Can I Use a Self-Directed IRA to Buy a House?

A Self-Directed IRA gives you all sorts of investment options that you can’t hold in a standard IRA. Instead of being confined to stocks, bonds, and mutual funds, you can invest in private businesses and startups, precious metals, promissory notes, and perhaps most attractive of all, real estate.

A Self-Directed IRA gives you all sorts of investment options that you can’t hold in a standard IRA. Instead of being confined to stocks, bonds, and mutual funds, you can invest in private businesses and startups, precious metals, promissory notes, and perhaps most attractive of all, real estate.

High growth, passive income, steady returns, and many different property types to choose from make real estate a compelling investment, especially when paired with a tax-advantaged retirement account like a Self-Directed IRA. If you just opened or are considering opening a Self-Directed IRA for real estate investing, you might have your eye on a new home as a first investment. You’re wondering, “Can I use a Self-Directed IRA to buy a house?” We’re glad you asked, because there are some important things to know before buying a home with a Self-Directed IRA.

The Short Answer

You can absolutely use a Self-Directed IRA to buy a house, whether directly through the IRA or under a dedicated entity such as an LLC. Being able to purchase real estate with tax-advantaged retirement funds is one of the key benefits of a Self-Directed IRA compared to a standard IRA. Some people call it a Real Estate IRA because real estate is such a popular Self-Directed IRA investment.

Aside from residential property, you can also use your Self-Directed IRA to invest in commercial real estate, raw land, Private Real Estate Trust Investments (REITs) and more. It’s a great way to build a real estate investment portfolio. You can even fix and flip houses. When it comes to residential property, however, keep in mind:

The BIG Caveat

You can use a Self-Directed IRA to buy a house, yes—but that house can’t be your home. Any property you purchase with your Self-Directed IRA must be for investment purposes only.

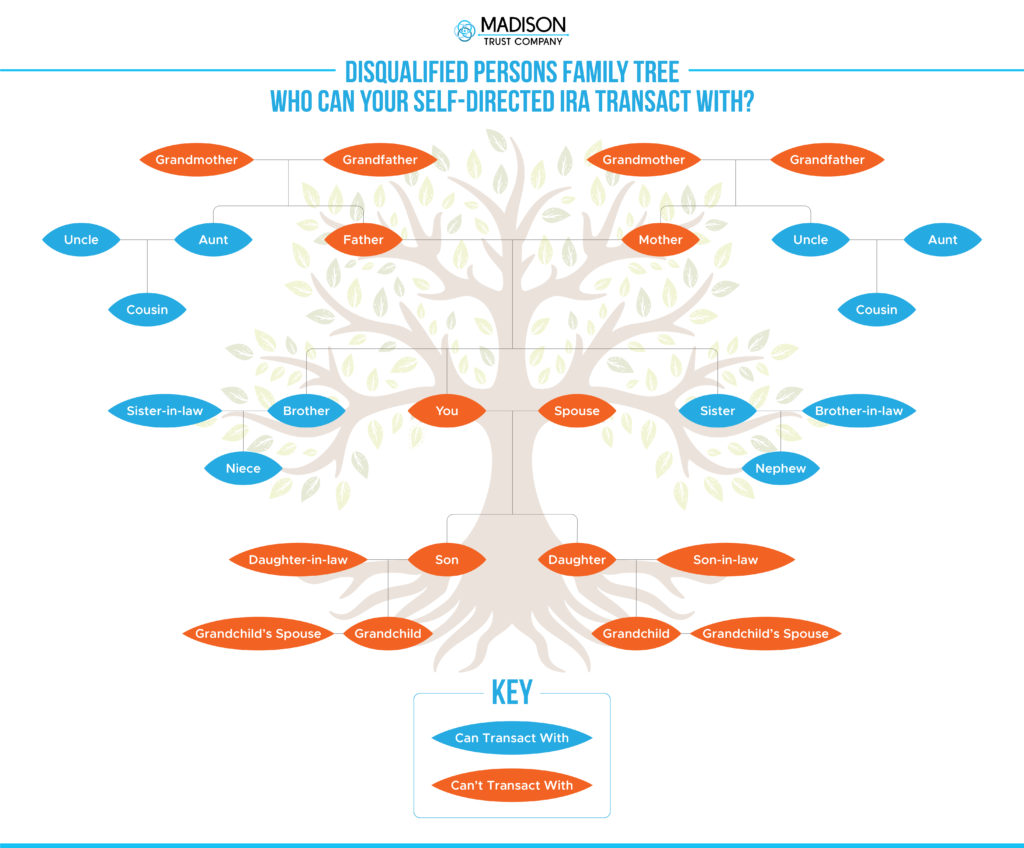

You cannot live in or use the home for your personal benefit. Neither can certain family members. Additionally, you cannot sell the home to those family members. All expenses—including taxes, insurance, and repairs—must flow through the Self-Directed IRA, which is managed by a Self-Directed IRA custodian like Madison Trust. Any rental income must also be handled by your Self-Directed IRA custodian or a permissible third party such as a property management company.

