How To Convert a Traditional IRA to a Self-Directed IRA

Written By: Daniel Gleich

Key Points

- You can convert a Traditional IRA to a Self-Directed IRA by completing an IRA-to-IRA transfer.

- Self-Directed IRAs allow you to gain control of your investments and diversify your portfolio.

- Madison Trust Specialists can guide you every step of the way so you can complete a successful transfer of funds to your Self-Directed IRA.

When it comes to saving for retirement, there are many plans you can choose from including standard IRAs, Self-Directed IRAs, 401(k)s, and more. Once you select a retirement account, you also get to choose when you would like to receive tax advantages and set up an account that corresponds with your selection - Traditional, Roth, SEP, SIMPLE, or an inherited account.

But what happens if you already have a retirement account, and are looking to open an account that allows for more investment opportunities and control of your assets? Let’s explore this topic further and address how to convert a Traditional IRA to a Self-Directed IRA.

Can You Convert a Traditional IRA to a Self-Directed IRA?

Yes! It is simple to convert your Traditional IRA to a Self-Directed IRA. However, there are some key rules to be aware of before transferring funds.

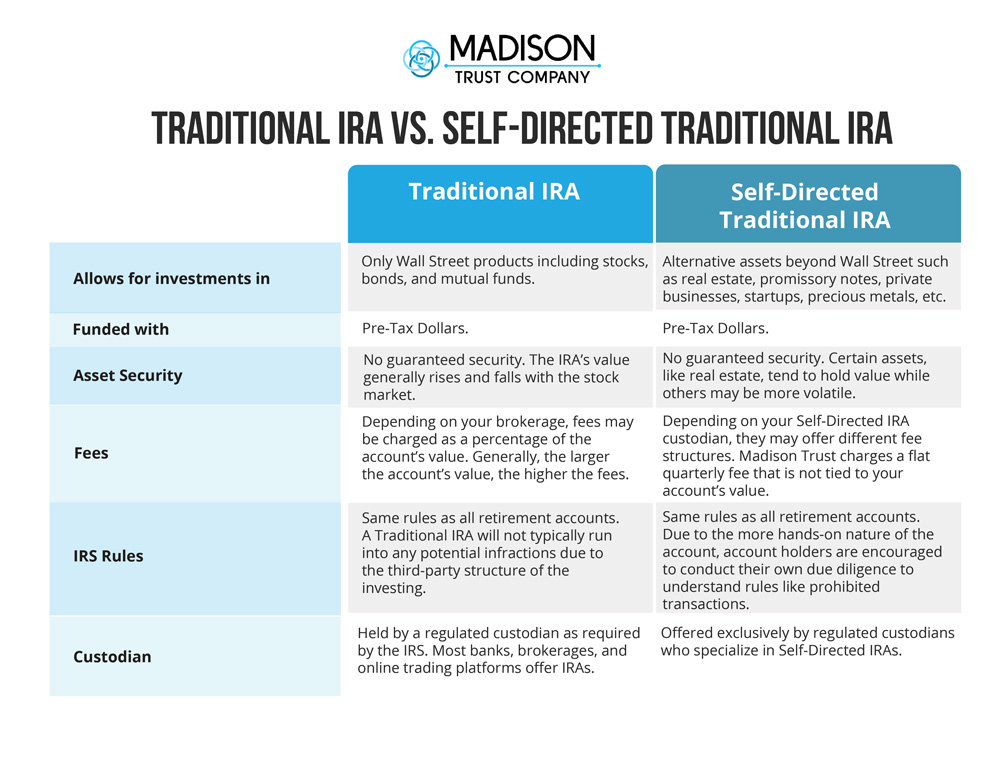

Traditional IRA vs. Self-Directed IRA

First, let’s explore what is the difference between a standard Traditional IRA and a Self-Directed Traditional IRA.

