Brick by Brick to Retirement Bliss: Investing in a Real Estate Syndication with a Self-Directed IRA

Written By: Daniel Gleich

Key Points

- A real estate syndication is an investment opportunity where multiple investors pool funds together to purchase a single investment.

- Real estate syndications allow investors to access a generally larger, more lucrative property that may otherwise be unattainable.

- Madison Trust’s client-centered approach and industry knowledge provides self-directed investors industry-leading service.

With the abundance of real estate investment opportunities available, you may be unsure where to start or how to choose property. You may also find yourself wanting to act quickly on an investment, but simply may not have the time. Luckily, there is a way to invest in real estate without having to do all the heavy lifting yourself!

In this blog we’ll discuss what a real estate syndication is, how they work, and how you can invest in a real estate syndication with a Self-Directed IRA.

What Is a Real Estate Syndication?

A real estate syndication is an investment opportunity where multiple investors pool funds together to purchase a single investment. Real estate syndications allow investors to access larger, more generally lucrative properties that may otherwise be unattainable.

Real estate syndications not only pool financial resources, but also combine intellectual resources to make educated decisions about the properties being invested in. By teaming up with other real estate investors and an investment sponsor, you can sit back and invest passively.

Types of Real Estate Syndication Investment Opportunities

Popular real estate syndication opportunities available to self-directed investors include:

- Multi-family properties (apartment buildings, duplexes, townhomes, condos, etc.)

- Commercial properties (office buildings, retail centers, hotels, storage facilities, parking garages, etc.)

- Housing Developments

- Rehab properties

- Mobile home parks

How Do Real Estate Syndications Work?

