How Inflation Affects Your Retirement Account

Key Points

- Inflation not only impacts the present price of consumer goods but can affect your retirement savings.

- Depending on your investments, inflation will affect your portfolio differently.

- A Self-Directed IRA is a powerful retirement account used to diversify your portfolio with assets beyond Wall Street, so you can have a balanced portfolio and overcome market volatility. including raw land, commercial property, residential property, and crowdfunding opportunities.

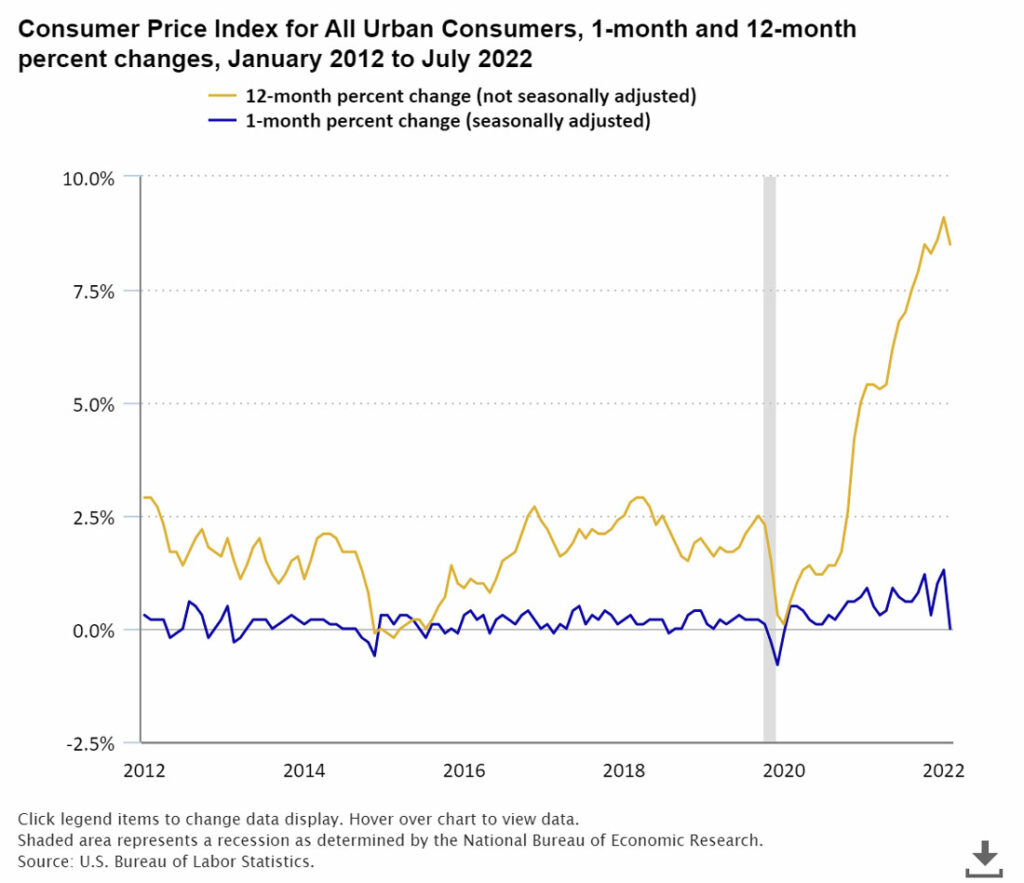

Inflation has been the hot topic of conversation this year. Americans have seen an increase in the price of energy, food, shelter, automobiles, and more. To try to curb inflation and fulfill its dual mandate of keeping prices stable and maximizing employment, the Federal Reserve has raised the federal funds rate by 2.25 percentage points in less than 6 months. The U.S. Chair of the Board of Governors of the Federal Reserve, Jerome Powell, warned Americans that the Fed plans to continue to raise interest rates and keep them “for some time” in hopes to decrease inflation.

Inflation not only impacts the price of consumer goods but can also affect your retirement savings by taking a bite out of your nest egg. Understanding how inflation and interest rate increases affect your retirement portfolio can help ensure you have enough assets to last through your golden years.

What Does Rising Inflation Mean for My Retirement Account?

Depending on the types of investments, inflation and the interest rate hike will affect your portfolio differently.

Standard Assets

Stocks – When inflation is high, consumers are less likely to spend, which results in lower profits for companies. This can negatively affect your retirement because when there is a decrease in a company’s revenue, their stock price usually decreases.

Bonds – The rise in interest rates caused bond yield prices to top 3% in June 2022, the highest level in 11 years. This negatively affects bond investors because of the inverse relationship between bond yields and bond prices. When yields rise, there is a decrease in the value of bonds that are already in the market and issued at a lower interest rate.

Alternative Assets

Alternative assets like real estate, precious metals, commodities, and promissory notes may see more stability than standard assets at this time.

Real Estate – As inflation increases, mortgage rates also rise. This causes more consumers to rent until conditions improve, which causes a high demand for rental properties.

Precious Metals - Precious metals like gold often have an inverse relationship with the stock market. When the stock market decreases, typically the value of gold increases (and vice versa), causing your investment in precious metals to be more valuable during high inflation.

Commodities – Commodities like sugar, livestock, raw materials, and natural gas will always be in demand despite the current economic conditions. Their value will continue to increase as the supply decreases.

