Directed Trust: The Case for South Dakota

Key Points

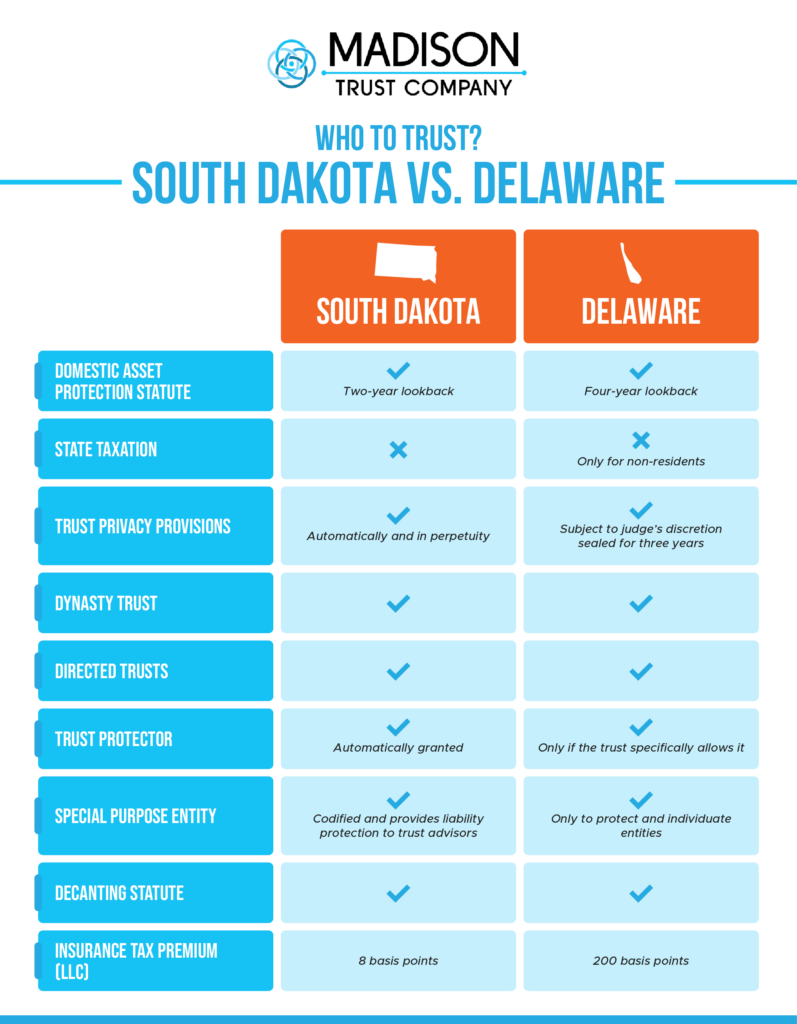

- Delaware has long been the go-to state for trusts, but South Dakota has surpassed it legislatively making it a better state to form trusts.

- Focusing on trust aspects like fiduciary liability, decanting, dynasty, asset protection and privacy, South Dakota ranks higher than Delaware.

- South Dakota’s focus as a business-centric state is attracting investors; they will likely continue this trend to create an even more business-friendly environment in the future.

When creating trusts, particularly Directed Trusts, individuals tend to use Delaware almost reflexively on the East coast.

While Delaware is a solid choice, since 1984, South Dakota has been on the legislative foreground in trust law. Potential trustees and financial advisors would be well served to take a close look at the advantages South Dakota offers!

There are various elements of trusts to consider as different regulations can affect a trust’s ability to grow, transfer assets, and affect its ease of management. Comparing the most common and important variations, savvy individuals can easily see how South Dakota has claimed the title of “Best State to Create a Trust” according to Trust & Estate Magazine (Jan, 2022).

Decanting

South Dakota: #1

Delaware: #3

Definition: Decanting is the flexibility of a trust to distribute trust assets into another trust with different terms than the original trust.

Similarities: Both states allow for decanting without the need for court approval, provided that certain conditions are met. In both states, the trustee must give notice to interested parties, including the grantor, beneficiaries, and any co-trustees, and must follow specific statutory procedures for the decanting process.

