Investing in Commercial Real Estate with a Self-Directed IRA: The Essentials to Get Started

Written By: Daniel Gleich

Key Points

- Self-Directed IRAs (SDIRAs) offer exciting opportunities for investors to diversify their retirement portfolios by investing in alternative assets like commercial real estate.

- Commercial real estate investments through an SDIRA can provide the potential for steady rental income and long-term returns.

- Madison Trust simplifies the process of setting up a Self-Directed IRA for commercial real estate investments.

Navigating the world of retirement investments often leads savvy investors to Self-Directed IRAs (SDIRAs), known for their flexibility and the breadth of investment choices they offer in alternative assets. For those looking to step beyond Wall Street products, SDIRAs present exciting opportunities, particularly in the realm of commercial real estate. This investment avenue has gained traction among discerning investors drawn to its potential for substantial long-term returns and portfolio diversification.

Why Open a Self-Directed IRA?

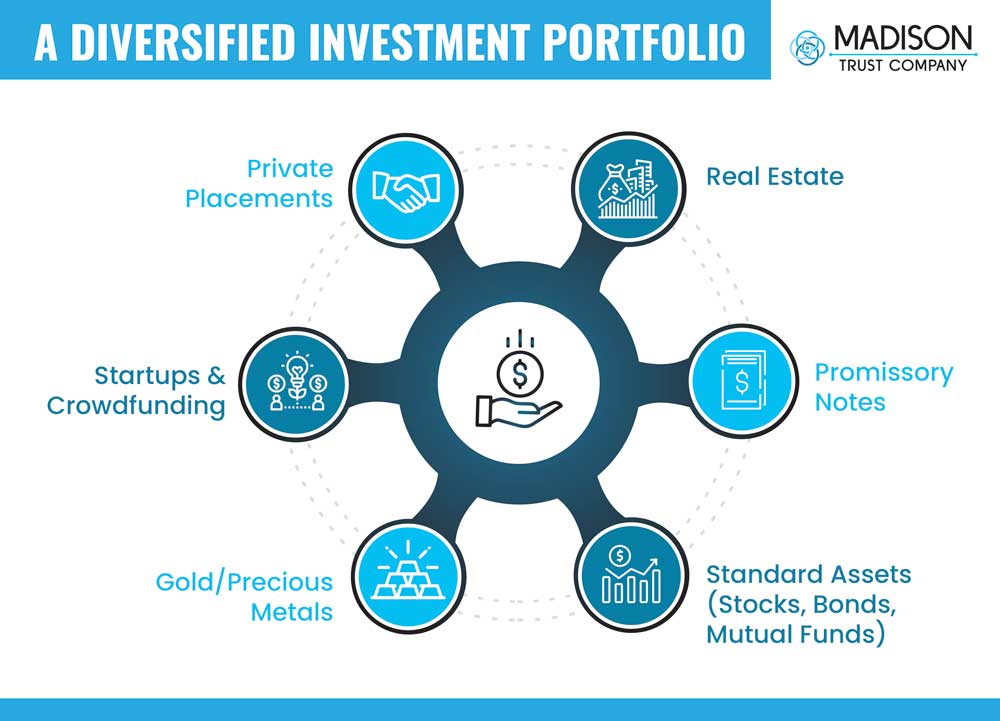

In terms of functionality, a Self-Directed IRA is not markedly different from a standard IRA; it’s a retirement savings account with tax advantages. However, what sets it apart is the ability to invest in alternative assets. Unlike standard IRAs limited to stocks, bonds, and mutual funds, SDIRAs open the door to real estate, precious metals, private businesses, and much more. An SDIRA empowers investors with more control of their retirement investing. This autonomy enables you to align your retirement savings with your specific knowledge, expertise, and interests, including in areas like commercial real estate.

Why Invest in Commercial Real Estate?

Investing in commercial real estate with an SDIRA is not just about adding another asset to your retirement portfolio; it's about leveraging the investment potential that a commercial property can offer.

