How To Set Up a Self Directed Roth IRA

What is a Self Directed Roth IRA?

A Self Directed Roth IRA combines two functions. First, it allows investors to place retirement funds in almost any asset. Second, it does so within a Roth framework. That means the money invested comes from post-tax dollars and can now grow tax-free.

Investors generally open a Self Directed Roth IRA to access a wider variety of assets. Some of the more popular investments include:

- Real Estate – A private investor can buy a property and lease it out. This grows the retirement account with both property value and rental income.

- Private Placement – Sometimes an investor will run across a good private deal. A Self Directed Roth IRA allows them to place retirement funds in that deal.

- Pre-IPO Stock – Brokerages don’t normally allow investing in a company before it goes public. The only way to do so with retirement funds is by using a Self Directed IRA.

How Does a Self Directed Roth IRA Differ from a Traditional Self Directed IRA?

There are two major differences between a Self Directed Roth IRA and its Traditional counterpart:

- Tax Benefits – Contributions to a Traditional IRA are tax deductible. Contributions to a Roth are not. Instead, the tax benefit comes from tax-free growth.

- RMDs (Required Minimum Distributions) – In a Traditional IRA, account holders must start taking RMDs by age 72. In a Roth IRA, there is no mandatory age. An account holder has the option to never take a distribution and pass their retirement funds on to their heirs.

Who Can Open a Self Directed Roth IRA?

The requirements for opening a Self Directed Roth IRA are the same as a standard Roth. The IRS looks at your filing status and your MAGI (Modified Adjusted Gross Income.) A Roth IRA is unique in that you may be able to make a full contribution, partial, or none at all. The partial phased out contribution can be calculated using these instructions from the IRS. Currently the full contribution limit is $6,000/year. If you are over 50, the limit is $7,000/year.

Here’s what you can contribute to your Self Directed Roth IRA in 2022 based on your income and filing status.

| Filing Status | MAGI | Contribution Allowed |

| Married – filing jointly | Less than $204,000 | Full Contribution |

| Married – filing jointly | $204,000 - $214,000 | Partial Contribution |

| Married – filing jointly | Greater than $214,000 | No Contribution |

| Single - (not married or filing separately) | Less than $129,000 | Full Contribution |

| Single - (not married or filing separately) | $129,000 - $144,000 | Partial Contribution |

| Single - (not married or filing separately) | Greater than $144,000 | No Contribution |

How to Set Up a Self Directed Roth IRA

Setting up a Self Directed Roth IRA follows the same process as a traditional Self Directed IRA. The process varies based on how the funding occurs and what kind of self-direction is needed. It can also change based on the kind of account opened. A Self Directed Roth IRA comes in one of three types of accounts:

- Custodial IRA – This is the standard account. Its defining feature is that the custodian performs all transactions.

- IRA LLC – This starts with a custodial account, but then invests in a dedicated LLC. This allows for checkbook control without going through the custodian for each transaction.

- IRA Trust – This account is similar to the IRA LLC, but uses a Trust instead of an LLC.

Setting Up a Custodial Account

The first step is to identify the custodian you wish to use. Research custodians and determine which offer the investment tools you need. (For example, not all custodians offer checkbook control). Then research that list to see who is the best reviewed and who has the best fee schedule. Based on your results, you should be able to decide on 1-2 winners.

Once you have chosen a self-directed custodian, you can now open an account. This is easy and can be finished in about 15 minutes. The process involves filling out a form which covers standard account information. The type of information requested includes:

- Contact information

- Type of account being opened

- Source of funding (transfer, rollover, or contribution)

Funding a Self Directed Roth IRA Custodial Account

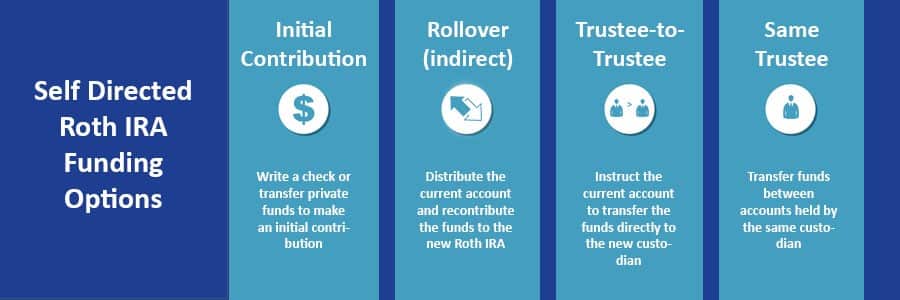

The next step is to fund the account. This can be done with an initial contribution, conversion, transfer, or rollover. If you are making an initial contribution, this can be as easy as sending in a check. If you are funding the account with a transfer or rollover, the process is a bit more involved.

Self Directed Roth IRA Conversion

There are three main methods to convert funds from an existing retirement account into a Self Directed Roth IRA. In all three cases, you will have to pay taxes on the untaxed amount of the Traditional IRA or 401(k). The way to report this conversion is with Form 8606.