The South Dakota Difference: South Dakota's laws on trust decanting are generally considered to be more flexible than Delaware's. South Dakota has fewer statutory restrictions on the power to decant and allows for more expansive powers to be included in the trust instrument. Additionally, should court intervention be required to modify a trust, South Dakota courts are both expedient and cost effective compared to Delaware courts.

Dynasty Trust

South Dakota: #1

Delaware: #7

Definition: A Dynasty Trust allows the trust and its assets to be passed on through generations without incurring taxes (i.e., gift, estate, inheritance, and generation skipping transfer).

Similarities: Both states have favorable laws regarding dynasties as well income tax regulations that benefit trusts and their beneficiaries.

The South Dakota Difference: South Dakota has no limit on the duration of a dynasty trust, meaning it can last for hundreds of years in perpetuity. Additionally, South Dakota has no state income tax, which can provide significant tax savings for beneficiaries. While Delaware does not assess income tax on non-residents, there are exceptions, and its coverage is not as robust as South Dakota’s coverage.

Asset Protection

South Dakota: #1

Delaware: #6

Definition: Asset Protection refers to a trust’s ability to hold assets for protection from creditors and lawsuits.

Similarities: Both states offer strong asset protection. The lookback to qualify for asset protection is relatively short compared to other states.

The South Dakota Difference: In South Dakota, the lookback is only two years versus the four-year lookback in Delaware. Furthermore, in South Dakota, there are no restrictions on the type of assets that can be placed in a trust.

Trust Protector Statutes

Definition: A Trust Protector is a person whose sole purpose is to protect the trust from actions that may be against the best interests of the trust’s purpose and its beneficiaries.

Similarities: Both Delaware and South Dakota have trust protector statutes to protect the integrity of the trust.

The South Dakota Difference: In Delaware, a trust protector can only be implemented if the trust specifically allows for one. However, in South Dakota, a trust protector is automatically granted, offering trustees and beneficiaries more protection.

Special Purpose Entity (SPEs)

Definition: Special Purpose Entities silo assets into separate entities protecting them from each other. In the case that one asset doesn’t perform, the others are protected from liability, creditors, bankruptcy, and the like.

Similarities: Special Purpose Entities are available in both states.

The South Dakota Difference: South Dakota takes the concept and evolves it into an iteration that shields individuals, not only entities, from potential individual liability (i.e., investment and distribution committee members, trust protectors and family advisors, etc.). South Dakota also has this statute legislated, unlike Delaware.

Income Tax

Definition: Income Tax is a tax paid on the income the trust generates.

Similarities: Both states offer income tax benefits, however there are significant differences. Delaware has a state fiduciary income tax. There is a full exemption if the income is accumulated for beneficiaries who are not Delaware residents. However, for trusts that own real estate in Delaware, even if the trustees and beneficiaries live out-of-state, trust assets may be subject to income tax.

The South Dakota Difference: South Dakota does not have a state income tax, saving money for both trusts and individuals.

Privacy

South Dakota: #1

Delaware: #3

Definition: Privacy in context of trusts refers to who has access to the information on the trust creation, details, if court proceedings are necessary and the assets it holds.

Similarities: Both South Dakota and Delaware have statutes permitting silent trusts which allow for trustees to create a trust without informing the beneficiaries until a set time.

The South Dakota Difference: South Dakota statutes allow for automatic and perpetual seal on all court litigation and codification. In Delaware, a judge has the discretion to grant a seal, but it is not automatic nor is it perpetual, expiring after only three years.

And the Winner is…

While Delaware has long been known as a business-friendly state, South Dakota has emerged as a leader in the world of trusts. With favorable laws regarding decanting, dynasty trusts, asset protection, and privacy, South Dakota offers a compelling option for those looking to establish trusts. Additionally, the state’s strong trust industry and top rankings in various studies indicate its reliability and competitive option for trust administration.

Want to Learn More How You Can Benefit from a Trust?

If you're looking to take a deeper dive into Directed Trusts, watch our latest webinar replay!

Disclaimer: All of the information contained in our website is a general discussion for informational purposes only. Madison Trust Company does not provide legal, tax or investment advice. Nothing of the foregoing, or of any other written, electronic or oral statement or communication by Madison Trust Company or its representatives, is intended to be, or may be relied as, legal, tax, investment advice, statements, opinions or predictions. Prior to making any investment decisions, please consult with the appropriate legal, tax, and investment professionals for advice.