SHARE:

Written by: Daniel Gleich

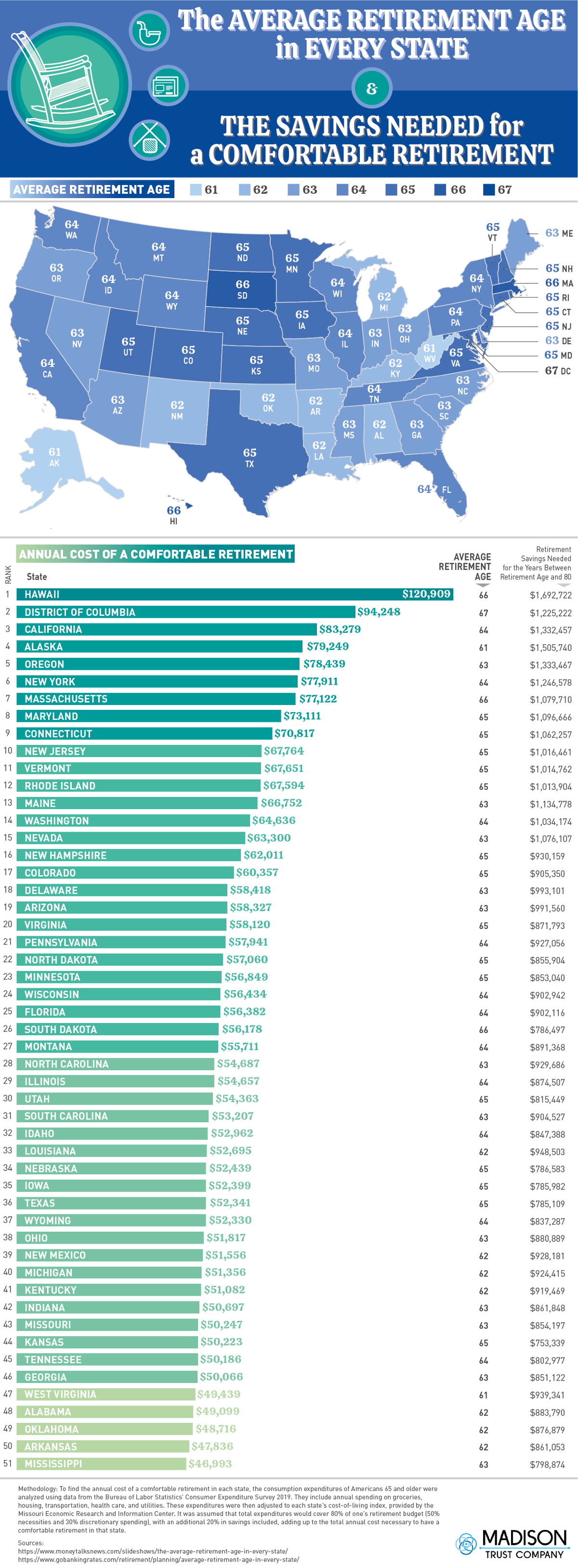

Are you in the process of retirement planning and wondering how much to save for retirement? An important step in the process is ensuring that you have enough retirement savings to live a comfortable life in the years following your retirement. Since the cost of living is so varied across the U.S., the team at Madison Trust Company put together this retirement guide that explores the average age of retirement in each state as well as the average annual cost that would be needed to live a comfortable retirement in each of the states.

The annual retirement costs for each state were found through GoBankingRates’s analysis of data from the Bureau of Labor Statistics Consumer Expenditure Survey 2019. Using this data, they found the total annual costs of groceries, housing, transportation, health care, and utilities, which were then adjusted to each state’s cost-of-living index. These expenditures would cover 80% of one’s retirement budget, with an additional 20% in savings included, to add up to the annual cost of a comfortable retirement in that state. How much will you need to retire? Read on to see how much to save for retirement in your state.

What Is the Average Retirement Age in the United States?