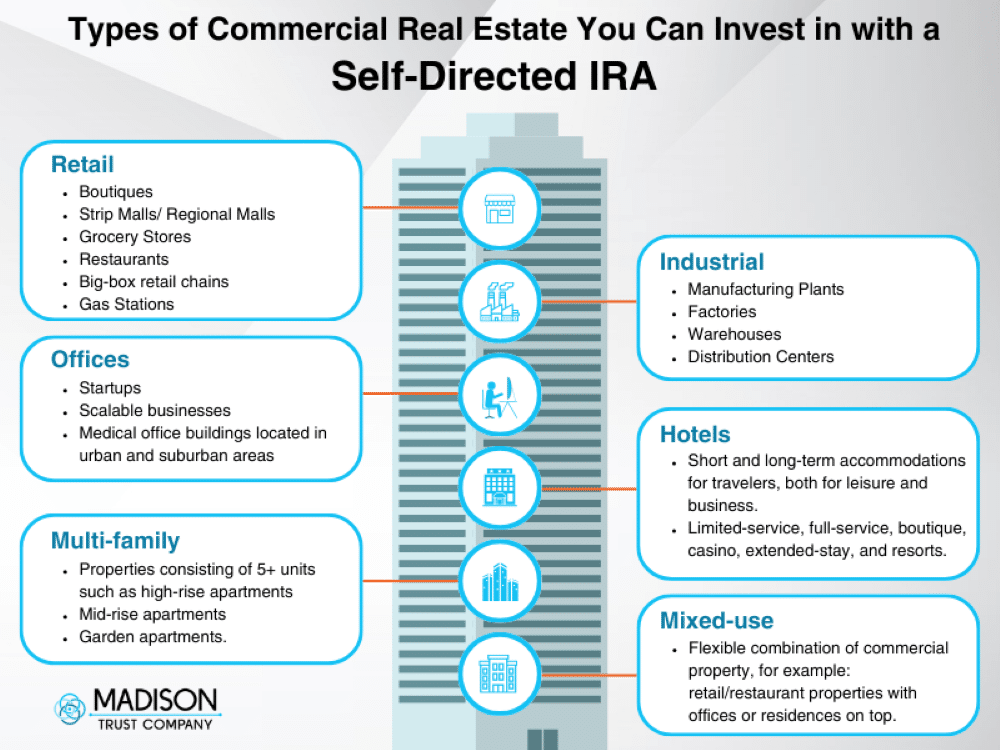

Whether office buildings, retail spaces, or industrial complexes, commercial properties bring the possibility of steady rental income. This income can be significantly higher than residential properties, especially in prime locations with high demand. Commercial leases typically extend over longer periods compared to residential leases, potentially providing stability and more predictability in income.

Navigating the Path to Commercial Real Estate with an SDIRA

The first step to investing in commercial real estate with a Self-Directed IRA is to set up your Self-Directed IRA. At Madison Trust, the setup process is simple:

Open

Open a Self-Directed IRA with Madison Trust by completing our easy online application.

Fund

Fund your Self-Directed IRA by transferring or rolling over all - or a portion of - your funds from an existing retirement account, such as an IRA or 401(k), or by making an initial contribution.

Invest

Instruct Madison Trust to send your IRA funds by writing a check or sending a wire directly to your investment.

As with any investment, commercial real estate generally involves strategy, knowledge, and, quite frankly, some homework. Understanding the local real estate market is crucial. Factors such as location, property type, and market trends can significantly impact the success of the investment. Keep in mind that commercial real estate usually requires active management, including maintenance, tenant relations, and adherence to legal and regulatory requirements. You might consider hiring a professional property manager. It’s also important to consider an exit strategy for a given property, including a potential sale or transfer, in line with your retirement investing goals.

Investment transactions within an SDIRA are facilitated and completed by your custodian, such as Madison Trust, at the account holder’s direction. However, there’s a type of SDIRA called a Checkbook IRA that grants the account holder freedom to manage everyday transactions without custodian involvement once the account is set up. A Checkbook IRA can be ideal for transaction-heavy investments like commercial real estate. Learn more about opening a Checkbook IRA with Madison Trust’s sister company, Broad Financial. You get the best of two highly rated companies in one streamlined process!

Whether through a classic SDIRA or a Checkbook IRA, investing in commercial real estate with a Self-Directed IRA can be an exciting and rewarding investing strategy for retirement. Ready to explore the exciting opportunities? At Madison Trust, you can count on exceptional service. Schedule a discovery call today!