Planning a Pool Party and Your Retirement

Written By: Daniel Gleich

Key Points

- Self-Directed IRAs offer the freedom to invest in alternative assets you know and believe in.

- Similar to a pool party, Self-Directed IRAs must be opened, require planning, are under your direction, and can help you achieve your goals.

- Madison Trust Self-Directed IRA Specialists can answer your questions about self-directed investing.

With the summer season in full swing, outdoor activities are being planned. From pool parties, barbecues, beach bashes, and campfires, there is no shortage of things to do. While your schedule fills up, it’s important to stay on track with your retirement planning. You may be surprised to learn that planning a pool party is like planning for retirement with a Self-Directed IRA (SDIRA).

Both a Pool and a Retirement Account Must Be Opened

If you live in a climate where you cannot keep your pool open all year due to winter conditions, you may be familiar with the responsibility of opening your pool for the season. This may include removing the pool cover, conducting a safety inspection, adding water, removing any visible debris, and adding chlorine or other treatments.

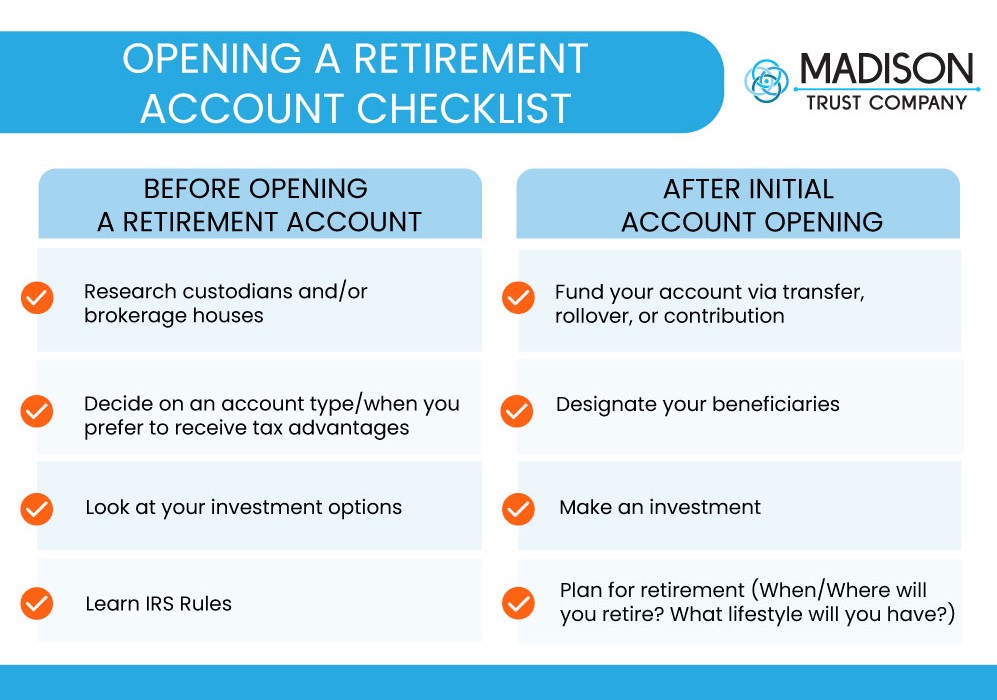

Similarly, preparing for retirement starts with opening an account. Before opening an account, you may decide on an account type, research different custodians or brokerage houses, and look at your investment options. The retirement account type you open affects when you will receive tax advantages, either tax-deferred (Traditional IRA) or tax-free (Roth IRA).

Both Pool Parties and Retirement Require Planning

After your pool is opened, you can then start to plan who you are going to invite, what food you will serve, and what games you will play.

Comparably, once your retirement account is opened, you can plan how much you will contribute, who your beneficiaries are, what assets you will invest in, and when you will retire. When planning for retirement, there is a lot to remember. Speaking with a financial advisor and Self-Directed IRA Specialist can ensure all your questions are answered.

Both the Pool Party and Your Retirement Portfolio are Under Your Direction

As the party planner, you get to decide on the pool party’s theme. Common themes include a Hawaiian Luau, USA when celebrating the 4th of July, and a kids’ movie such as The Little Mermaid or Pirates of the Caribbean.

When building a retirement portfolio, you get to decide the assets you invest in. While a standard IRA limits your investments to stocks, bonds, and mutual funds, a Self-Directed IRA allows you to invest beyond Wall Street.

Self-Directed IRA account holders have the opportunity to invest in alternative assets such as real estate, private companies, precious metals, and promissory notes. Your portfolio is designed by you, for you. You get to invest in assets that you know and believe in so you can achieve your retirement goals!

Both are Subject to Risk

With the excitement of hosting a pool party, it’s important to remember certain rules to keep your guests safe. You may consider hiring a lifeguard or putting up signs to remind your guests of safety rules such as no running.

It’s also important to keep in mind that like all investments, Self-Directed IRA investments involve risk. Since you are self-directing your investments, it’s essential to conduct due diligence on your investment. If you’re looking to learn more about Self-Directed IRA rules, Madison Trust offers free educational resources like articles and videos.

Both Result in Achieving Your Goals

Once you have thoughtfully planned all the details and the day of the party has arrived, you’ll be able to sit back, relax, and take a dip in the pool! Although it’s a short-term goal, planning a successful pool party is something to celebrate!

Although you may tweak your portfolio as investment opportunities arise, you can watch your new retirement strategy work for you. When you choose a Self-Directed IRA custodian that is client-focused, like Madison Trust, you will have a pleasant journey to retirement. Then, once you reach retirement age, all your hard work will pay off and you can enjoy the retirement of your dreams.

Conclusion: Let's Tie It All Up

Although an unlikely pair, planning a pool party and planning for your retirement can both be fun and beneficial. If you are looking to learn more about growing your retirement savings with a Self-Directed IRA, visit our Self-Directed IRA FAQs or read our latest blog posts. You can also schedule a call with a Self-Directed IRA Specialist to speak to a live, knowledgeable representative about your exciting investment opportunity.

Disclaimer: All of the information contained on our website is a general discussion for informational purposes only. Madison Trust Company does not provide legal, tax or investment advice. Nothing of the foregoing, or of any other written, electronic, or oral statement or communication by Madison Trust Company or its representatives, is intended to be, or may be relayed as, legal, tax, investment advice, statements, opinions, or predictions. Prior to making any investment decisions, please consult with the appropriate legal, tax, and investment professionals for advice.