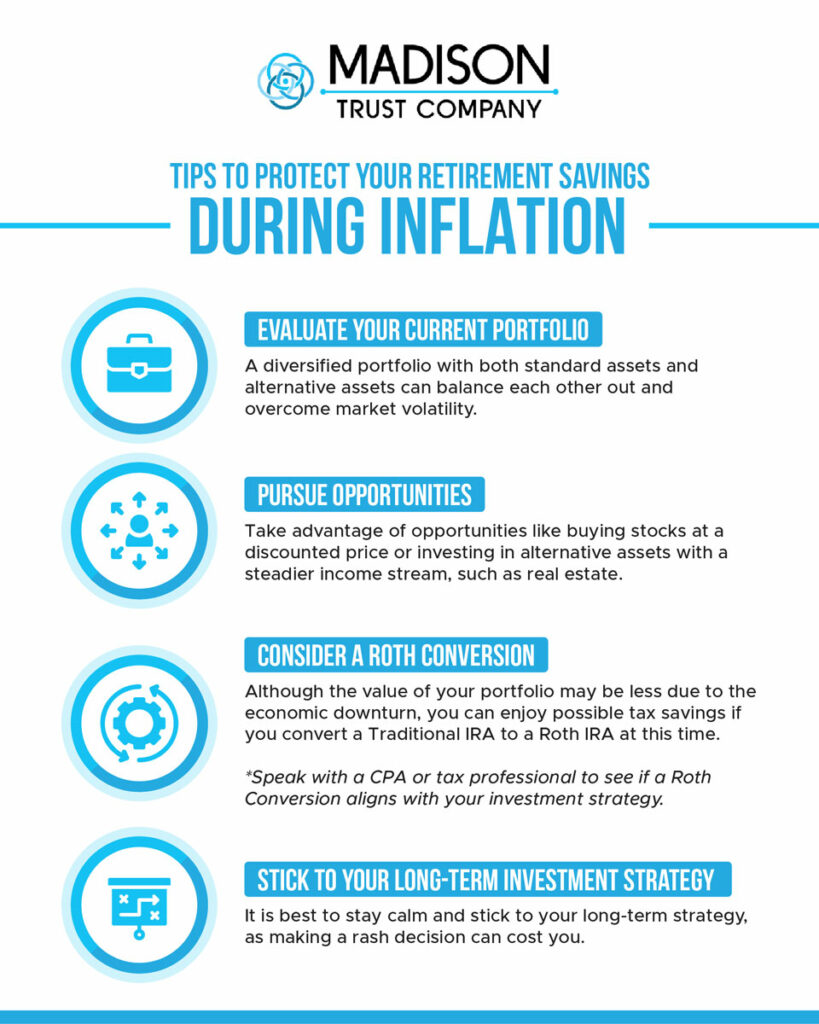

Tips to Protect Your Retirement Savings During Inflation:

Here are a few tips to protect your retirement portfolio during inflation.

Before making any changes, review your investment strategy with a financial advisor.

1. Evaluate Your Current Portfolio

One of the most important rules to beat inflation in retirement is to use a tax-advantaged account, such as an IRA, to invest steadily throughout your working years in a variety of assets. The longer you invest, the better chance your return will beat inflation. A truly diversified portfolio includes a mix of standard assets (stocks, bonds, and mutual funds) as well as alternative assets (real estate, precious metals, commodities, promissory notes, and more). The mix of assets balances each other out, helping your portfolio overcome market volatility.

2. Pursue Other Opportunities, like Investing with a Self-Directed IRA

Although it may not seem like it, periods of high inflation can result in opportunities for investors. For example, when inflation occurs stock values typically decrease. If time is on your side, consider this an opportunity to buy them at a discount and see greater growth as the market climbs back up.

Another opportunity that typically only the savviest of investors are aware of is the ability to invest in alternative assets with retirement funds. Self-Directed IRAs give you the power to invest in almost any asset you choose. Consider how you can diversify your portfolio beyond Wall Street with assets like real estate or precious metals and receive steadier investment income.

In addition, as borrowing is more expensive when there are rising interest rates, you may want to consider using a Self-Directed IRA to invest in promissory notes or loans. As a lender, you can charge a higher interest rate to the borrowers and receive a greater return on your investment.

3. Consider a Roth Conversion

Another option during a market downturn is the opportunity to convert your Traditional IRA to a Roth IRA (known as a Roth Conversion). If you choose the path of a Roth Conversion, you will pay taxes on the amount that is currently in your account.

For example, assume you originally had $200,000 in your Traditional IRA, but the market downturn caused your portfolio’s value to decrease to $120,000. If you choose to convert to a Roth IRA now, you would be saving money since you will only pay taxes on the $120,000. As the assets in your portfolio recover, you will be able to enjoy tax-free withdrawals and gains in your new Roth IRA.

Please speak to a tax professional or CPA to ensure this aligns with your investment strategy.

4. Stick to Your Long-Term Investment Strategy

Keep in mind that the Fed raises interest rates to ensure that the financial system doesn’t derail itself by growing too fast. A growing economy is good, but we must keep in mind that there may be a few bumps along the way. It is best to stay calm and stick to your long-term strategy, as making a rash decision can cost you. The best way to stay on track during economic volatility is to have a diversified and often rebalanced portfolio.

Conclusion: Let’s Put It All Together

Seeing how inflation impacts the value of your retirement portfolio can be nerve-wracking. However, it is important not to make any quick reactions and to maintain your regular contributions to your retirement account.

Actions such as evaluating your portfolio, pursuing opportunities, considering a Roth Conversion, and sticking to your long-term investment strategy can be beneficial. A diversified portfolio is advantageous during economic volatility and keeps you on track to enjoy your golden years.

Interested in investing in alternative assets with a Self-Directed IRA to hedge against inflation? Schedule a call with a Self-Directed IRA Specialist to get started.

Disclaimer: Madison Trust Company does not provide legal, tax or investment advice. Prior to making any investment decisions, please consult with the appropriate legal, tax, and investment professionals for advice.