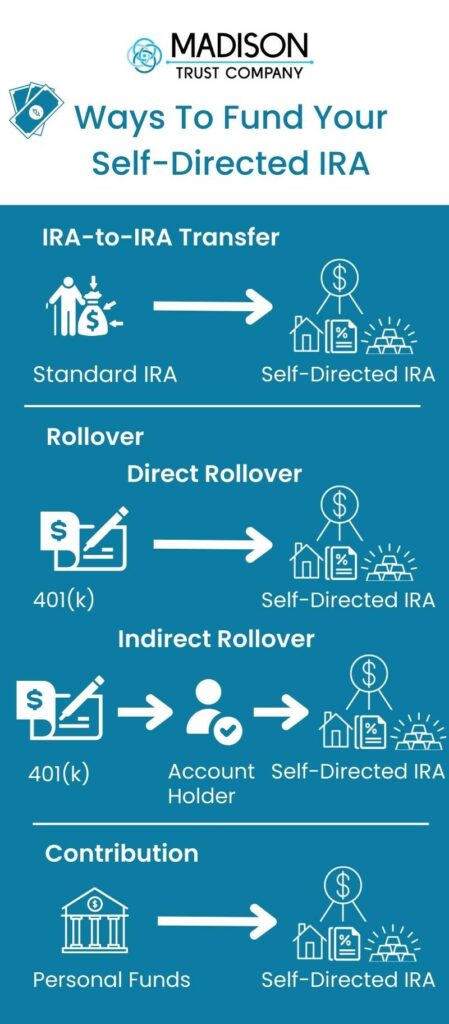

Ways To Fund Your Account

Once you decide to gain control of your investments with a Self-Directed IRA, the next step is to fund your new account. There are three ways you can fund your account: transfer, rollover, and contribution. The type of account you already have affects how you will move your funds into your Self-Directed IRA.

1. Transfer

If you have an existing IRA set up at a bank or brokerage, you can complete an IRA-to-IRA transfer to move the funds directly into your new Self-Directed IRA. A transfer is a direct transfer from your bank or brokerage directly into your Self-Directed IRA. It is a tax-free transaction and does not require any IRS reporting.

2. Rollover (Direct Rollover or Indirect Rollover)

If you have an existing 401(k), 403(b), or another qualified retirement plan at another financial institution, you may fund your account through a rollover. You initiate the rollover by contacting your Plan Administrator and asking them to send funds to your new Self-Directed IRA. You can either complete a direct rollover or an indirect rollover. For more information, visit The Self-Directed IRA Rollover - A Complete How-To Guide.

3. Contribution

If you do not have an existing retirement account, you can fund your new Self-Directed IRA by contributing personal funds.

When funding your Self-Directed IRA, it is important to note that the ability to move your funds depends on the account types you are transferring to/from. For example, you can transfer a Roth IRA to a Self-Directed Roth IRA, but you cannot transfer a Roth IRA to a Self-Directed Traditional IRA. Refer to the IRS’s rollover chart to see how you can – and cannot – move your retirement funds.

How Can You Convert a Traditional IRA to a Self-Directed IRA

You can move your Traditional IRA funds to a new Self-Directed Traditional IRA in just a few simple steps:

1. Open a Self-Directed IRA by completing Madison Trust’s easy online application.

2. Fund Your Account - To transfer cash or assets in-kind from another IRA custodian to Madison Trust, please complete a Transfer Authorization Form. Once you fill out the form, Madison Trust will send the request directly to the custodian currently holding your funds. The funds will move directly from your previous custodian to Madison Trust via check or wire, depending upon your selection.

3. Invest Your Funds by instructing Madison Trust Company to issue a check or a wire to the investment of your choice.

Can I Transfer Funds from a Traditional IRA to a Self-Directed Roth IRA?

Although, the IRS does not allow you to transfer from a Traditional IRA directly into a Roth IRA. However, there are a few ways you can indirectly add traditional funds to a Roth IRA:

- First, you’ll convert your Traditional IRA to a Roth IRA at your previous custodian. Then, you’ll directly transfer your current Roth IRA to your new Self-Directed Roth IRA.

- Open a Traditional IRA with Madison Trust, transfer your funds, and then complete a Roth Conversion to convert your funds to your Roth account.

Conclusion: Let's Tie It All Up

Our team members at Madison Trust are experts in Self-Directed IRAs. If you work with us to transfer your funds to a self-directed account, you can be confident that we’ll guide you every step of the way. We’ll ensure you know which account funding option is best for you and take you through the steps to complete a successful transfer.

Schedule a call to chat with one of our Self-Directed IRA Specialists and we’ll assist you in switching to a Self-Directed IRA so you can explore the world of opportunities to grow and diversify your retirement portfolio.

Disclaimer: All of the information contained in our website is a general discussion for informational purposes only. Madison Trust Company does not provide legal, tax or investment advice. Nothing of the foregoing, or of any other written, electronic or oral statement or communication by Madison Trust Company or its representatives, is intended to be, or may be relied as, legal, tax, investment advice, statements, opinions or predictions. Prior to making any investment decisions, please consult with the appropriate legal, tax, and investment professionals for advice.