What Is a Self-Directed SIMPLE IRA?

Written By: Daniel Gleich

Key Points

- A Self-Directed SIMPLE IRA is a flexible retirement option for small businesses, offering exciting investment opportunities beyond Wall Street products.

- Comparing a SIMPLE IRA to a SEP IRA can help small business owners understand which plan may align with their goals and workforce structure.

- A Self-Directed SIMPLE IRA can be a useful tool for recruiting, retention, and portfolio diversification.

Small business owners may face unique challenges when it comes to offering retirement benefits to their employees. From identifying a cost-effective plan to providing flexibility and, quite simply, finding the time to implement your chosen plan, you might be wondering where to start.

One potential solution to consider is a Self-Directed SIMPLE IRA. By understanding where this unique retirement account fits into the broader landscape of cost-effective 401(k) options for small businesses, you can decide whether it’s right for you, your business, and your employees.

First, What Is a SIMPLE IRA?

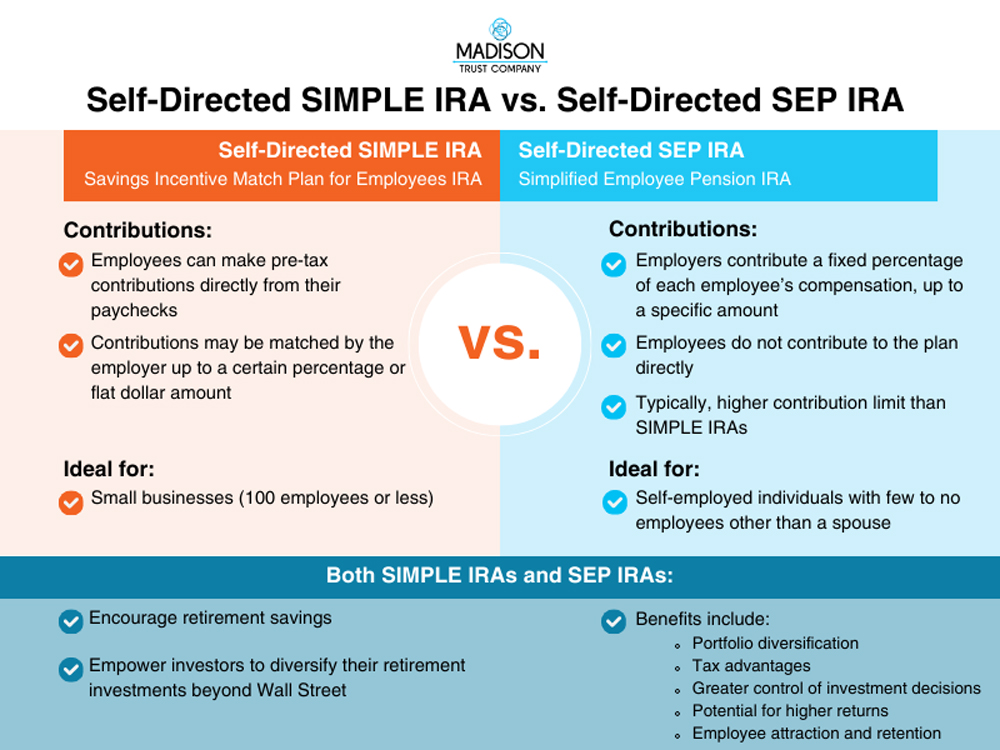

A SIMPLE IRA, or Savings Incentive Match Plan for Employees Individual Retirement Account, is a retirement plan tailored for small businesses. It combines some of the features of a standard 401(k) with the simplicity of an Individual Retirement Account (IRA).

In a SIMPLE IRA, employees can make pre-tax contributions directly from their paychecks, which are then matched by the employer up to a certain percentage or a flat dollar amount. This match encourages employees to save for retirement and can be an attractive benefit for job candidates.

A key advantage of a SIMPLE IRA is its simplicity. It doesn't have the administrative complexity or costs typically associated with larger 401(k) plans. That’s why it’s considered a cost-effective option for small businesses. Contributions are tax-deductible for employers, and employees can benefit from the tax-deferral of their contributions until their withdrawals during retirement. This is why a SIMPLE IRA can be an excellent retirement savings vehicle for businesses with 100 or fewer employees.

What About a SEP IRA?

While researching a SIMPLE IRA, you might also consider exploring the option of a SEP IRA, or Simplified Employee Pension Individual Retirement Account. A SEP IRA is another retirement plan suitable for small businesses, and it shares some similarities with the SIMPLE IRA.

The key distinction between a SEP IRA and SIMPLE IRA lies in the contribution structure. In a SEP IRA, only the employer makes contributions; employees do not contribute to the plan directly. Employers can contribute a fixed percentage of each employee's compensation, up to a specific annual limit. A SEP IRA can work well for a self-employed individual with few to no employees other than possibly a spouse who supports the business.

The SEP IRA's contribution limit is typically higher than that of a SIMPLE IRA, which can be appealing to business owners who want to maximize their retirement savings. However, it's important to remember that only the employer contributes, and employees have no direct involvement in the plan. Therefore, if you're looking for a retirement plan that encourages employee participation, a SIMPLE IRA might be the better choice.

A SIMPLE Comparison to Keep in Mind

Think of a SIMPLE IRA as the small business counterpart to a standard 401(k). It combines employee and employer contributions, much like a 401(k) but in a more straightforward and cost-effective manner. A SEP IRA, on the other hand, is comparable to a Solo 401(k) because only the employer makes contributions.

Now, What Is a Self-Directed SIMPLE IRA?

Understanding the core comparison of a SIMPLE IRA vs. SEP IRA is foundational. With that knowledge, you can take the exploration a step further, into the concept of a Self-Directed SIMPLE IRA.

A Self-Directed SIMPLE IRA offers the ability to invest in alternative assets beyond the typical stocks, bonds, and mutual funds normally associated with retirement plans. These alternative assets can include real estate, private businesses, precious metals, and more. As a small business owner, you can set up a Self-Directed SIMPLE IRA platform for your business to enable both you and your employees to invest more freely. It’s a whole new way of investing for retirement.

Benefits of a Self-Directed SIMPLE IRA

- Portfolio Diversification: Standard retirement plans limit your investment choices to Wall Street products. Self-Directed SIMPLE IRAs break free from these constraints, allowing investments in countless alternative assets. This diversification can help reduce risk and enhance returns.

- Tax Advantages: Self-Directed SIMPLE IRAs retain the same tax advantages as their standard counterparts. Contributions are tax-deductible, and any investment gains grow with a tax advantage.

- Greater Control: With a Self-Directed SIMPLE IRA, you and your employees have more control of your respective investment decisions. Everyone can choose assets that align with their interests and financial goals. Whether it's investing in a rental property or supporting a startup, the power is in self-direction.

- Potential for Higher Returns: Alternative investments like real estate or private placements often have the potential for steadier returns compared to Wall Street products. This can potentially help employees grow their retirement savings quicker.

- Employee Attraction and Retention: As a creative tool for retirement investing, a Self-Directed SIMPLE IRA can be appealing to prospective and current employees alike.

The world of retirement planning can be complex, but understanding your options can turn that complexity into creativity and flexibility. A Self-Directed SIMPLE IRA provides a cost-effective solution for small business owners. If you're curious about bringing a Self-Directed SIMPLE IRA into your company benefits package, Madison Trust can help educate you further so you can decide whether it’s the solution you’ve been looking for. Schedule a free discovery call today!