- Rollover – This is similar to an indirect rollover for non-Roth accounts. The custodian for the Traditional IRA will send a check made out to you. You then have 60 days to place it in the new Self Directed Roth IRA.

- Trustee-to-Trustee Transfer – Here the funds are sent to the new custodian directly. Alternatively, the check will be sent to you but made out to the new custodian.

- Same Trustee Transfer- If the original Traditional IRA and the Roth IRA are both held by the same custodian, funds can be transferred directly.

When you are rolling over from an employer plan (like a 401(k)), you can do a direct or indirect rollover. That starts by contacting your employer or plan administrator and filling out a few forms. They will then send over the funds. (Your employer will let you know if the funds are available for rollover. Many companies do not allow rollovers if you are working for them).

When doing an indirect rollover, the employer will generally withhold 20% for taxes. This has important consequences. If you do nothing, the IRS will view those funds as a distribution. They will be taxed as income and possibly invoke other penalties.

In order to avoid those penalties, you will need to replace the withheld amount with other funds. That way the same amount that was distributed from the employer plan will be recontributed to the Self Directed Roth IRA. When you file taxes that year, the withheld funds will be returned as a tax refund. If you do a direct rollover, it avoids this situation entirely.

Setting Up a Self Directed Roth IRA LLC

An IRA LLC is a vehicle used by a Self Directed IRA investor to gain checkbook control and superior liability protection. To set up a Self Directed Roth IRA LLC, you follow the same steps for setting up a custodial account. Then, these additional steps are performed:

- LLC Setup – Either your custodian or a trusted partner will set up a custom LLC for your account. Madison Trust works with our sister company, Broad Financial, as a one-stop shop. Madison Trust serves as the custodian of your Self Directed Roth IRA, while Broad Financial upgrades you by creating an IRA LLC. This LLC is unique in that it adheres to all IRS rules for retirement investments. (That is why you cannot use a pre-existing LLC).

- Capitalization – You tell the custodian to invest your Self Directed Roth IRA funds into the new LLC. This is similar to investing in a different company like Amazon or IBM. It’s just in this case you are investing in your own company.

- Checking Account – Open a checking account for the LLC. This can be done at any bank. Once it is open, you can use its checkbook to invest your Roth IRA funds into the asset of your choice.

Setting Up a Self Directed Roth IRA Trust

A Self Directed Roth IRA Trust offers checkbook control, but at a lower price than an IRA LLC. Here are the steps to open one:

- Open a new Self Directed Roth IRA account with the custodian, in this case Madison Trust.

- Broad Financial (or another checkbook IRA facilitator) opens a trust account for your Self Directed Roth IRA.

- The custodian capitalizes the Trust by sending a check or wiring funds.

- You can now open a checking account for the Trust.

- Invest as usual by simply using the account’s checkbook or debit card.

Investing With a Self Directed Roth IRA

If your Self Directed Roth IRA is a custodial account, you can invest by filling out a form. Complete an Investment Authorization Form and then submit it to Madison Trust. On this form, you will list the asset(s) that your account should purchase. The custodian, Madison Trust, will then acquire the assets for your account.

With an IRA LLC or IRA Trust, the process is even easier. Just write a check for the asset (from the LLC or Trust checking account) and you are finished. The LLC or Trust now owns the asset, which makes it part of your retirement account. No additional paperwork is required.

Selling an asset is just as simple. The Roth IRA LLC or IRA Trust can sell the asset straight to any buyer. The funds are then deposited in the dedicated checking account. Once there, they are now available for another investment.

Investing Mistakes with a Self Directed Roth IRA

When using a Self Directed Roth IRA to invest, the most pressing concern is prohibited transactions. Tax law states that neither the investor, nor their close relatives, can transact with the account. These situations often arise when the asset is a property. Common examples of prohibited transactions involving property include:

- Using a close relative to perform work on the property.

- Selling a house you already own to your IRA.

- Renting an IRA-owned home to your children.

You can learn more about prohibited transactions here.

Another common issue with a Self Directed Roth IRA is “sweat equity”. This refers to the account owner providing free services to the asset. For example, an account owner may not personally paint a home owned by the IRA. Such an action is viewed by the IRS as a non-cash contribution and is prohibited. (Account owners are allowed to provide high level management of the asset, but never anything physical).

Prohibited transactions are serious but are easy to avoid. Self Directed Roth IRA account holders can and should get educated about prohibited transactions. The rules are simple to grasp and provide the basis for a workable plan. If an account holder has questions, they can always ask a specialist in the field.

Conclusion

A Self Directed Roth IRA allows account holders to invest in more diverse assets. Setting up the account is fairly simple and usually just involves paperwork. Investors have a choice of opening a basic custodial account or one with checkbook control. Depending on the account opened, the investing process involves paperwork or just signing a check. Investors do have to be careful, though, to avoid prohibited transactions.

Still have questions about Self-Directed Roth IRAs?