Can You Take Money Out of a Self-Directed IRA?

Written By: Daniel Gleich

Key Points

- You can take money out of a Self-Directed IRA, but there are certain distribution rules to be aware of.

- If you’ve opened your Self-Directed IRA as a Traditional IRA, you’ll need to take the Required Minimum Distribution (RMD) each year after the age of 73. If your Self-Directed IRA is a Roth IRA, the annual RMD does not apply.

- The IRS grants certain exceptions to the early withdrawal penalty. It’s best to view the full list of exceptions on the IRS website and consult a tax professional if you believe you may be eligible for an exception.

Tapping into the freedom and control of a Self-Directed IRA can bring its fair share of questions regarding what types of assets you can invest in, how to open a Self-Directed IRA, and whether you can take money out of a Self-Directed IRA.

In some ways, a Self-Directed IRA is much different than a standard IRA, especially when it comes to the investments allowed. With a Self-Directed IRA, you can invest in real estate, promissory notes, precious metals, and many other alternative assets. Meanwhile, a standard IRA is limited to stocks, bonds, and mutual funds.

In other ways, a Self-Directed IRA works no differently than a standard IRA. That’s also the case for distributions. Just like with a standard IRA, you can take money out of a Self-Directed IRA—of course being mindful of early withdrawal penalties and proper tax reporting. Here are the answers to common questions involving Self-Directed IRA distributions:

When Can You Withdraw Funds from a Self-Directed IRA?

To avoid the early withdrawal penalty, you will ideally wait until you’re 59 ½ years old to begin taking distributions from your Self-Directed IRA. After the age of 59 ½, you can take advantage of the tax benefits that your IRA offers, whether it’s a tax-deferred Traditional IRA or a tax-free Roth IRA.

Life happens, and sometimes, unexpected circumstances arise. You may see the need to pull money from your IRA earlier than expected for an emergency or if your finances become tight. If that occurs, you can take money out of your Self-Directed IRA. You may have to pay the early withdrawal penalty.

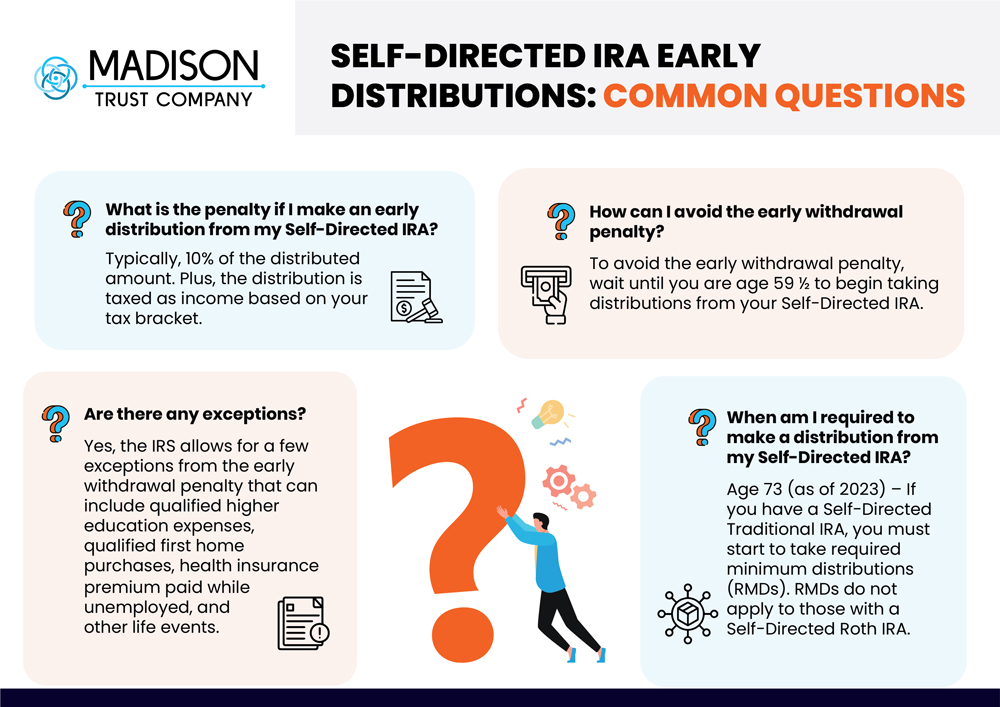

What Is the Self-Directed IRA Early Withdrawal Penalty?

The early withdrawal penalty for any IRA is usually 10 percent of the distributed amount. The distribution is also taxed as income based on your tax bracket. Keep in mind that a passive custodian like Madison Trust will not be responsible for applying the penalty to your distribution. It will need be included in your tax planning and filing.

