- About

- Self-Directed IRA

- Sponsors Hub

- Assets

- Information Center

- Client Resources & Forms

- Contact Us

close

- About

- Self-Directed IRA

- Sponsors Hub

- Assets

- Information Center

- Client Resources & Forms

- Contact Us

close

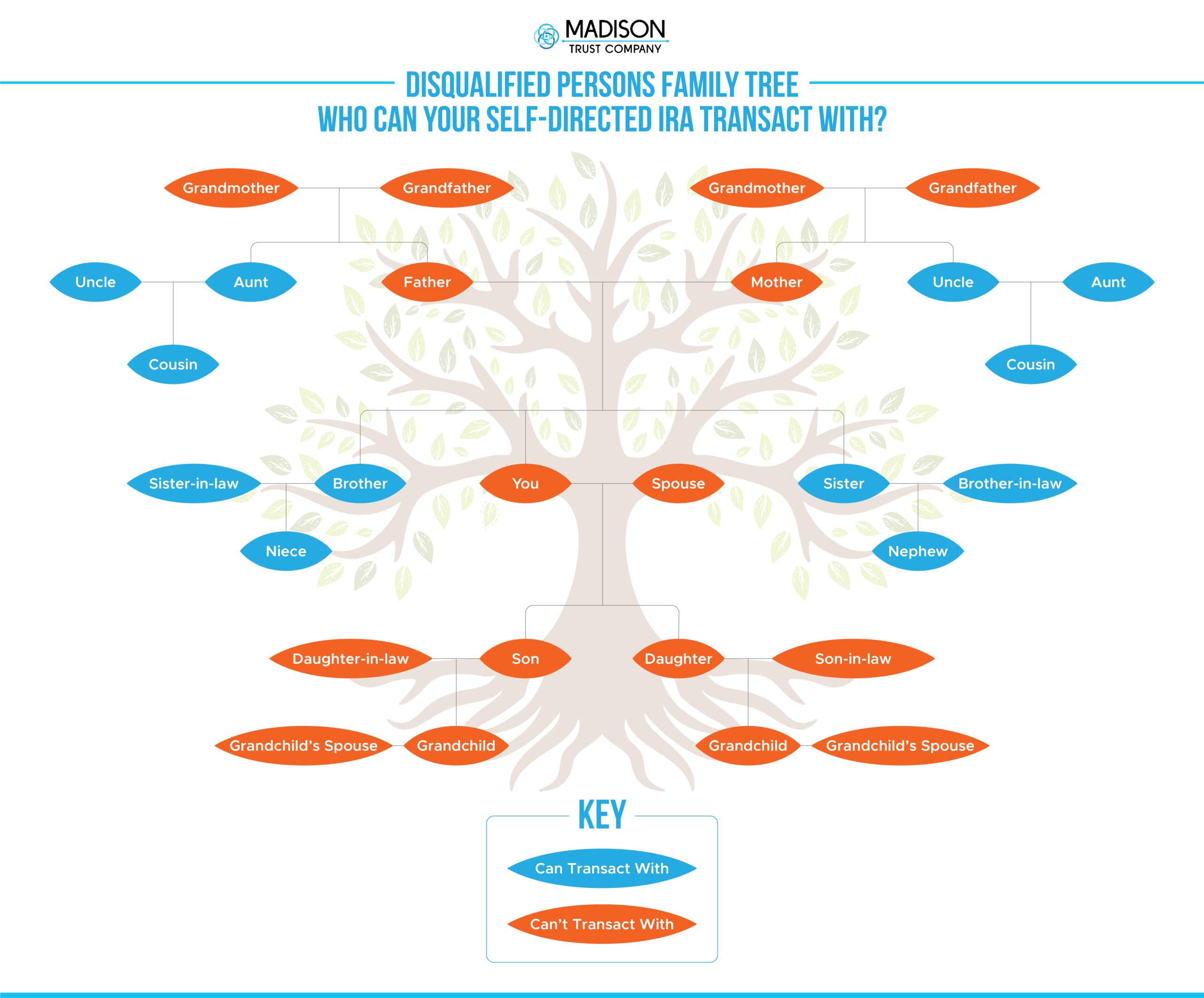

When researching Self-Directed IRAs, you may come across the term "prohibited transaction." Self-Directed IRA prohibited transactions are improper transactions that occur between an IRA and a disqualified person. IRA account holders need to understand exactly what an improper transaction is and who is considered a disqualified person. A general rule of thumb is that an IRA may transact with third parties but may not transact with close family members or closely held entities.

In essence, IRS Self-Directed IRA prohibited transactions do not limit WHAT an IRA can invest in but rather WHO an IRA can transact with. For example, an IRA may purchase a well-priced rental property from a friend, but that same IRA cannot purchase property from a parent, spouse, or child.

Congress passed the Employee Retirement Income Security Act of 1974, commonly known as ERISA, with the intention of helping Americans save for retirement. Tax advantages were offered to encourage Americans to participate in such plans. But Congress incorporated prohibited transaction rules into the act to prevent people from taking advantage of these specialized retirement accounts.

All of the above transactions are perfectly permissible when performed with third parties; they only become problematic when performed with disqualified persons.

The Self-Directed IRA account holder and their spouse.

The account holder’s direct ancestors, such as parents and grandparents.

The owner’s descendants, such as their children and grandchildren, and their spouses.

The fiduciary of the Self-Directed IRA and anyone else that provides services to the account/plan (e.g., accountant or financial advisor).

Any entity (e.g. corporation, partnership, LLC) that is owned 50% or more, singularly or collectively, by disqualified persons (i.e., the persons described above).