The Future of Funding: How To Raise Capital with Self-Directed IRAs

Written By: Daniel Gleich

Key Points

- Self-Directed IRAs (SDIRAs) are a widely untapped source of funds that Investment Sponsors and Fund Managers can use to raise capital.

- With a Self-Directed IRA, your investors have the exciting opportunity to diversify their portfolio and potentially receive greater returns.

- Madison Trust’s streamlined process and dedicated Sponsors Team make it simple to move your investors’ retirement money into your fund.

Innovative strategies and the proper account type make all the difference when looking to raise capital. One account type gaining popularity among investors is a Self-Directed IRA (SDIRA). This investment vehicle not only offers account holders a way to diversify their portfolio and gain more control over their retirement funds, but it also provides Investment Sponsors with a game-changing opportunity to raise capital.

Why Use a Self-Directed IRA to Raise Capital?

Currently, there is approximately $37.5 trillion held in IRAs and 401(k)s. This is an untapped source of retirement funds that is accessible to be invested into your fund.

A Self-Directed IRA is a type of retirement account your investors can utilize to invest in your fund. Self-Directed IRAs allow account holders to invest beyond Wall Street into alternative assets such as real estate, private businesses, private placements, private equity, startups, and more. With the growing desire of investors to diversify their portfolio and earn potentially higher returns, Self-Directed IRAs open the door for Investment Sponsors to seamlessly raise capital.

Who Can Invest in Your Fund? Exploring Possible Investors for Raising Capital with Self-Directed IRAs

When looking to raise capital, it’s important to consider the best potential investors for your fund. These may include:

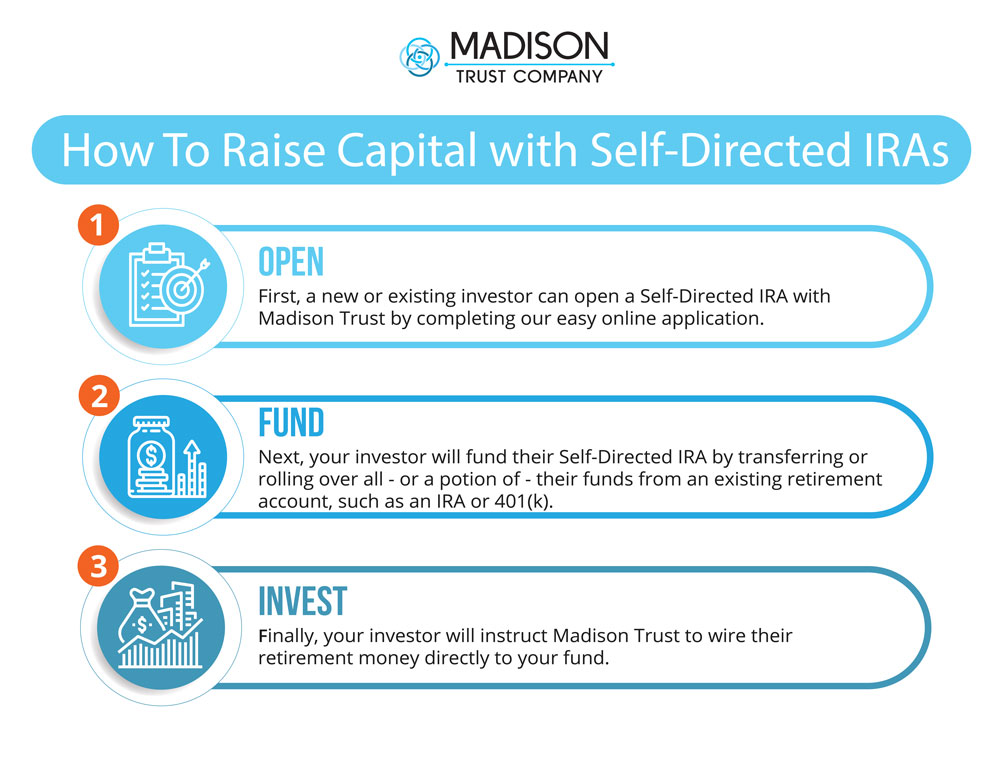

How It Works: How To Raise Capital with Self-Directed IRAs

The IRS requires all IRAs to be held by a custodian. Madison Trust, a Self-Directed IRA custodian, makes it simple to gain a potentially vigorous revenue stream for your fund by tapping into Self-Directed IRAs. Our Sponsors Team can assist in pre-approving your deals. This creates a streamlined and hassle-free process for your investors to move their retirement money into your fund.

Here are three simple steps on how your investors can move their retirement money into your fund:

Note: To place an investment, it’s important that the investor submits the necessary documentation. For example, a Subscription Agreement may be submitted to show the IRA’s investment amount and ownership of a private placement. For more information regarding the paperwork needed for a specific investment, consider viewing our “How To” Flowcharts.

How Can Madison Trust Help You? A Personalized Approach with Our Dedicated Sponsors Team

Fund Managers and Investment Sponsors alike have come to rely on Madison Trust Company to seamlessly channel their investors’ IRA money into their fund. Here’s what Madison Trust can offer the Investment Sponsors we work with.

A Dedicated Representative from our Sponsors Team

Investment Sponsors who work with Madison Trust will have their own dedicated representative, that can provide you and your investors with answers catered to your specific fund. Madison Trust strives to provide exceptional service centered around strong communication.

Your dedicated representative from our Sponsors Team can:

- Guide your investors through the process of setting up an account and investing in your fund.

- Pre-approve your investment documents to streamline the process and create a hassle-free experience for your investors. This process is optimized so that your investors can move their retirement money into your fund in under two weeks.

- Provide helpful resources such as account navigation phone calls that walkthrough transfers, our online portal, and address any questions new clients may have.

Educational Resources

Madison Trust can discuss the self-directed investing process through educational resources such as email blasts, blogs, and webinars. We aim to educate investors on the world of Self-Directed IRAs.

Conclusion: Let's Tie It All Up

By offering both new and existing investors a streamlined process to invest in your fund through Madison Trust's Self-Directed IRA, Investment Sponsors typically can increase their AUM. Interested in how to raise capital with Self-Directed IRAs? Schedule a call with our Sponsor Team to learn more.