How Does a Self-Directed IRA Work? A Comprehensive View of SDIRA Operations, Simplifying Complex Concepts

Written By: Daniel Gleich

Key Points

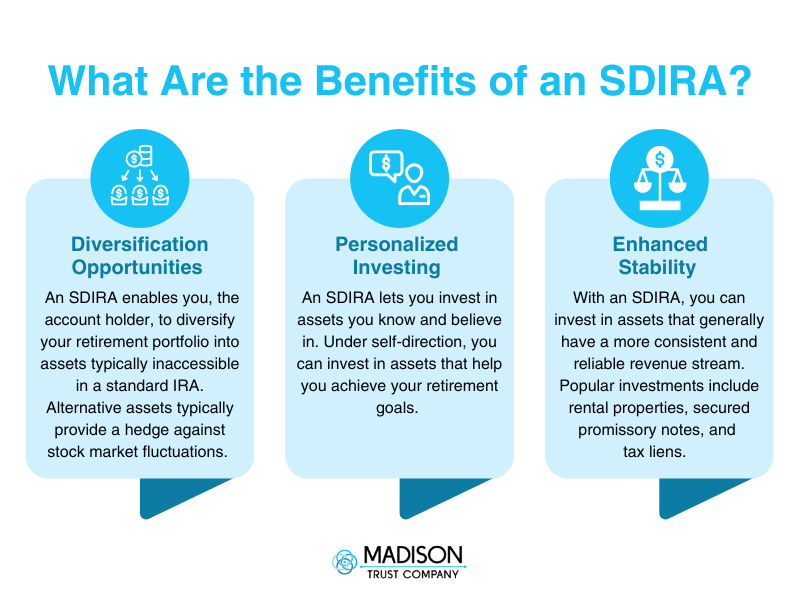

- Self-Directed IRAs (SDIRAs) are ideal for investors looking to diversify with alternative assets, receive tax advantages, and gain more control over their retirement portfolios.

- Once you identify an alternative asset, direct your SDIRA custodian to place your investment by providing required documentation and funding instructions.

- Madison Trust's SDIRA Specialists are here to answer your questions about how Self-Directed IRAs work and the investing process.

IRAs are a great opportunity to invest for your golden years. If you are seeking to invest in alternative assets like precious metals or real estate, you’ll need a Self-Directed IRA. Let’s explore how a Self-Directed IRA works as well as the ins-and-outs of the account so you can determine if this retirement account is right for you.

What Is a Self-Directed IRA (SDIRA)?

A Self-Directed IRA (SDIRA) is an individual retirement account that allows you to diversify your retirement portfolio with alternative investments in a tax advantaged account.

