Prioritizing Retirement Planning with a Self-Directed SEP IRA

Written By: Daniel Gleich

Key Points

- A Self-Directed SEP IRA offers advantageous contribution limits, allowing self-employed individuals and business owners to maximize their retirement savings up to $69,000 for 2024.

- With a Self-Directed SEP IRA, you can invest in real estate, private businesses, precious metals, and more.

- Understanding the SEP agreement is crucial, as it outlines the rules and guidelines for the SEP IRA and must be submitted to Madison Trust for account approval.

- Timing your contributions for tax purposes will also be an important consideration to keep in mind if you decide to open a Self-Directed SEP IRA.

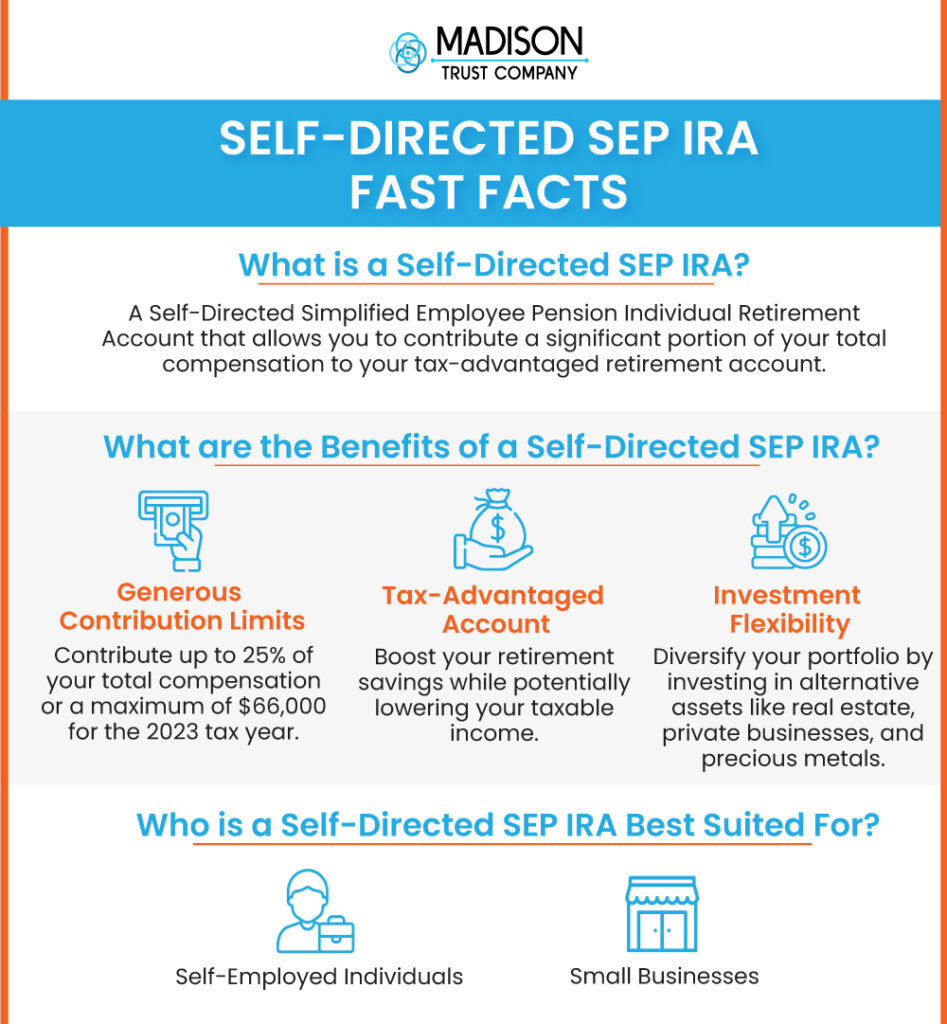

Are you a self-employed individual or small business owner? Have you always wondered how you can save for retirement but never found a feasible solution that fits in with your finances? You shouldn’t have to put off retirement planning to pursue your passion and grow your business. That’s why there’s a unique retirement savings tool designed specifically for entrepreneurs like you. It’s called a Self-Directed Simplified Employee Pension Individual Retirement Account (Self-Directed SEP IRA). Here’s how it works and why it’s ideal for anyone who runs their own business:

What Is a Self-Directed SEP IRA?

