Is Now the Time to Convert to a Roth IRA?

Key Points

- A Roth Conversion is the process of switching the tax treatment of your IRA funds by converting your Traditional IRA to a Roth IRA.

- Converting to a Self-Directed Roth IRA helps investors potentially reduce their lifetime tax burden, avoid RMDs, maximize their estate for their heirs, and execute a backdoor strategy.

- Before converting to a Roth IRA, please consider if the funds will be needed to be removed in the next 5 years, if it will place you in a higher tax bracket, and if you can pay the conversion taxes.

- Madison Trust makes a Roth Conversion a seamless process.

Typically, before making a large purchase, shoppers will do their research to find the best product and biggest sale. Similarly, when it comes to personal finance, investors do their due diligence to make the most educated decision and get the most bang for their buck.

With the stock market down and current low tax rates, now may be the perfect opportunity to do a Roth Conversion as you can enjoy some tax savings. Let’s explore what a Roth Conversion is and whether it is the right opportunity for you.

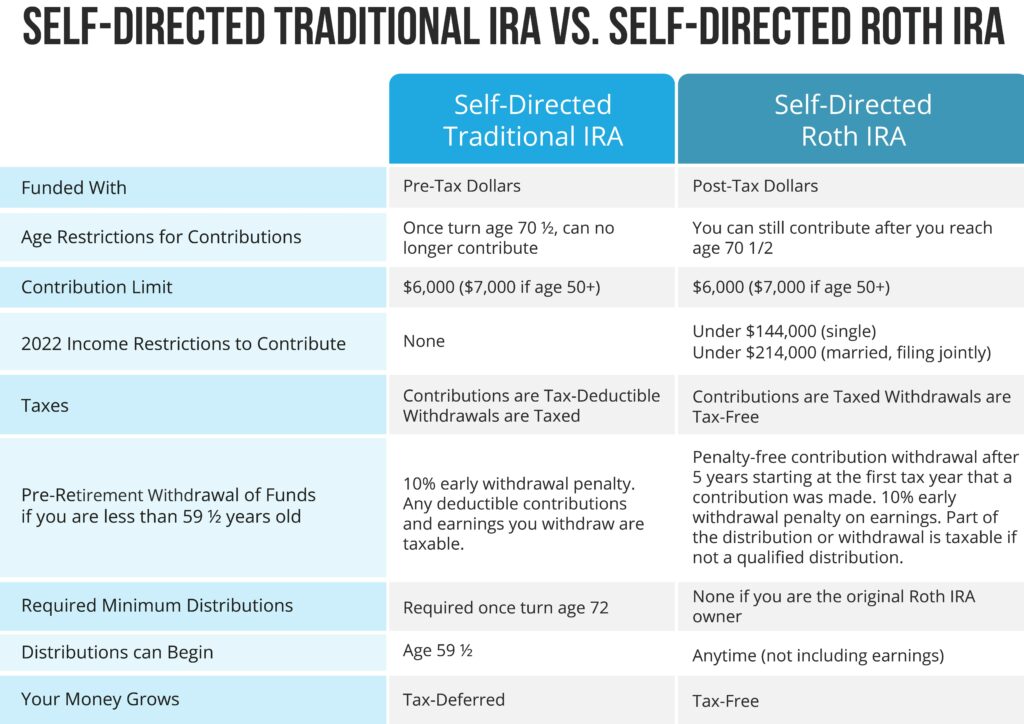

Fundamental Differences: Self-Directed Traditional IRA vs. Self-Directed Roth IRA

A Self-Directed Traditional IRA is a tax-deferred retirement investment account funded with pre-tax dollars and taxed when withdrawn after age 59 ½. Conversely, a Self-Directed Roth IRA is a retirement investment account funded with after-tax dollars and grows tax-free.

What is a Roth Conversion?

A Roth Conversion is the process of switching the tax treatment of your IRA funds by converting your Self-Directed Traditional IRA to a Self-Directed Roth IRA. Taxes are paid on the converted amount. Once the funds are in a Self-Directed Roth IRA, no taxes are paid on qualified withdrawals, giving you more flexibility to manage your taxes in retirement and boost after-tax income.

The deadline to convert your IRA for the current tax year is December 31.

Is Now the Time to Convert to a Roth IRA?