The average retirement age in U.S. is 64 years old, with the average retirement age across all states spanning from 61 to 67 years old. The Social Security Act sets the minimum age to retire at 65 to receive full retirement benefits, although the minimum retirement age will continue to rise.

Which states have the youngest and oldest average age of retirement in the U.S.? Alaska and West Virginia both have the youngest average retirement age in the USA, 61 years old. Interestingly, Alaska has the youngest U.S. retirement age but was also found to require the fourth-highest amount of retirement savings to live comfortably. The District of Columbia has an average retirement age of 67, the oldest in the United States. The average retirement age in Hawaii, Massachusetts, and South Dakota is a close second, averaging 66 years old.

Which State Has the Highest Annual Cost for Retirement?

Hawaii has the highest annual cost for retirement, with an average of $120,909 needed in retirement savings each year to pay for groceries, housing, transportation, health care, utilities, as well as putting some in savings. How much money do you need to retire in Hawaii? With the average age of retirement in Hawaii being 66 years old, one would need a total of $1,692,722 in retirement savings to live comfortably until the age of 80. Why do people living in Hawaii need so much in retirement savings? The high annual cost is due to Hawaii being the most expensive state in the U.S. to live in. Hawaii’s cost of living index is 193.3, nearly twice the national average. On the other end, Mississippi was found to have the lowest annual retirement cost at just $46,993 per year, nearly a third of the annual amount needed to retire in Hawaii.

THE 10 STATES WITH THE HIGHEST ANNUAL COST FOR RETIREMENT

- Hawaii: $120,909

- District of Columbia: $94,248

- California: $83,279

- Alaska: $79,249

- Oregon: $78,439

- New York: $77,911

- Massachusetts: $77,122

- Maryland: $73,111

- Connecticut: $70,817

- New Jersey: $67,764

Next time you’re wondering, “How long will my retirement savings last?” refer back to our guide to find the median retirement savings that will be needed to live a comfortable life in retirement where you live. Then, learn more about the benefits a self-directed IRA or Roth IRA can offer when it comes to saving for retirement.

Average Retirement Age in Every State

| State | Average Retirement Age |

| District of Columbia | 67 |

| Hawaii | 66 |

| Massachusetts | 66 |

| South Dakota | 66 |

| Maryland | 65 |

| Connecticut | 65 |

| New Jersey | 65 |

| Vermont | 65 |

| Rhode Island | 65 |

| New Hampshire | 65 |

| Colorado | 65 |

| Virginia | 65 |

| North Dakota | 65 |

| Minnesota | 65 |

| Utah | 65 |

| Nebraska | 65 |

| Iowa | 65 |

| Texas | 65 |

| Kansas | 65 |

| California | 64 |

| New York | 64 |

| Washington | 64 |

| Pennsylvania | 64 |

| Wisconsin | 64 |

| Florida | 64 |

| Montana | 64 |

| Illinois | 64 |

| Idaho | 64 |

| Wyoming | 64 |

| Tennessee | 64 |

| Oregon | 63 |

| Maine | 63 |

| Nevada | 63 |

| Delaware | 63 |

| Arizona | 63 |

| North Carolina | 63 |

| South Carolina | 63 |

| Ohio | 63 |

| Indiana | 63 |

| Missouri | 63 |

| Georgia | 63 |

| Mississippi | 63 |

| Louisiana | 62 |

| New Mexico | 62 |

| Michigan | 62 |

| Kentucky | 62 |

| Alabama | 62 |

| Oklahoma | 62 |

| Arkansas | 62 |

| Alaska | 61 |

| West Virginia | 61 |

States Ranked by the Highest Annual Cost for a Comfortable Retirement

| State | Average Retirement Age | Annual Cost of a Comfortable Retirement | Retirement Savings Needed for the Years Between Retirement Age and 80 | |