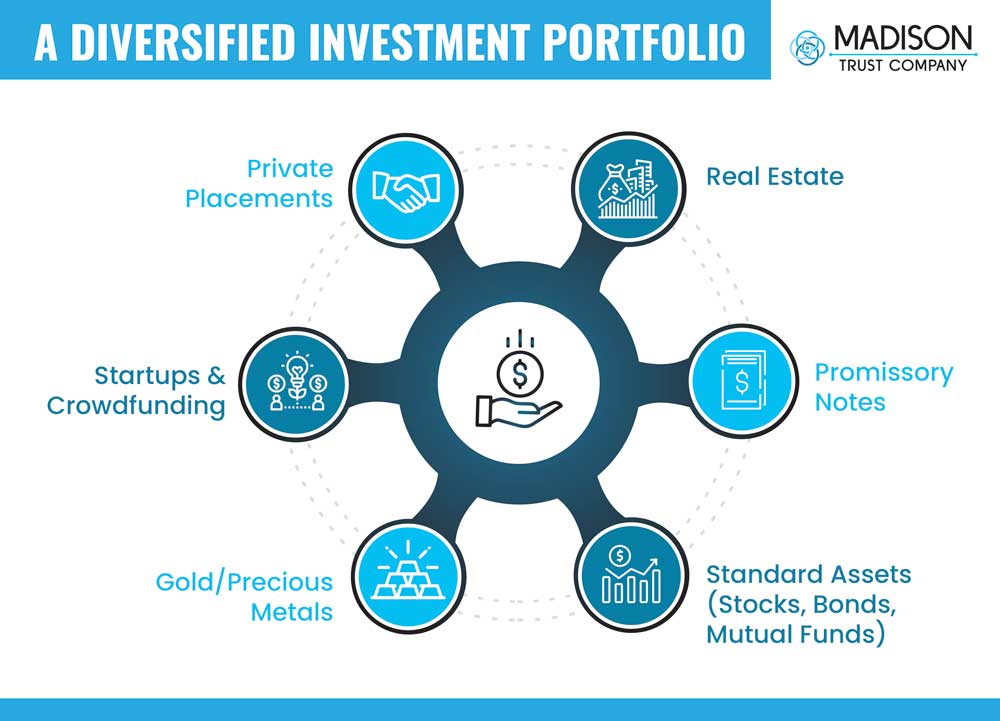

A Self-Directed IRA differs from a standard IRA because of its robust investment opportunities. A standard IRA confines you to stock market products such as stocks, bonds, and mutual funds. A SDIRA empowers you invest in alternative assets such as real estate, promissory notes, precious metals, and private businesses.

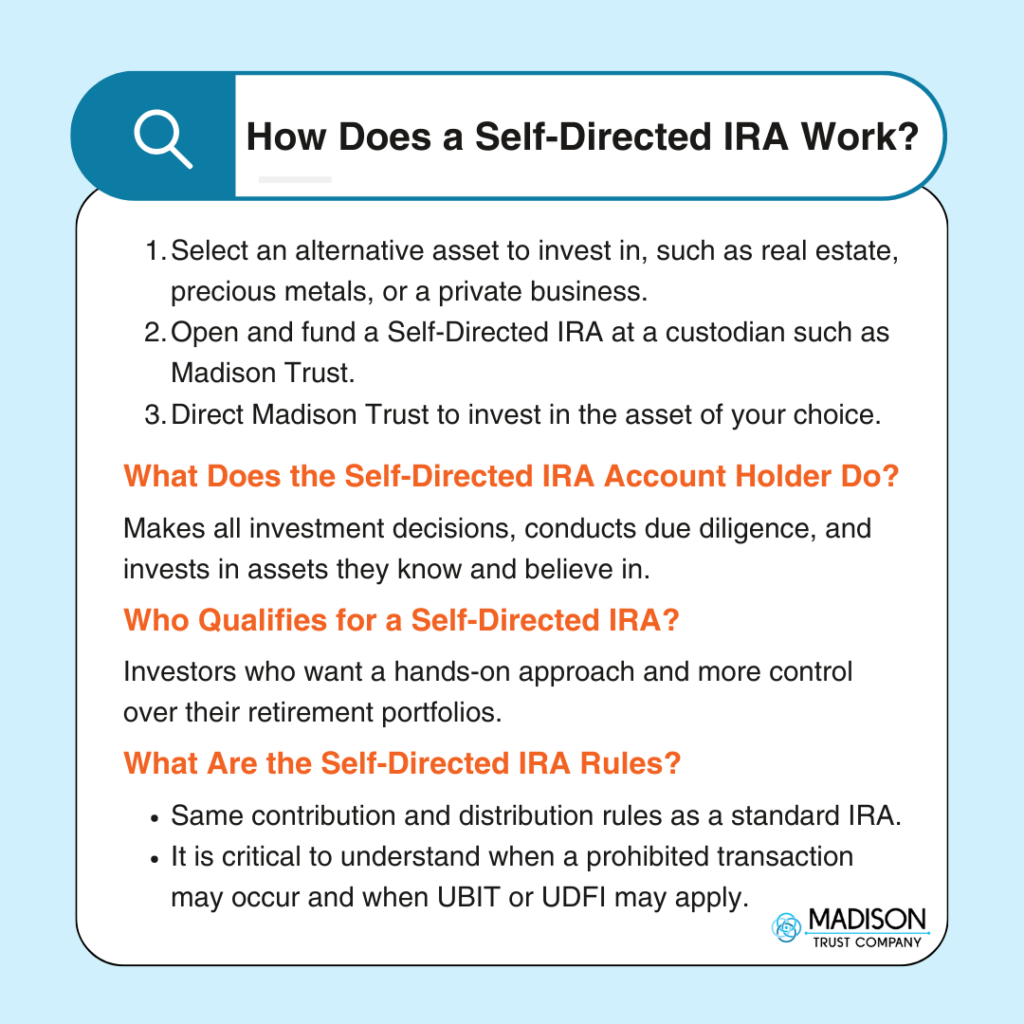

“Self-directed” means that you, the account holder, are in the driver’s seat of your retirement investing. You have the power to make all investment decisions, conduct due diligence, and invest in assets you know and believe may perform well – without having to rely solely on fund managers and financial advisors.