There has been a recent uptick in Roth Conversions in the past few years due to the current economic environment.

- Asset values are down due to the current bear market, which generally means you will owe less tax at the time you convert to a Roth IRA.

- The current, low tax rates set by the Tax Cuts and Jobs Act (TCJA) are set to expire in December 2025. If you convert to a Roth IRA now, you would be taxed at a potentially lower rate than in the future.

- If you are in a lower tax bracket than you predict to be in retirement (e.g., due to pandemic-related job loss or are maybe just starting a new career), converting to a Roth IRA may result in tax savings.

Benefits of Converting to a Self-Directed Roth IRA

1. Potentially Reduce Lifetime Tax Burden from your Retirement Accounts

If you can afford to pay the taxes due on the Roth Conversion, you can pay the taxes now to avoid paying them in the future on a larger pool of assets. If you predict future tax hikes and income increases, converting at the current tax rate potentially allows you to pay fewer taxes. Plus, the sooner you convert, the more time your investments have to grow tax-free.

2. Avoid Required Minimum Distributions (RMDs) and Maximize Your Estate for Your Heirs

Traditional IRA account holders who are 72 years old are required to take taxable distributions from their retirement account. However, Roth IRA account holders have already paid taxes upon contribution, so RMDs are not required. The IRA funds can be passed down to your heirs and taken out tax-free.

3. Backdoor Access into a Roth IRA for Those Whose Income Exceeds the Limit

Eligibility to contribute to a Roth IRA depends on your Modified Adjusted Gross Income (MAGI) and tax-filing status, restricting high earners. However, there is a way to avoid the contribution limit restriction - known as a “backdoor” strategy. Since there are no income eligibility limits for Roth Conversions, it is a common strategy to contribute to a Traditional IRA and then convert it to a Roth IRA. Please keep in mind the Pro-Rata Rule and consult with a tax advisor to see if this strategy makes sense for your financial goals.

Considerations Before Making a Roth Conversion

Will You Personally Need the Funds in the Next 5 Years?

There is a Roth IRA 5-Year Rule that requires account holders to wait five years before withdrawing any converted balances (contributions or earnings) regardless of their age. If funds are taken out before five years, the account holder will be subject to a 10% early withdrawal penalty. The timeline begins on January 1 of the year of the conversion.

Generally, a Roth IRA Conversion should not be done if the funds are personally needed within the next five years. The more time you hold your Roth IRA funds untouched, the more tax-free earnings will potentially accumulate.

Will a Roth Conversion Place You in a Higher Tax Bracket?

The funds converted are considered “reportable income” by the IRS. As a result, there is a chance that you may be bumped into a higher tax bracket the year you convert. To avoid this, consider only converting a portion of your Traditional IRA. An unlimited amount of conversions are allowed, so it may make more sense to convert smaller amounts over several years to spread the conversion-related taxes out and avoid accidentally bumping yourself into the next tax bracket.

Will You Have Enough Funds to Pay the Conversion Taxes?

Typically, you do not want to pay the conversion taxes with IRA funds. This is because the funds you take out are considered a distribution, which could result in higher taxes in the year you convert. Also, if you are under age 59 ½ you will be subject to the 10% early withdrawal penalty on the amount withdrawn.

How To Convert a Traditional IRA to a Roth IRA

Madison Trust makes your Roth Conversion seamless. Complete a Roth Conversion Request to convert your Self-Directed Traditional, SEP, or SIMPLE IRA to a Self-Directed Roth IRA.

If you are converting assets besides cash, you are required to provide Madison Trust with a current certified valuation of the assets.

Conclusion: Let’s Tie It All Up

Roth Conversions can help some investors save on taxes; however, it is not for everyone. Make sure to speak with a financial advisor to determine if a Roth Conversion is the right strategy for you.

Do you have questions about Roth Conversions or self-directed investing? Enjoy a free call from one of our Self-Directed IRA Specialists today.

Disclaimer: All of the information contained on our website is a general discussion for informational purposes only. Madison Trust Company does not provide legal, tax or investment advice. Nothing of the foregoing, or of any other written, electronic or oral statement or communication by Madison Trust Company or its representatives, is intended to be, or may be relied as, legal, tax, investment advice, statements, opinions or predictions. Prior to making any investment decisions, please consult with the appropriate legal, tax, and investment professionals for advice.