| 1 | Hawaii | 66 | $120,909 | $1,692,722 |

| 2 | District of Columbia | 67 | $94,248 | $1,225,222 |

| 3 | California | 64 | $83,279 | $1,332,457 |

| 4 | Alaska | 61 | $79,249 | $1,505,740 |

| 5 | Oregon | 63 | $78,439 | $1,333,467 |

| 6 | New York | 64 | $77,911 | $1,246,578 |

| 7 | Massachusetts | 66 | $77,122 | $1,079,710 |

| 8 | Maryland | 65 | $73,111 | $1,096,666 |

| 9 | Connecticut | 65 | $70,817 | $1,062,257 |

| 10 | New Jersey | 65 | $67,764 | $1,016,461 |

| 11 | Vermont | 65 | $67,651 | $1,014,762 |

| 12 | Rhode Island | 65 | $67,594 | $1,013,904 |

| 13 | Maine | 63 | $66,752 | $1,134,778 |

| 14 | Washington | 64 | $64,636 | $1,034,174 |

| 15 | Nevada | 63 | $63,300 | $1,076,107 |

| 16 | New Hampshire | 65 | $62,011 | $930,159 |

| 17 | Colorado | 65 | $60,357 | $905,350 |

| 18 | Delaware | 63 | $58,418 | $993,101 |

| 19 | Arizona | 63 | $58,327 | $991,560 |

| 20 | Virginia | 65 | $58,120 | $871,793 |

| 21 | Pennsylvania | 64 | $57,941 | $927,056 |

| 22 | North Dakota | 65 | $57,060 | $855,904 |

| 23 | Minnesota | 65 | $56,869 | $853,040 |

| 24 | Wisconsin | 64 | $56,434 | $902,942 |

| 25 | Florida | 64 | $56,382 | $902,116 |

| 26 | South Dakota | 66 | $56,178 | $786,497 |

| 27 | Montana | 64 | $55,711 | $891,368 |

| 28 | North Carolina | 63 | $54,687 | $929,686 |

| 29 | Illinois | 64 | $54,657 | $874,507 |

| 30 | Utah | 65 | $54,363 | $815,449 |

| 31 | South Carolina | 63 | $53,207 | $904,527 |

| 32 | Idaho | 64 | $52,962 | $847,388 |

| 33 | Louisiana | 62 | $52,695 | $948,503 |

| 34 | Nebraska | 65 | $52,439 | $786,583 |

| 35 | Iowa | 65 | $52,399 | $785,982 |

| 36 | Texas | 65 | $52,341 | $785,109 |

| 37 | Wyoming | 64 | $52,330 | $837,287 |

| 38 | Ohio | 63 | $51,817 | $880,889 |

| 39 | New Mexico | 62 | $51,556 | $928,181 |

| 40 | Michigan | 62 | $51,356 | $924,415 |

| 41 | Kentucky | 62 | $51,082 | $919,469 |

| 42 | Indiana | 63 | $50,697 | $861,848 |

| 43 | Missouri | 63 | $50,247 | $854,197 |

| 44 | Kansas | 65 | $50,223 | $753,339 |

| 45 | Tennessee | 64 | $50,186 | $802,977 |

| 46 | Georgia | 63 | $50,066 | $851,122 |

| 47 | West Virginia | 61 | $49,439 | $939,341 |

| 48 | Alabama | 62 | $49,099 | $883,790 |

| 49 | Oklahoma | 62 | $48,716 | $876,879 |

| 50 | Arkansas | 62 | $47,836 | $861,053 |

| 51 | Mississippi | 63 | $46,993 | $798,874 |

Would you like to display this on your website? Copy and paste the code below!

<center>

<textarea readonly>

<a href=”https://www.madisontrust.com/average-retirement-age/”>

<img src=”https://www.madisontrust.com/wp-content/uploads/average-retirement-age-3.png” alt=”The Average Retirement Age in Every State and the Savings Needed for a Comfortable Retirement – MadisonTrust.com – Infographic” title=”The Average Retirement Age in Every State and the Savings Needed for a Comfortable Retirement – MadisonTrust.com – Infographic”></a><br><a href=”https://www.MadisonTrust.com” alt=”MadisonTrust.com” title=”MadisonTrust.com”>By MadisonTrust.com</a>

</textarea>

</center>