Who Qualifies for a SDIRA?

Self-Directed IRAs are ideal for investors who want a hands-on approach and more control over their retirement portfolios. SDIRA investors know that although alternative assets may have greater risk, but have the potential for substantial returns. They also know they are responsible for conducting due diligence to understand their investments and make all investment decisions.

SDIRAs are also helpful for investors with specialized knowledge in a niche market, such as real estate investing. Or, for those interested in investing in a startup or private placement not traded on Wall Street.

Types of Self-Directed IRAs

Like a standard IRA, you can open an SDIRA as a Self-Directed Roth IRA, Self-Directed Traditional IRA, Self-Directed SEP IRA, or Self-Directed SIMPLE IRA. The type of account you open will determine when you will receive tax benefits.

In addition to the account types listed above, a Self-Directed IRA can be upgraded to a Self-Directed Checkbook IRA. A Checkbook IRA establishes an IRS-compliant entity such as an LLC or trust to create checkbook control. Together, the entity and a designated checking account enables you to make instant everyday transactions without contacting your Self-Directed IRA custodian.

Self-Directed IRA Contribution Limits and Withdrawal Rules

Self-Directed IRAs have the same contribution limits and withdrawal rules as standard IRAs. Here are a few rules:

- There is an annual contribution limit across all IRA accounts. As of 2024, the contribution limit is $7,000 ($8,000 if age 50+).

- Qualified withdrawals during retirement are taxed as ordinary income

- Early withdrawals before age 59 ½ without a qualifying exception generally result in a 10% penalty and regular income taxes.

- Self-Directed Traditional IRA account holders must take required minimum distributions (RMDs) starting at age 73 as of 2024.

For more information, visit Self-Directed IRA rules.

Who Offers Self-Directed IRAs?

SDIRAs must be opened at a Self-Directed IRA custodian. Self-Directed IRA custodians have the appropriate staff, expertise, and capacity to maintain custody of the alternative assets in your account. SDIRA custodians administer your account and cannot give investment advice.

It’s important to choose the best Self-Directed IRA custodian for you. Madison Trust offers flat-fees, unparalleled customer service, and alternative asset expertise.

What Can You Invest in with a Self-Directed IRA?

You can invest in almost any alternative asset with a Self-Directed IRA. Popular self-directed investments include real estate, gold, private equity, and promissory notes. The only assets the IRS prohibits are life insurance, S-corporations, and collectibles (art, antiques, stamps, etc.).

Do You Pay Taxes on a Self-Directed IRA?

The investment income made from your Self-Directed IRA investments are generally tax-deferred (Self-Directed Traditional IRA) or tax-free (Self-Directed Roth IRA), due to the passive nature of the investments.

However, if your Self-Directed IRA investment generates income that is not substantially related to the tax-exempt purpose of the IRA (saving for retirement) or if leveraged is used to fund an investment, you may owe taxes. This is known as Unrelated Debt Financed Income (UBIT) and Unrelated Debt Financed Income (UDFI), and should be reported on IRS Form 990-T. It is considered best practice to consult with a tax professional regarding your Self-Directed IRA investments.

Benefits of a Self-Directed IRA

How Does a Self-Directed IRA Work?

Once you identify an investment, you direct your SDIRA custodian to place the investment by providing required documentation and funding instructions through an Investment Authorization Form. Your profits earned from the investment flow back into your tax advantaged account, and all investment expenses flow from your SDIRA.

How Long Does It Take to Set Up a Self-Directed IRA?

A SDIRA can be opened in 10 minutes by simply completing an online application. The process takes one to two weeks to fund your account and invest in the asset of your choice, depending on the processing time of your previous custodian.

Conclusion: Let’s Tie It All Up

Self-Directed IRAs are retirement accounts that give you the power to diversify your portfolio into assets you know and believe in. Self-Directed IRAs can be an excellent choice for investors looking for a more hands-on approach to their investment strategy.

Are Self-Directed IRAs Right for You?

Madison Trust’s Self-Directed IRA Specialists are here to answer your questions so you can begin your journey to a richer retirement. Schedule your free discovery call today!