Managing Self-Directed IRA Expenses for Real Estate Investments

Key Points

- To avoid a prohibited transaction, never pay for real estate expenses with personal funds.

- Certain family members are disqualified persons who cannot use or transact with property held in your IRA. Make sure you know who’s allowed and who’s disqualified.

- Real estate expenses should go through your custodian or, if you have a Checkbook IRA, through a checking bank account tied to your IRA LLC or IRA Trust.

A Self-Directed IRA is a unique and empowering way to put real estate to work for your retirement savings. You can use a Self-Directed IRA to buy a house, a vacation home, or just about any other property including commercial buildings, fix-and-flips, and raw land.

Once you purchase property, it’s extremely important that you know the rules for paying and managing the related expenses. The big ones of course are property taxes, utilities, and maintenance—but even small things like cleaning supplies must be purchased correctly to avoid potential penalties. Here’s what you need to know:

Self-Directed IRA Expenses: How Much Does a Self-Directed IRA Cost?

Before we get into real estate expenses, keep in mind that there are also a few Self-Directed IRA expenses to open and maintain your account. Self-Directed IRA fees vary from one Self-Directed IRA custodian to the next. This quick guide outlines what to consider and expect for fees. We’ve also created a helpful cost comparison calculator. At Madison Trust, we keep our fees low and straightforward so anyone can open a Self-Directed IRA without feeling weighed down.

Paying Real Estate Expenses with a Self-Directed IRA

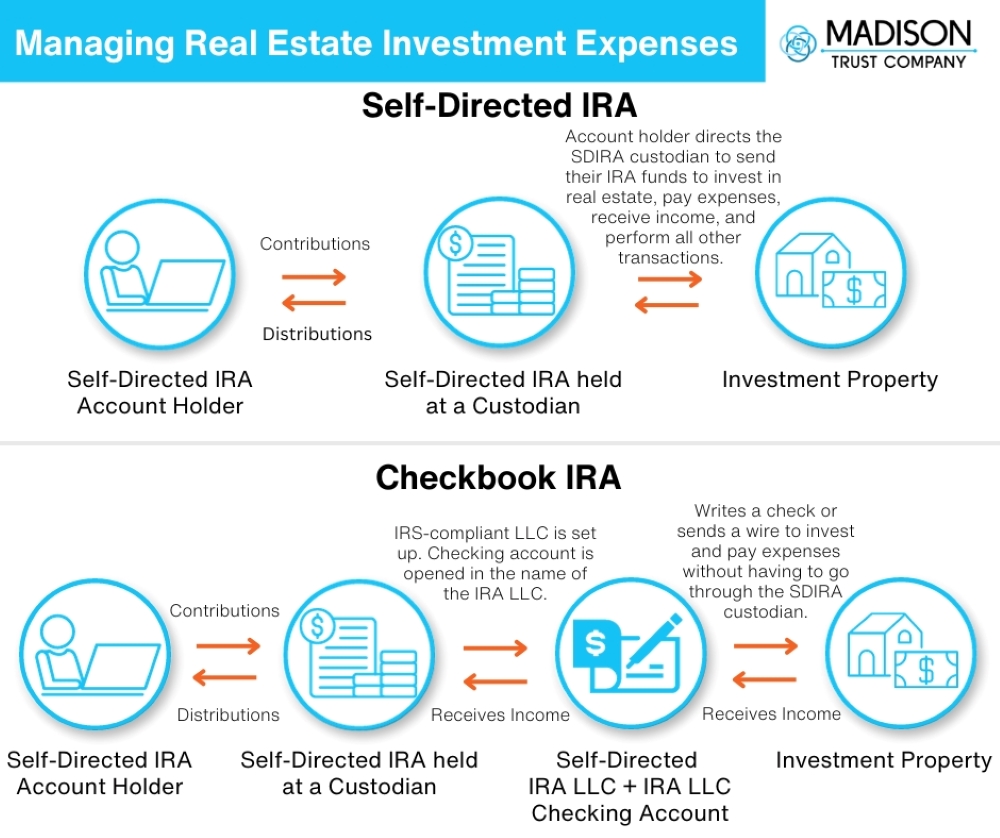

In a Self-Directed IRA, everything goes through a designated Self-Directed IRA custodian like Madison Trust. When you first purchase a property, your custodian will be listed as the buyer and owner. The custodian will also be responsible for wiring the earnest money deposit (EMD). This effectively makes your IRA the owner of the property rather than you personally owning the property. From there, any real estate expenses are to be paid from your IRA and the transactions must be executed by your custodian.

At Madison Trust, you simply send the invoice for any real estate expense to us, along with a completed Expense Payment Request form, and we take care of the rest through your account.

Paying Real Estate Expenses with a Checkbook IRA

Many people—new and seasoned real estate investors alike—take their Self-Directed IRA a step further by getting what’s called checkbook control. This is also known as a Checkbook IRA. With a Checkbook IRA, the account holder doesn’t need to go through their custodian for transactions once the account is set up properly. They can simply write checks and send wire transfers on their own from a checking account tied to their IRA LLC or IRA Trust. Learn how a Checkbook IRA works and why it’s often the ideal option for investing in rental properties or for fixing and flipping houses.

Managing Real Estate Investment Expenses: Self-Directed IRA vs. Checkbook IRA Process

What About Hiring a Property Management Company?

Can you hire a property management company to deal with the day-to-day maintenance at properties owned by your Self-Directed IRA? Absolutely! It can be a great way to build a rental portfolio without having to take on the extra job of physically attending to your properties, communicating with tenants and so on. If you go this route, the property manager will collect rent, pay expenses, and send any profits to your IRA custodian to deposit into your IRA.

Two Things Never to Do

Whether you have a classic Self-Directed IRA or a Checkbook IRA, there are two simple rules of thumb that can help keep your account and investments in good standing with the IRS.

1. Never Pay for Real Estate Expenses with Personal Funds

At no point should you ever pay for a single expense (including a small expense) from your personal bank account. Doing so could result in a prohibited transaction.

2. Never Hire a Disqualified Person to Perform Work on Your Property

As the account holder of your Self-Directed IRA, you are the first and foremost disqualified person from transacting with investments held in your IRA—but you’re not the only disqualified person! The full list of disqualified persons in a Self-Directed IRA real estate investment includes:

- You (IRA holder)

- Your parents

- Grandparents

- Children

- Spouse

- Children-in-law

- Grandchildren

For example, if your daughter owns a property management company, you shouldn’t hire her as a consultant or her company as a property manager for real estate in your Self-Directed IRA. Even something seemingly as harmless as paying a son-in-law $50 to mow the lawn on the weekend is forbidden by the IRS.

Complex Doesn’t Have to Mean Complicated

When it comes to investing in real estate with a Self-Directed IRA, there’s undoubtedly a lot to be mindful of. It’s a relatively advanced investment strategy, but don’t let that keep you from taking the leap. Madison Trust has streamlined and simplified the process so you can combine the high growth potential of real estate with the tax advantages of an IRA and the freedom of a Self-Directed IRA. Learn more and get started today!

Disclaimer: All of the information contained in our website is a general discussion for informational purposes only. Madison Trust Company does not provide legal, tax or investment advice. Nothing of the foregoing, or of any other written, electronic, or oral statement or communication by Madison Trust Company or its representatives, is intended to be, or may be relied on as, legal, tax, investment advice, statements, opinions or predictions. Prior to making any investment decisions, please consult with the appropriate legal, tax, and investment professionals for advice.