways to define a short-term property.

- A stay shorter than 7 days.

- A stay shorter than 30 days where personal services are offered.

At its core, short-term rentals are just another real estate class. Therefore, at the beginning stages a short-term rental is treated like any other real estate property held within a SDIRA.

- The IRA must be listed as the owner of the property.

- The property must be purchased with IRA funds and if needed, leveraged with a non-recourse loan.

- The Disqualified Persons rule applies so you and other disqualified people, like your spouse or other lineal relatives cannot benefit from the property.

- You cannot personally do any work on the property. You may want to consider hiring a property manager to manage all of your listings.

Tax and Fee Considerations

Most states and municipalities consider short-term rentals like Airbnb to be like hotels, motels, and similar lodging options, and tax it with that consideration.

For example, in the state of Florida there is a tax of 6% on the listing price including cleaning fees for rentals that are shorter than 183 nights.

Some cities or municipalities require permits for short-term rentals that need renewal yearly.

Another factor to consider are hosting platform fees. For example, Airbnb charges a service fee for each booking usually ranging from 3-15% of the total reservation cost. As with any investment, it's important to do your own due diligence and speak with a tax advisor before making any investment decisions.

UBIT Considerations

When considering the purchase of an Airbnb for a Self-Directed IRA, one of the most important considerations is UBIT, or Unrelated Business Income Tax. This tax applies to income generated from a trade or business that is not substantially related to the primary purpose of a tax-exempt account, like an IRA.

To learn more about UBIT, watch our explainer video. To be on the safe side, there are two ways to avoid incurring UBIT with a short-term rental.

- When a rental is shorter than 7 days, the investment may be considered active. Consult with a tax specialist for guidance. You can potentially sidestep it by only offering stays 7 days or longer to avoid the UBIT trigger.

- The other is not offering personal services that can be found in Airbnb rentals, like cleaning services, tours, or cooked meals. These services are out of the scope of the original investment: rental property and would therefore be subject to UBIT.

UBIT should not necessarily deter you from investing your Self-Directed IRA in alternative assets. Many investors miss out on profitable opportunities because they are unfamiliar with UBIT. Investing in alternative assets, rather than traditional investments, with a Self-Directed IRA creates a diversified portfolio and the opportunity to increase your IRA funds.

How to Invest in an Airbnb with a Self-Directed IRA

Once you have chosen a short-term rental property to invest in with your SDIRA, you will complete the following steps:

Putting It All Together

Like all investments, there are risks and benefits to owning a short-term rental. Familiarizing yourself with the ins and outs of the regulations that are unique to short-term rentals will set you up for success.

To learn more about investing in short-term rentals or other types of real estate, schedule a call with one of our Madison Trust Specialists!

Disclaimer: All of the information contained in our website is a general discussion for informational purposes only. Madison Trust Company does not provide legal, tax or investment advice. Nothing of the foregoing, or of any other written, electronic or oral statement or communication by Madison Trust Company or its representatives, is intended to be, or may be relied as, legal, tax, investment advice, statements, opinions or predictions. Prior to making any investment decisions, please consult with the appropriate legal, tax, and investment professionals for advice.