What Are the Self-Directed IRA Early Withdrawal Exceptions?

The IRS offers exceptions to the 10 percent withdrawal penalty on early distributions. For example, higher education expenses and first-time homebuyers can potentially qualify for the penalty to be waived. See the full list of early withdrawal exceptions as provided by the IRS. Again, these apply to all IRAs, including Self-Directed IRAs.

Do Self-Directed IRAs Have Required Minimum Distributions?

If you’re switching from a Traditional Wall Street IRA to a Self-Directed IRA, you may be wondering if you’ll still need to take a Required Minimum Distribution (RMD) once you turn 73. Yes, the RMD equally applies for a Self-Directed IRA, and you’ll take the RMD each year from age 73 onward. Calculating the RMD can be somewhat confusing, so consider working with your accountant or financial advisor to take the correct amount or you can call Madison Trust.

The RMD does not apply to Roth IRAs, including those that are Self-Directed IRAs, since you’re paying taxes when making contributions. Foregoing the RMD is one of the benefits of a Roth IRA for those who want to keep growing their savings well into retirement age.

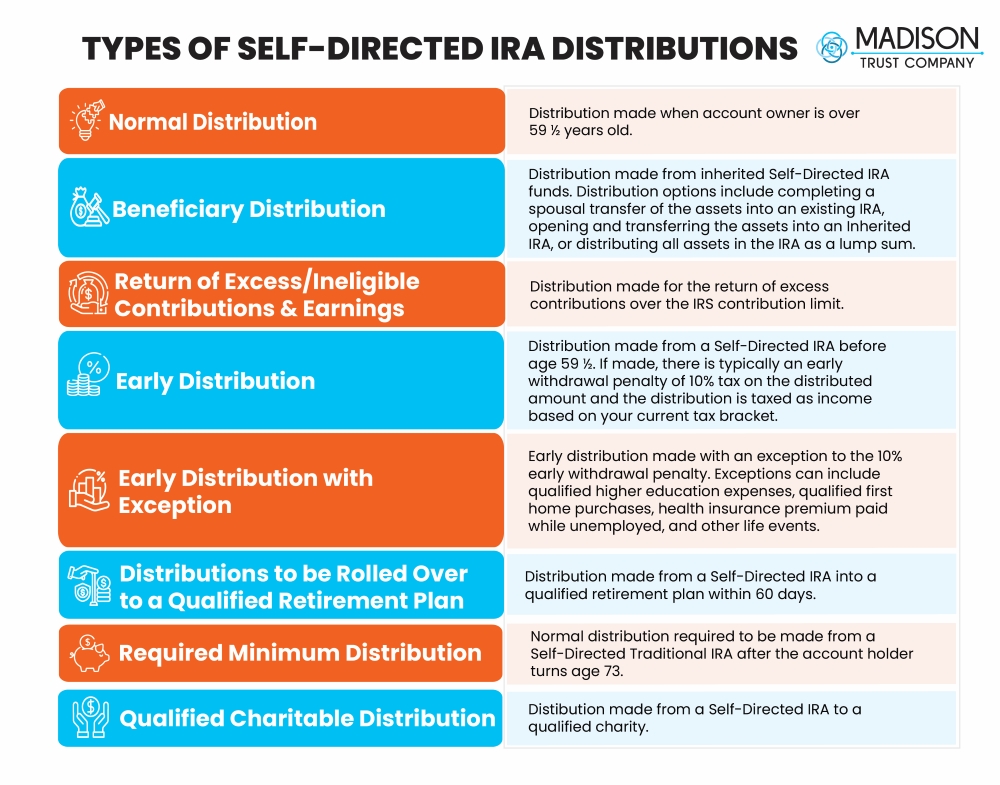

What Are the Types of Self-Directed IRA Distributions?

Know the Rules for Self-Directed IRA Distributions

Before taking any type of distribution from your Self-Directed IRA, whether you’re taking cash or distributing an asset, it’s important to know the rules of Self-Directed IRA distributions. Any distribution from a Self-Directed IRA must also go through the designated Self-Directed IRA custodian. Learn more about the Self-Directed IRA distribution rules.

Looking to speak with a Self-Directed IRA Specialist about taking money out of your retirement account?

Disclaimer: All of the information contained on our website is a general discussion for informational purposes only. Madison Trust Company does not provide legal, tax or investment advice. Nothing of the foregoing, or of any other written, electronic or oral statement or communication by Madison Trust Company or its representatives, is intended to be, or may be relayed as, legal, tax, investment advice, statements, opinions, or predictions. Prior to making any investment decisions, please consult with the appropriate legal, tax, and investment professionals for advice.