Summer Bucket List: How to Plan for Your Longest Vacation (Retirement)

Written By: Daniel Gleich

Key Points

- Retirement is your longest vacation, so it’s important to be proactive and plan ahead.

- To kickstart your retirement planning journey, consider opening a retirement account, creating a well-balanced portfolio, setting retirement goals, and automating your contributions.

- Madison Trust’s Self-Directed IRA (SDIRA) gives you the opportunity to grow your retirement savings by investing in assets that you know and believe in.

Summer is here! It’s time to kick back and relax by the pool, devour some ice pops, and soak up the sun. Along with the temperature rising, our expenses typically increase in the summer too. The cost of vacations, barbeques, summer camps, and other activities adds up.

Retirement planning should be done continuously, and the summer is a perfect time for a mid-year checkup. Here’s a summer bucket list you can enjoy while keeping up with your retirement planning.

1. Get Your Feet Wet / Open and Maintain Your Retirement Account

One of the best ways to cool off from the summer heat is by taking a dip in the pool or a trip to the beach. The first step into the water might seem a bit intimidating, as the water may be cooler than the sizzling summer air. However, once you take the plunge you will feel a lot better.

Similarly, it may take some time to research your retirement account options to see which account best suits your needs. You can choose to participate in your employer-sponsored 401(k) or save for retirement with a Self-Directed IRA (SDIRA), among other options. Once you open an account and start investing, you may feel more prepared for your future since you put in the effort to grow your retirement savings.

2. Plan Activities / Create Retirement Goals and a Budget

Budgeting is essential when it comes to planning for both your summer activities and your retirement goals. In the short term, for your summer plans, you may want to allocate funds for transportation, food, lodging, and extra items like souvenirs. When planning for retirement, you can create a short-term budget by first separating your spending into needs and wants. Then, you can factor in how much you can afford to contribute to a retirement account.

In the long term, summer goals may include traveling to your dream destination. Here are a few questions to ask yourself when budgeting for a vacation:

- Where is my dream travel destination?

- What excursions will I do there?

- How much should I budget for this trip?

- When can I travel there?

Similarly, when planning your financial goals, consider asking yourself the following questions:

3. Protect Yourself with Sunscreen / Hedge Against Inflation and the Stock Market with Alternative assets

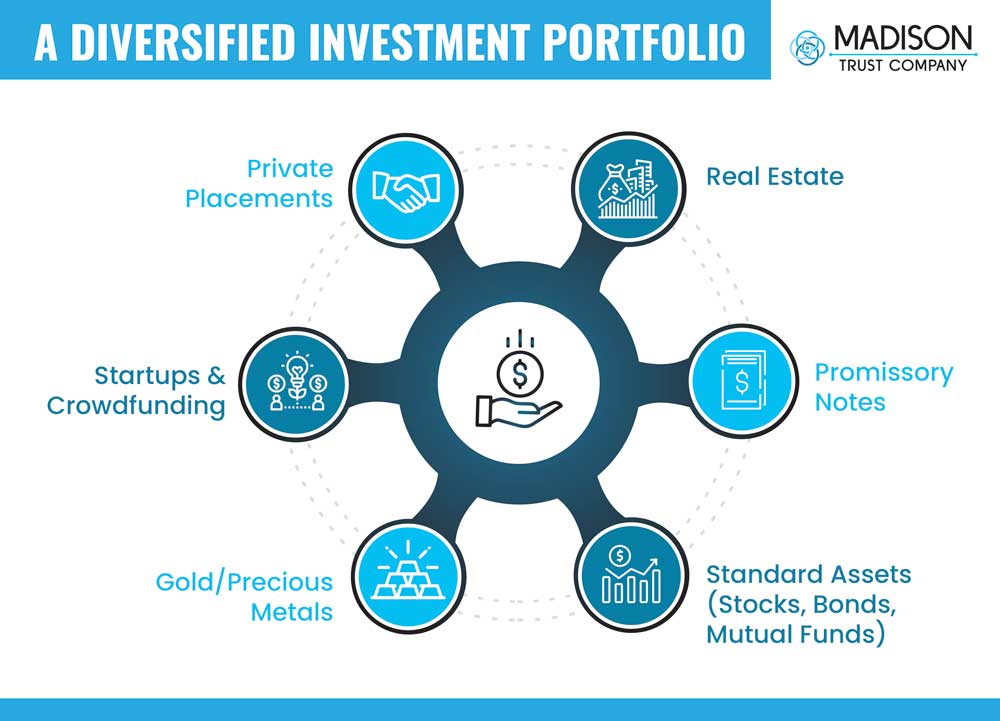

As a child, you may have been reminded to put on sunscreen to protect your skin from the sun. Similarly, the strategy of diversifying your investment portfolio can protect your retirement savings from the volatility of the stock market.

Investing in alternative assets such as real estate, precious metals, and promissory notes can provide a hedge against inflation and the stock market. Alternative assets generally perform inversely to stocks, bonds, and mutual funds. A well-diversified portfolio ensures you get the most out of your investments and continue to grow your retirement savings despite market conditions.

4. Automate Your Sprinkler / Automate Your Savings

As your summer schedule starts to fill up, you may not have time to think about smaller tasks like watering your lawn or turning off the air conditioning when you are away from home. Luckily, there are automated systems that can complete those tasks for you.

Similarly, consider automating your retirement savings. Depending on your account, you may be able to set up direct deposit so your funds move directly from your paycheck to your retirement account. This ensures that you hit your savings goals, without having to take extra time to manually contribute to your retirement account.

Conclusion: Let's Tie It All Up

Retirement is your longest vacation, so it’s best to be proactive and plan ahead. Having a retirement account, a well-balanced portfolio, and retirement goals are the first few steps to enjoying your golden years.

Do you have questions about self-directed investing and/or retirement planning? Schedule a free discovery call with a Self-Directed IRA Specialist to get the answers you need.

Disclaimer: All of the information contained on our website is a general discussion for informational purposes only. Madison Trust Company does not provide legal, tax or investment advice. Nothing of the foregoing, or of any other written, electronic, or oral statement or communication by Madison Trust Company or its representatives, is intended to be, or may be relayed as, legal, tax, investment advice, statements, opinions, or predictions. Prior to making any investment decisions, please consult with the appropriate legal, tax, and investment professionals for advice.