Determining the Right Self-Directed IRA Custodian: Guidelines on How to Choose the Right SDIRA Custodian

Written By: Daniel Gleich

Key Points

- A Self-Directed IRA (SDIRA) custodian is responsible for administering the retirement account and holding custody of the IRA’s assets.

- A Self-Directed IRA account holder’s responsibility is to perform due diligence before directing the custodian to place the investment.

- To determine the best Self-Directed IRA custodian for you, look at factors such as reputation, experience, fees, client support, investment options, and security measures.

- Madison Trust is one of the leading Self-Directed IRA custodians, with straightforward fees, unparalleled client support, and industry expertise.

Self-Directed IRAs (SDIRAs) are growing in popularity, as more investors realize the potential growth their retirement savings can see by investing in alternative assets. With this exciting opportunity gaining light, more Self-Directed IRA custodians are being established. While having several options on who will hold your retirement assets is nice, it is important to thoroughly explore your potential custodians. It all starts by conducting research and asking the right questions.

In this blog, we’ll address your pressing questions, including “What does an IRA custodian do?” and “How do I choose a Self-Directed IRA custodian?”

What is a Self-Directed IRA Custodian?

The Retirement Industry Trust Association (RITA) describes the role of a Self-Directed IRA custodian as follows:

“A Self-Directed IRA custodian is a passive, non-discretionary custodian of customer-directed, also known as self-directed, individual retirement accounts (IRAs), as IRA is defined in Section 408 of the Internal Revenue Code as amended.”

All IRAs must be held by a custodian, such as a bank or a trust company. Self-Directed IRA custodians allow account holders to invest beyond Wall Street and into alternative assets such as real estate, promissory notes, private businesses, precious metals, and more.

Who Regulates Self-Directed IRA Custodians?

Custodians are regulated by state and federal law. They must comply with IRS requirements and are overseen and regularly audited by the regulating state. Madison Trust Company is regulated by the Division of Banking of South Dakota. For more information, here’s a list of state-charted trust companies in South Dakota.

What Does a Self-Directed IRA Custodian Do?

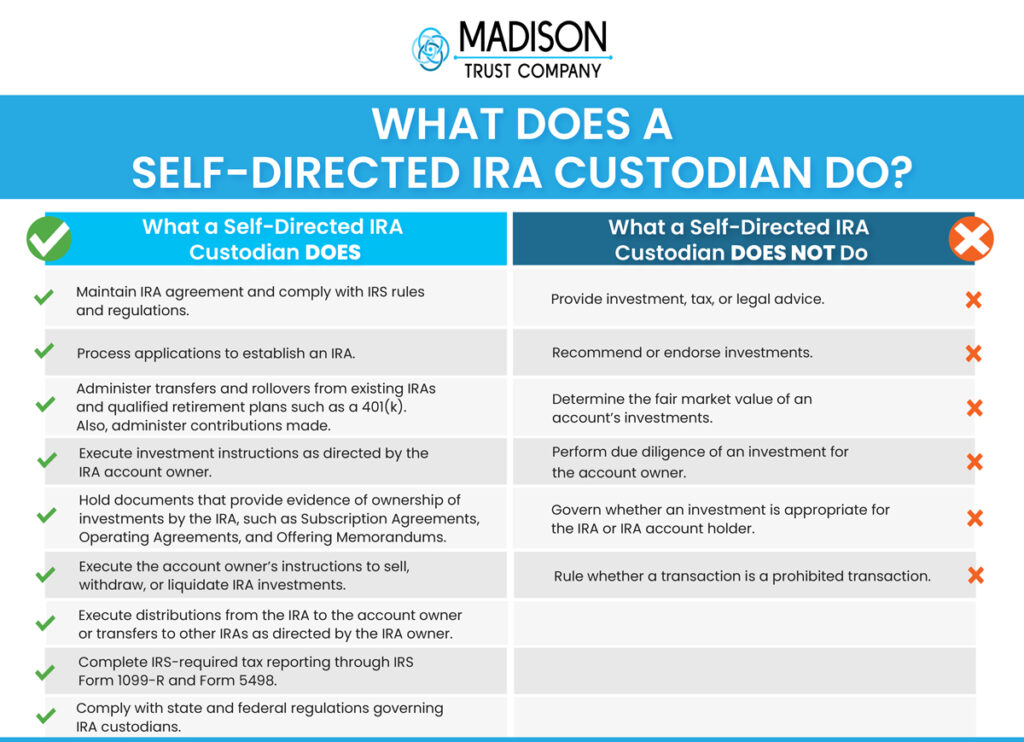

A Self-Directed IRA custodian is responsible for executing investment directions from the IRA account holder, holding custody of the IRA’s assets, and performing the administrative duties necessary to ensure the tax-advantaged status of the IRA. Self-Directed IRA custodians are passive and do not provide any investment, legal, or tax advice. Here’s a breakdown of what a Self-Directed IRA custodian does and does not do.

How To Choose the Right Self-Directed IRA Custodian

Choosing a Self-Directed IRA custodian is an important decision when planning for retirement. You want to select the best custodian that fits your needs. Here are some factors to consider when choosing a Self-Directed IRA custodian:

Experience and Reputation

Find a custodian with a solid track record and a good reputation in the industry. Research their background and reviews to ensure they have the necessary expertise to hold Self-Directed IRAs. A Self-Directed IRA Reviews website is a handy, easy-to-use website that compares custodians in one place.

Madison Trust has been a regulated trust company and industry leader since 2014. As of 2023, we have 20,000+ happy clients across all 50 states.

Straightforward Fees

Just like typical brokerage accounts, the fees vary based on the custodian. Consider comparing the custodian’s fees to ensure they are reasonable and transparent.

Madison Trust has a flat-rate fee structure, resulting in all accounts incurring the same fees regardless of the account’s value. Among the lowest in the industry, we aim to provide exceptional service at a fair price. For more details, please visit our Fee Schedule.

Client Support

When planning your finances for retirement, exceptional client support is beneficial. You do not want to wait in long call queues or pay premium prices for assistance with account-related matters or investment transactions. Look for a custodian that provides prompt and reliable customer support.

Madison Trust offers free, ongoing support to all our clients. Our knowledgeable and friendly staff can answer your questions on a live phone call. We strive to provide the best service in the industry, evident through our 2,000+ 5-star reviews on online rating platforms.

Investment Options

Once you determine the investments you would like to place, ensure that the custodian you choose can hold these investments. Standard brokerages typically can only hold standard assets (stocks, bonds, and mutual funds), while Self-Directed IRA custodians generally allow alternative investments.

Secure Investing

Security is often a top priority when looking at custodians who can hold your retirement funds. Determine whether your custodian has the proper systems and controls in place to protect your personal and financial information.

At Madison Trust, we take the proper precautions to protect your information. When you submit sensitive information (i.e., credit card number), it is protected both online and offline through encryption technology. For more information, please visit our privacy policy.

Potential Risks Associated with SDIRA Custodians

Recently the SEC, NASAA, and FINRA warned investors of the potential risks of Self-Directed IRAs. Their main claim was that although a Self-Directed IRA allows investment in a broader portfolio of assets than standard IRAs, these assets are potentially riskier. Like any investment, alternative assets may involve risk, however, these higher risks can lead to higher rewards.

Conclusion: Let's Tie It All Up

When you are saving for retirement, you want to get it right. That starts by selecting the right custodian to hold your IRA’s assets and administer your account. Madison Trust’s Self-Directed IRA Specialists are here to answer your questions so you can begin your journey to a richer retirement.