When Is a Self-Directed IRA Taxed?

Written By: Daniel Gleich

Key Points

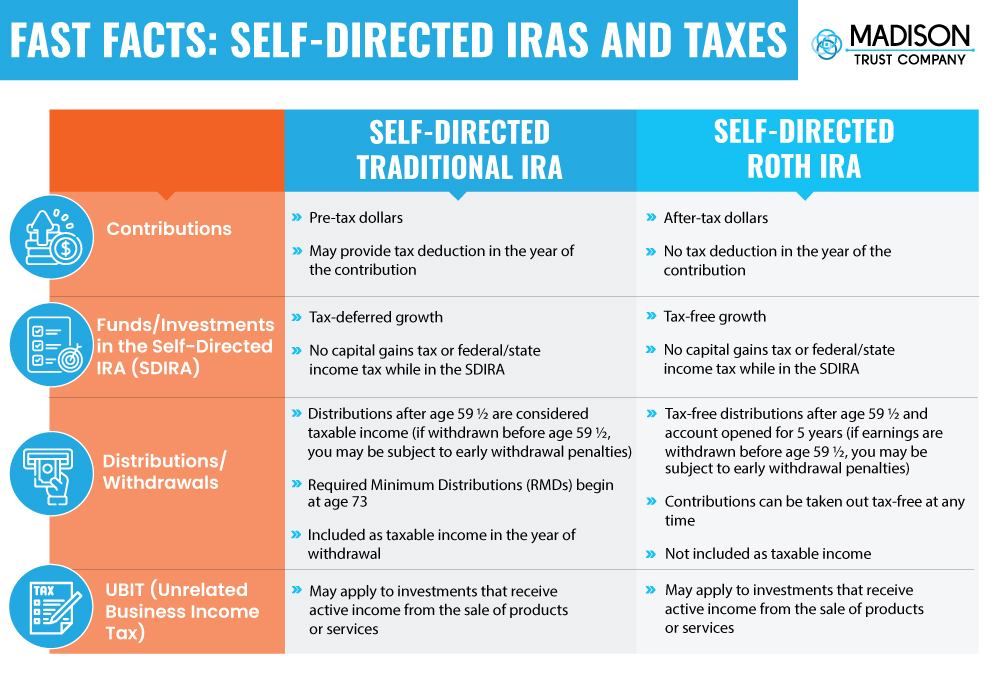

- Distributions from a Traditional IRA after age 59 ½ are considered taxable income, while distributions from a Roth IRA after age 59 ½ are tax-free.

- Early distributions before age 59 ½ may be subject to an early withdrawal penalty unless an exception is granted.

- Unrelated Business Income Tax (UBIT) may be applied to investments such as private businesses that receive income from the sale of products or services.

A Self-Directed IRA enables you to save for retirement in new and exciting ways beyond stocks, bonds, and mutual funds. Whether you choose to invest in real estate, precious metals, startups, or any of the countless other alternative assets allowed in a Self-Directed IRA, you’ll enjoy tax savings on gains and potential deductions for contributions. Of course, there are still tax considerations to be mindful of, especially if or when you choose to distribute funds from your account. Here are the basics:

Distributions

IRA distributions are taxed depending on the type of IRA you open. Traditional IRAs are funded with pre-tax money. In a Traditional IRA, any withdrawals or distributions taken after the age of 59 ½ will be considered taxable income. On the other hand, Roth IRA contributions are deposited with post-tax money and therefore withdrawals after age 59 ½ will not be subject to additional taxes. This is why Traditional IRAs are known for being tax-deferred, while Roth IRAs are tax-free.

If your Self-Directed IRA is a Traditional IRA, you’ll pay taxes on withdrawals completed after age 59 ½ according to your income tax bracket. If your Self-Directed IRA is a Roth IRA, you won’t need to pay taxes on withdrawals after age 59 ½. The tax on Traditional IRA withdrawals also applies to the required minimum distributions (RMD) that begin at age 73 and continue annually thereafter.

Early Distributions

If you decide to take a distribution from your Self-Directed IRA before the age of 59 ½, the same Traditional and Roth IRA tax guidelines apply. Early withdrawals from a Traditional IRA are taxed, while early withdrawals of contributions from a Roth IRA are not. However, early withdrawals from a Traditional IRA are often subject to an early withdrawal penalty of 10 percent the distributed amount, as are early withdrawals of earnings from a Roth IRA. The IRS does grant early withdrawal exceptions for certain life events, circumstances and expenses.

Unrelated Business Income Tax (UBIT)

If you’re using a Self-Directed IRA for investments that generate active income, Unrelated Business Income Tax (UBIT) is an important factor to keep in mind. UBIT generally applies when unrelated business activity is conducted through a tax-exempt organization, such as an IRA. In the case of a Self-Directed IRA, any active income generated from investments held within the account may be subject to UBIT if certain criteria are met. Learn more about UBIT and how it's calculated.

Let's Tie It all Up

Be a Savvy Self Director

Understanding how Self-Directed IRAs are taxed is essential for enjoying the tax advantages and avoiding potential drawbacks. At Madison Trust, we’re committed to not only serving as your Self-Directed IRA custodian, but also equipping you with the information you need to self-direct your retirement savings with freedom, confidence, and diversification. Tap into a world of information on our Self-Directed IRA blog and schedule a discovery call to speak with a Self-Directed IRA Specialist today.

Disclaimer: All the information contained on our website is a general discussion for informational purposes only. Madison Trust Company does not provide legal, tax or investment advice. Nothing of the foregoing, or of any other written, electronic, or oral statement or communication by Madison Trust Company or its representatives, is intended to be, or may be relayed as, legal, tax, investment advice, statements, opinions, or predictions. Before making investment decisions, please consult the appropriate legal, tax, and investment professionals for advice.