Sit Down with Your Sweetheart and Discuss Your Finances

Key Points

- Talking openly about your finances allows you and your sweetheart to work towards common goals and advance your relationship with money and each other.

- To foster a richer relationship with your loved one, take time to learn how they value money, discuss goals and dreams, and consider creating an investing strategy.

- Madison Trust’s Self-Directed IRA Specialists can set you and your partner up with individual self-directed retirement accounts and answer any questions you have along your retirement planning journey.

Valentine’s Day 2022, according to the National Retail Federation, was one of the highest spending years on record. About $23.9 billion was spent on gifts for loved ones. In addition to shopping for your sweetheart, consider giving the gift of financial clarity. Although talking about finances may seem stressful, it is an important discussion that can promote openness and honesty, inspire better money management, and secure a plan for your future.

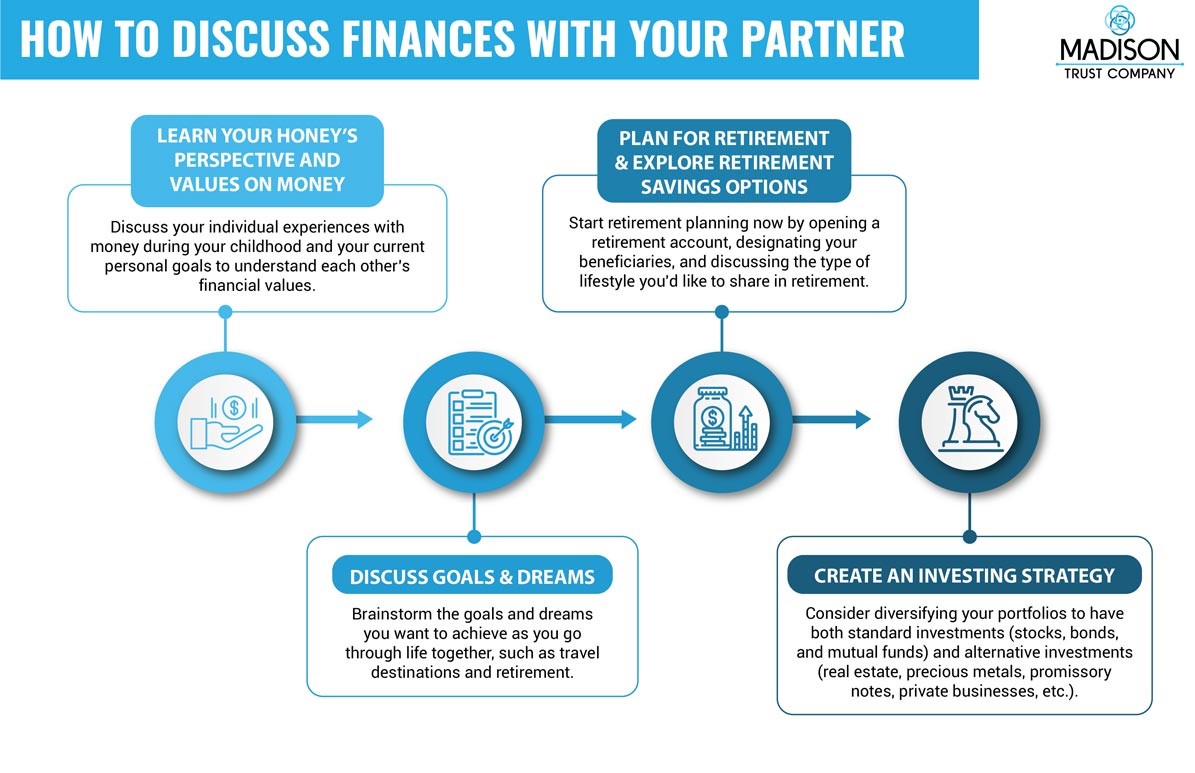

Here are four steps to kickstart your financial conversation with your sweetheart to encourage a richer (metaphorically and literally) relationship and retirement.

1. Learn Your Honey's Perspective and Values on Money

Depending on factors such as your upbringing and current personal goals, your attitude towards money may differ from your partner’s. Discussing your individual experiences with money can help you understand each other’s financial values.

To start the conversation, consider asking your partner the following questions:

- How did your family handle money when you were growing up?

- How do you prioritize your spending? Do you save up for travel and entertainment or do you prefer to budget for donations and everyday purchases?

- If we have any misunderstandings about money management, how should we discuss them and how can we avoid them in the future?

2. Discuss Goals & Dreams

Contrary to popular belief, financial planning is not just budgeting your expenses and focusing on what you cannot buy. It can be exciting and include brainstorming the goals you want to achieve as you go through life together.

Here are some fun questions to consider asking your partner.

- Do we want to start saving for any big purchases, such as a house, car, or dream travel destination?

- What are we looking forward to in the next 5 years? 10 years?

3. Plan for Retirement & Explore Retirement Saving Options

There are many ways you and your sweetheart can prepare for your golden years. First, if you have not started saving for retirement already, consider starting now! There are a variety of tax-advantaged accounts to choose from depending on your financial situation:

- 401(k) and IRA – If both spouses are working, you each can contribute earned income to an employer-sponsored 401(k) or an IRA.

- If your employer matches a percentage of your contributions, consider saving enough to obtain the match to ensure no money is left on the table.

- Consider contributing up to the maximum amount each year so you can achieve max savings and growth.

- Spousal IRA – If one spouse is a stay-at-home parent or only one of you earns income due to the loss of a job, the IRS allows you to open a Spousal IRA. The working partner can open and contribute to an IRA for the non-working spouse to save for retirement with tax-free or tax-deferred growth.

- Solo 401(k) or SEP IRA – If you are self-employed, you may choose to grow your retirement funds in a Solo 401(k) or SEP IRA.

Once your retirement accounts are set up, it’s important to designate a beneficiary or beneficiaries. It is even said that this is the first thing you should do when you arrive home from your honeymoon! This way, you're certain your money gets into the right hands.

When planning your retirement together, consider asking your partner:

- What lifestyle would you like to have in retirement?

- What will our expenses in retirement be?

- How much have you saved for retirement? How can we create one solid plan?

4. Create an Investing Strategy

It is common for people to have different investment strategies, with possibly one of you being more risk adverse. Consider diversifying your portfolios to have both standard investments (stocks, bonds, and mutual funds) and alternative investments (real estate, precious metals, promissory notes, private businesses, etc.).

Consider asking your partner:

- Where can we diversify to potentially mitigate volatility?

- How much should we have saved in an emergency fund?

- Do we have a financial advisor or retirement specialist to whom we can ask questions?

Conclusion: Let's Tie It All Up

By talking openly about finances with your sweetheart and working together to achieve your goals, you both will achieve a richer relationship and account balance. Challenge yourself to keep the conversation going and be a good listener so you gain financial clarity and achieve your goals together.

Do you have questions about how you and your partner can self-directed your retirement investments? Contact a Madison Trust Specialist today for a free discovery call!

Disclaimer: All of the information contained on our website is a general discussion for informational purposes only. Madison Trust Company does not provide legal, tax or investment advice. Nothing of the foregoing, or of any other written, electronic, or oral statement or communication by Madison Trust Company or its representatives, is intended to be, or may be relayed as, legal, tax, investment advice, statements, opinions, or predictions. Prior to making any investment decisions, please consult with the appropriate legal, tax, and investment professionals for advice.