Unlocking the Future of Investing: Using AI to Manage Your Self-Directed IRA Investments

Written by: Daniel Gleich

Key Points

- Artificial Intelligence (AI) is an emerging technology that can perform certain tasks that typically require human intelligence.

- Self-Directed IRA (SDIRA) investors can utilize the power of AI to potentially aid in optimizing and managing their investments.

- Madison Trust’s Self-Directed IRA Specialists are here to answer your questions about self-directed investing.

The advent of Artificial Intelligence (AI) has taken the world by storm. This emerging technology is inspiring, as computer programs can now perform tasks that typically require human intelligence. AI can potentially aid in decision making, problem solving, and data analysis, among a variety of other skills that can be helpful in almost any industry.

AI can also come in handy when optimizing and managing your investments. Self-Directed IRA (SDIRA) account holders looking to invest in alternative assets but do not have the time or expertise to actively manage their investments, can potentially utilize the power of AI to their advantage. Let’s explore how AI can possibly revolutionize self-directed investing in three popular alternative assets and create new opportunities for savvy investors.

Real Estate Investing & AI

One of the most popular alternative investments to hold within a Self-Directed IRA is real estate. Real estate investments can include residential properties, commercial real estate, rental properties, private REITs, raw land, and more. Here’s how AI can potentially help Self-Directed IRA investors manage their real estate investments:

- Select a Suitable Investment Property - AI can help identify a possible real estate investment opportunity by looking at the property’s location, neighborhood characteristics, and rental income potential. AI can also look at the property’s historical performance and potential for appreciation.

- Predict Maintenance – AI can predict possible maintenance problems based on past data and current sensor readings of the HVAC system usage, water usage, and energy consumption. This can help reduce unexpected expenses.

- Identify Rental Income Opportunities – AI can potentially help to optimize rental rates by analyzing the local rental market data and recommending possible rental prices.

- Screen Possible Tenants – AI can screen potential tenants by looking at credit history, criminal background, and rental history. This can likely help investors make better-informed decisions about who to rent to.

Private Business Investing & AI

Private business investments with a Self-Directed IRA can include buying equity in private companies not listed on Wall Street, startups and crowdfunding opportunities, or investing in another type of private placement. Here’s how AI can aid investors looking to diversify their retirement portfolio with a private business investment:

- Predict Growth Potential – AI can analyze a business's investment potential by examining past data, financial health, and current industry trends.

- Assess Investment Risk – AI can analyze a company’s financial records, legal records, and market conditions to identify possible investment risks.

- Conduct Market Research – AI can assess market trends, consumer behaviors, and competitor landscape that could potentially impact a business’s performance.

Precious Metals Investing & AI

Self-Directed IRA account holders can invest in precious metals such as gold, silver, platinum, and palladium to diversify their retirement portfolio and hedge against inflation. Typically, precious metals perform inversely to the stock market, which can help you grow your retirement savings despite market conditions.

- Analyze the Market – AI can analyze historical data, market trends, and geological events that may impact the precious metals market.

- Examine Market Sentiment – AI can gather information from social media, the news, and other online sources to determine market sentiment surrounding precious metals.

- Generate Predictions - AI can potentially predict future price movements and long-term trends to help investors make informed decisions about buying/selling their precious metals in their Self-Directed IRA.

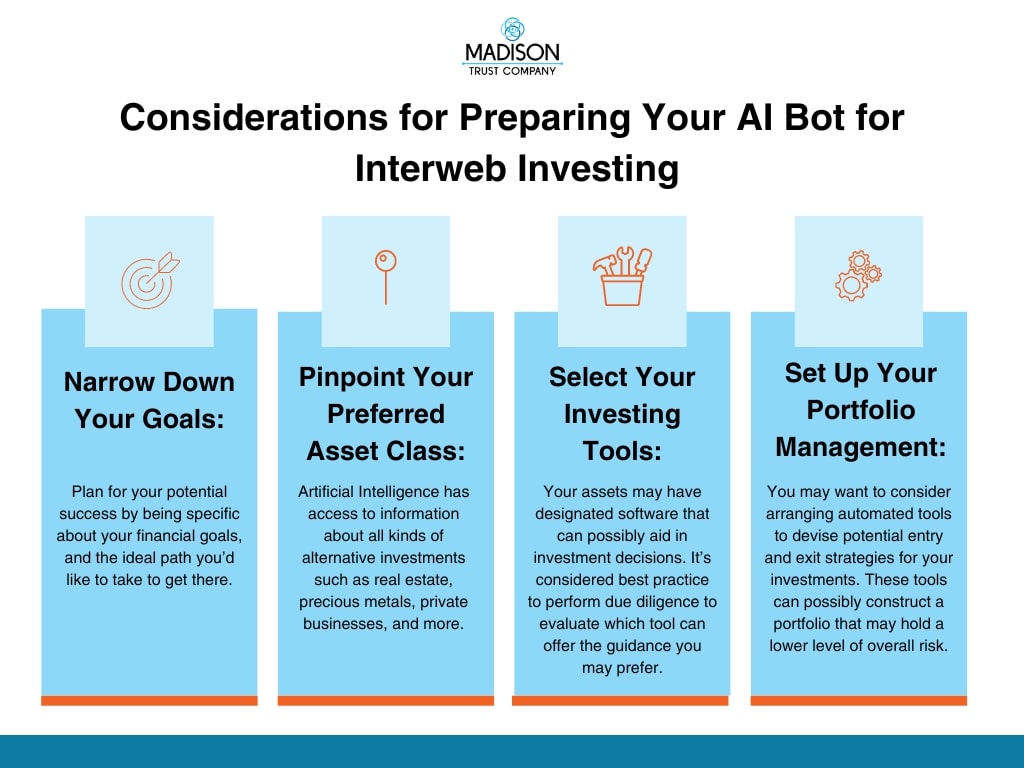

Potential Considerations of Using AI for Self-Directed Investing

While AI can be a powerful tool for self-directed investors, it is a relatively new and evolving technology. Therefore, there are certain considerations that investors should be mindful of:

Quality of Data

The accuracy of AI depends on the quality of the data it analyzes. If the data is incomplete, inaccurate, or biased, this may affect the reliability of AI’s predictions and conclusions.

Over-Reliance on AI

Although AI can provide helpful insights, it is critical to not rely solely on its predictions and conclusions. It is recommended that investors conduct due diligence and speak with the appropriate party, such as a tax professional or financial advisor, before making any investment decisions.

Conclusion: Let's Tie It All Up

AI can be a valuable tool for Self-Directed IRA investors looking to potentially grow and diversify their retirement portfolio with alternative assets. By providing data-driven insights, risk management, and predictive analysis, AI can possibly help investors effectively manage their investments and navigate the world of self-directed investing.

You Have Questions? We Have Answers!

Are you interested in learning more about self-directed investing? Schedule a free discovery call with a Self-Directed IRA Specialist to begin your journey to a richer retirement.