With a Self-Directed SEP IRA, you have the opportunity to contribute a significant portion of your total compensation, up to the maximum allowable limit set by the IRS, to your tax-advantaged retirement account. The SEP component allows you to accelerate your retirement savings, while the Self-Directed aspect gives you the freedom to invest in real estate, private businesses, precious metals, and other alternative assets that are not typically available in standard IRAs.

As a passive Self-Directed IRA custodian, Madison Trust enables you to gain greater control of your investments and diversify your retirement portfolio within your Self-Directed SEP IRA. In the process, you can capitalize on the benefits of a SEP IRA, including the larger contribution limits.

Self-Directed SEP IRA Contribution Limits

One of the most appealing aspects of a Self-Directed SEP IRA is its generous contribution limits, far exceeding those of standard Traditional IRAs and Roth IRAs. While standard IRAs cap annual contributions at $7,000 or $8,000 for 2024, a Self-Directed SEP IRA allows employers to contribute a maximum of $69,000 per participant but no more than 25% of the employee's compensation in 2024. This flexibility enables self-employed individuals and business owners to make substantial annual contributions, setting them on an accelerated path toward achieving their retirement goals.

Moreover, Self-Directed SEP IRA contributions are tax-deductible, providing an additional incentive to boost retirement savings while potentially lowering your taxable income. Both the higher contribution limits and tax-deductible contributions allow Self-Directed SEP IRA holders to maximize their retirement savings while optimizing their tax situation.

Understanding the SEP Agreement

The SEP agreement serves as the foundation of your Self-Directed SEP IRA, outlining the plan's rules, guidelines, and eligibility requirements. Typically, this agreement is completed by the business owner and should be submitted to their Self-Directed SEP IRA custodian, such as Madison Trust, for account approval. Ensuring that the SEP agreement complies with IRS guidelines is essential to prevent any potential complications down the road. With Madison Trust, you get the expertise and support of our Self-Directed IRA Specialists to ensure your SEP agreement is received. Quite simply and for your own protection, we won’t approve an account without a submitted SEP agreement.

Timing Contributions for Tax Reporting

As you contribute to your Self-Directed SEP IRA, it's important to understand the timing implications for tax reporting. Contributions made in a specific tax year will be reported on the following year's IRS Form 5498. For example, if an account holder places a contribution of $25,000 on January 3rd, 2023, designating it as their contribution for the tax year 2022, it will be recorded on the 5498 form for the tax year 2023. This distinction is crucial for accurate tax reporting. Consider keeping meticulous records of contributions and consulting a qualified tax professional to help ensure seamless compliance with reporting requirements.

Investing with a Self-Directed SEP IRA

Beyond the higher contribution limits, a Self-Directed SEP IRA opens a world of investment opportunities. From real estate to private businesses, precious metals, and much more, you have the freedom to align your retirement portfolio with your financial goals, interests, and risk tolerance. With a Self-Directed SEP IRA, you can even tap into private equity investments, such as start-ups or small businesses seeking capital. This avenue allows you to play an active role in supporting growing enterprises and potentially reaping substantial rewards.

Consider Allowing Self-Directed SEP IRAs for Your Employees, Too

As a business owner, you not only have the opportunity to benefit from a Self-Directed SEP IRA for yourself, but you can also extend its advantages to your employees. Offering a Self-Directed SEP IRA as a retirement benefit can be a valuable incentive to attract and retain talented employees while providing them with a pathway to secure their financial future. By contributing to your employees' Self-Directed SEP IRAs, you demonstrate your commitment to their well-being and financial success, while also benefiting from additional tax deductions. Plus, establishing a Self-Directed SEP IRA for your employees is relatively simple and cost-effective, making it an appealing alternative to a 401(k) plan.

Get Started

A Self-Directed SEP IRA presents a powerful and flexible retirement savings option for self-employed individuals and business owners. The combination of generous contribution limits, tax-deductible contributions, and investment flexibility positions the Self-Directed SEP IRA as an attractive retirement savings vehicle that addresses the common challenge of retirement planning for busy entrepreneurs. Ready to learn more? Explore the highest rated Self-Directed SEP IRA and speak with one of our specialists today!