Who Can Use the Home?

If you use your Self-Directed IRA to buy a house, your IRA or real estate company (not you personally, remember) can rent or sell the home to any of your following family members:

- Siblings

- Siblings-in-law

- Nieces and Nephews

- Aunts and Uncles

- Cousins

You can also of course choose to use the house as a true investment property by renting it out to tenants.

Disqualified Persons

Again, you as the Self-Directed IRA holder cannot use a home purchased with your Self-Directed IRA. You are considered a disqualified person, along with other close family members. Here’s the full list of disqualified persons in a Self-Directed IRA real estate investment:

- You (IRA holder)

- Your Parents

- Grandparents

- Children

- Spouse

- Children-in-law

- Grandchildren

As you move down the family tree, disqualified vs. non-disqualified persons can get a little confusing. Learn more about prohibited transactions and consult your Self-Directed IRA custodian if you’re unsure.

How To Finance Real Estate with a Self-Directed IRA

There are many different Real Estate IRA investment strategies. The simplest is to buy with cash from your Self-Directed IRA. If that’s not feasible, your IRA can partner with an investor such as yourself or your LLC, but this can get complicated during and after the transaction.

Unfortunately, you can’t use a traditional mortgage because it’s a personally guaranteed loan and you are a disqualified person for Self-Directed IRA purposes. However, you can use a non-recourse loan, with the home as collateral rather than your personal assets. If your IRA defaults on a non-recourse loan, the home will be foreclosed, but your IRA funds and personal assets will be safe.

The Small Mistake

When you use a Self-Directed IRA to buy a house, the process is familiar to buying a home personally. You’ll look at homes, make an offer on the one you want, and so on. Just keep in mind that your Self-Directed IRA custodian, such as Madison Trust, must be listed as the buyer and owner on all documentation, and the custodian will be the one to eventually wire the earnest money deposit (EMD) to open escrow and begin closing.

Many people mistakenly put their own name on real estate documents. This isn’t necessarily a big deal as long as your custodian catches it, but it does drag out the closing to have it corrected. It also raises the risk of a prohibited transaction, as many title companies may send an addendum assigning the purchased contract from the personal buyer to the Self-Directed IRA, which is also incorrect. If you put your own name on the documents, your Self-Directed IRA custodian will need to request, receive, and review new documents altogether.

The BIG Mistake

Most importantly, always remember that you are a disqualified person in anything having to do with a home that you purchase with your Self-Directed IRA. You cannot live in it. You cannot stay in it for a weekend. You cannot even fix a leak with your own personal funds. Secondly, it’s important to be aware of the other disqualified persons, including your parents, grandparents, children, spouse, children-in-law, and grandchildren. If any disqualified person has any involvement in a home purchased with your Self-Directed IRA, it becomes a prohibited transaction requiring full distribution of the account along with applicable taxes and potential penalties.

Self-Directed IRA Real Estate Rules To Keep In Mind

![Self-Directed IRA Real Estate Rules to Keep in Mind Infographic. Rule 1: Title the Property in the Name of Your Self-Directed IRA. Your IRA owns the property, not your personally. All documents must be titled “Madison Trust Company, Custodian FBO [Your Name & MTC Account Number]”. Rule 2: All Profits and Income Stay in the Self-Directed IRA. All profits and income must go back into your Self-Directed IRA by completing a Deposit Information Form to notify Madison Trust of the incoming funds. Rule 3: All Expenses are Paid Through the Self-Directed IRA. All expenses including taxes, insurance, repairs, etc. must be paid for with IRA funds by completing an Expense Payment Request Form and attaching your invoice. Rule 4: Be Aware of Prohibited Transactions. The property purchased with your Self-Directed IRA must be for investment purposes only. You or a disqualified person cannot live in the home, stay for a weekend, fix a leak with personal funds, etc. Rule 5: Financing Must be Through a Non-Recourse Loan. To obtain financing, the loan must be non-recourse. A non-recourse loan is backed by the property and not the borrower personally, keeping your IRA funds and personal assets safe.](https://www.madisontrust.com/wp-content/uploads/2023/01/Self-Directed-IRA-Real-Estate-Rules-to-Keep-in-Mind-751x1024.jpg)

"Why Use a Self-Directed IRA to Buy a House if I Can't Live in it?"

If you’re disappointed to learn that you can’t use a Self-Directed IRA to buy your next beautiful home for yourself and your family to enjoy, keep in mind that a Self-Directed IRA is a retirement account designed to fund your future. Investing in real estate can be a great way to build wealth, diversify your portfolio, and hedge against the stock market. You can buy a house with your Self-Directed IRA, rent it out to a non-disqualified person, and then, when you’re ready to retire, the home can be all yours once it’s distributed. With Madison Trust as your custodian, you have a dedicated support team of Self-Directed IRA Specialist to assist you along the way. Learn more about investing in real estate with a Self-Directed IRA.