IRS Tax Tips for Retirement Accounts

Key Points

- Typically, Self-Directed IRAs are not subject to annual taxes since most alternative investments are passive.

- It’s important to take time to consider the possible ways to lower your tax bill and save for retirement.

- The IRS offers taxpayers tools that can make their filing easier, such as an interactive tax assistant, refund tracker, and a variety of consumer-friendly educational articles.

- Madison Trust’s Self-Directed IRA Specialists are here to answer your questions regarding self-directed investing.

Although not a favorite season for some, tax season is here and in full swing! This year's tax filing deadline is Monday April 15, 2024.

Understanding tax rules is important for both young taxpayers and retirees since decisions you make now can affect your future tax bill. Whether you are filing your tax return yourself or are working with a financial professional, it is critical to review the IRS’s tax rules so you are properly prepared to file and can maximize potential tax savings. Here are a few points to keep in mind as you complete your tax return:

Tax Considerations for Self-Directed IRAs

UBIT and UDFI

Typically, standard IRAs and Self-Directed IRAs are not subject to annual taxation. However, some active investments, such as a real estate flipping or a business that sells goods and services, may incur UBIT (Unrelated Business Income Tax).

Another occurrence that may cause your Self-Directed IRA to be subject to tax is when leverage is used to finance an investment in your IRA. In this case, your IRA would be subject to UDFI (Unrelated Debt Financed Income) tax.

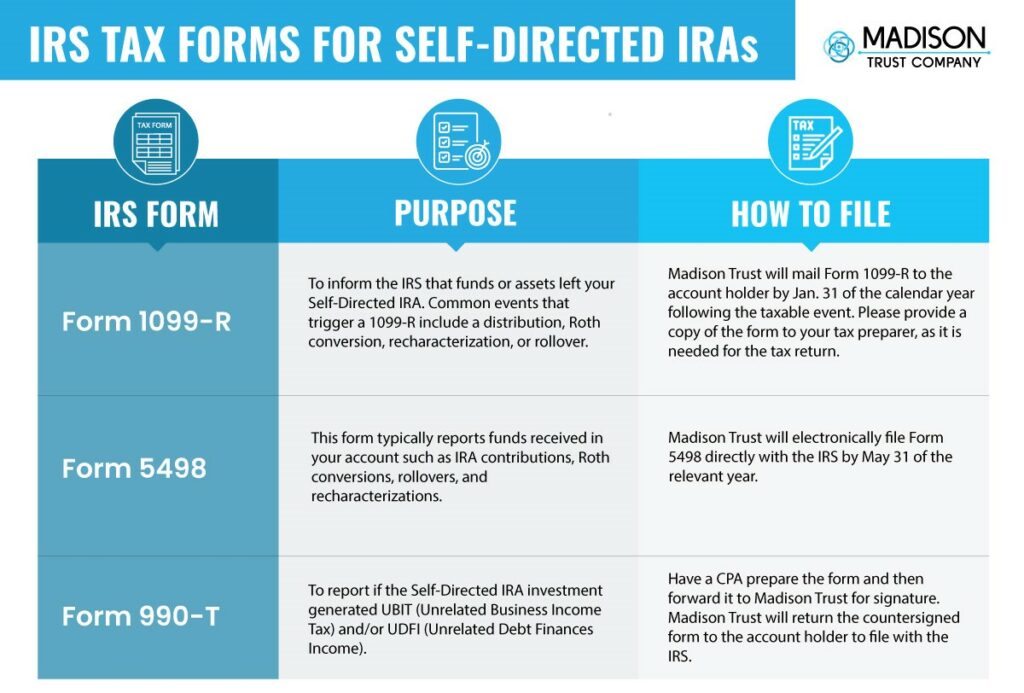

In both cases, Form 990-T must be filed and all taxes must be paid with IRA funds (using personal funds would be a prohibited transaction).

Tax Forms

Annual Valuation - Although taxes are not typically due on your Self-Directed IRA funds, the IRS generally requires account holders to file a valuation form. Madison Trust will complete IRS Form 5498 to report funds received in your account such as contributions, Roth conversions, rollovers, and recharacterizations as well as the fair market value of your account.

Form 1099-R - This form is used to inform the IRS that funds or assets left your IRA. Common events that generate Form 1099-R include a distribution, Roth Conversion, recharacterization, or rollover. Madison Trust will mail you the form by January 31 of the calendar year following the taxable event.

For more information regarding the tax forms for your Self-Directed IRA, please visit the tax forms FAQ page.

3 Ways You Can Lower Your Tax Bill by Contributing to Retirement

1. Contributing to Your Self-Directed IRA

Depending on your Self-Directed IRA account type, tax benefits will be received at different times. If you have a Traditional IRA, you can lower your income tax owed when you contribute to your account. If you have a Roth IRA, you pay taxes upfront, but your investments grow tax free.

2. Withdraw Strategically

Another way you may lower your tax bill is to make strategic withdrawals. To ensure no tax consequences, you may withdraw funds from your Traditional IRA after age 59 ½. In a Roth IRA, all contributions can be taken out tax-free at any time, but earnings cannot be withdrawn until age 59 ½ and the 5-Year-Rule is met. If you are in a lower tax bracket now than you think you will be in retirement, consider withdrawing more now so you can pay fewer overall taxes.

3. Save Your Tax Refund for Retirement

If/when you receive your tax refund, consider using those funds to contribute to your retirement account to boost your overall savings.

Utilize the IRS's Tools

The IRS’ website offers a lot of practical, easy-to-read articles and other tools that can benefit taxpayers. If you are looking for some of the latest developments, you can check out the IRS Newsroom. Here are a few tools that may affect your tax preparation:

Create an Online Account – This gives you access to your personal tax information, tax return transcripts, payment history, notices, prior-year adjusted gross income, power of attorney information, etc.

Interactive Tax Assistant – This tool answers common tax questions and can determine if the income you received is taxable or if the taxpayer is eligible to claim certain credits or deductions.

IRS Free File – This lets the user choose which software platform is best for their needs and guides them through the entire filing process.

Where’s My Return? – Once your taxes are filed, you can use this tool to check the status of your refund.

Find a Tax Professional Page – Use this directory to find Federal Tax Return Preparers with credentials and select qualifications.

Conclusion: Let's Tie It All Up

As you prepare your tax return this year, take time to consider what taxes you may be subject to and how you can lower your tax bill by contributing to retirement in a Self-Directed IRA. Also, be sure to check out the free tax tools the IRS provides American taxpayers.

Madison Trust Specialists are knowledgeable and can answer all your questions about self-directed investing. Schedule a free discovery call today to learn more about investing with a Self-Directed IRA!

Disclaimer: All of the information contained on our website is a general discussion for informational purposes only. Madison Trust Company does not provide legal, tax or investment advice. Nothing of the foregoing, or of any other written, electronic or oral statement or communication by Madison Trust Company or its representatives, is intended to be, or may be relayed as, legal, tax, investment advice, statements, opinions or predictions. Prior to making any investment decisions, please consult with the appropriate legal, tax, and investment professionals for advice.