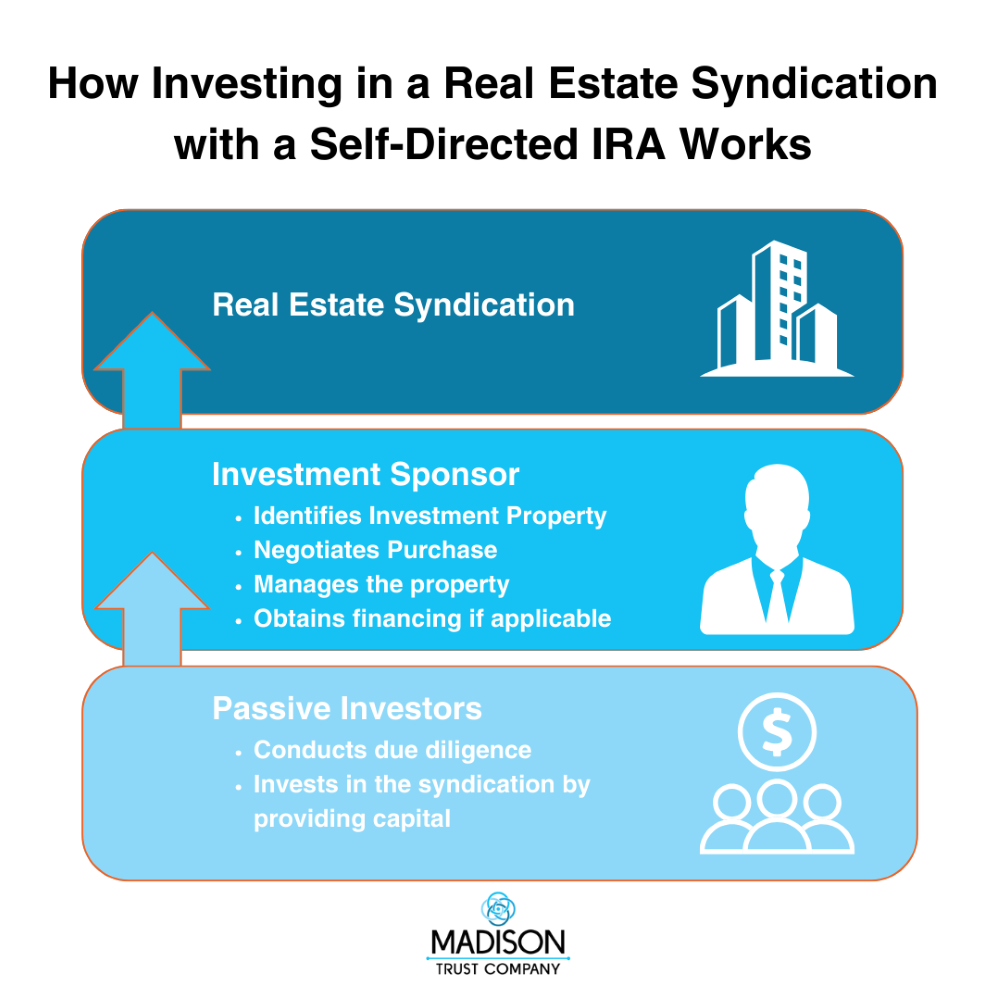

Generally, real estate syndications are structured as a limited liability company or partnership. In this case, an investment sponsor (also known as the general partner) is responsible for most of the hands-on work of the investment. Investment sponsors will identify the investment property, negotiate a purchase, obtain financing, and manage the property.

Your Self-Directed IRA typically participates as a passive investor (limited partner). It essentially acts as a financial investor and uses the expertise of the investment sponsor. As a Self-Directed IRA account holder, you are responsible for conducting due diligence on the investment, investment sponsor, and IRS rules.

Benefits of Using a Self-Directed IRA to Invest in Real Estate Syndications

Portfolio Diversification

Investing in alternative assets in addition to standard Wall Street products can balance your portfolio and provide diversification.

Steady Income and Tangible Asset

Real estate typically returns a steady flow of income. In addition, even if the property value decreases, you will still be able to sell the physical property.

Tax Advantages

The profit generated from a SDIRA investment can be tax-deferred (Self-Directed Traditional IRA) or tax-free (Self-Directed Roth IRA).

Invest in What You Know

Invest in assets you understand and fit well with your financial goals.

Managed by an Investment Sponsor

Experienced investment sponsors can likely source quality deals and obtain resources necessary to manage the property.

Access to Larger Opportunities

Pooling together funds from multiple investors allows for the investment in larger and generally more lucrative properties than if invested with solely your funds.

Things to Keep in Mind When Investing in Real Estate Syndications with a Self-Directed IRA

Expenses/Income

All expenses associated with your real estate investment must be paid with Self-Directed IRA funds. All income generated from your real estate investment must flow directly into your Self-Directed IRA.

Proper Titling

Your Self-Directed IRA is investing in the property, not you personally. All documents must be properly titled, “Madison Trust Company FBO [First Name, Last Name, MTC Account Number].

Prohibited Transactions

Your SDIRA must not partake in a prohibited transaction such as providing benefit to you or another disqualified person. You also cannot live in or vacation on the property.

UBIT (Unrelated Business Income Tax) and UDFI (Unrelated Debt Financed Income)

Taxes may occur if the profits arise from an active business owned by a tax-exempt entity (known as Unrelated Business Income Tax or UBIT). Or, if leverage is used to purchase an investment (known as Unrelated Debt Financed Income or UDFI).

Due Diligence

It is considered best practice to conduct due diligence before making an investment. It is the SDIRA account holders' responsibility to research the investment sponsor, investment, and Self-Directed IRA rules to understand their investment.

Liquidity

Real estate investments typically have a 3-5 year maturity, during which the capital is generally illiquid.

The Madison Trust Advantage

Client-Centered

When you contact us, you’ll always be able to speak to a live and knowledgeable representative.

Low Fees

Amongst the lowest in the industry, our fees are flat regardless of the value in your account.

Dedicated Sponsors Team

Our Sponsors Team will work directly with your investment sponsor and you to provide exceptional service.

Industry Knowledge

Our team completes rigorous CISP training and understands a variety of asset classes.

Conclusion: Let's Tie It All Up

Using your retirement funds to invest in real estate opens the door to more opportunities and potential long-term growth. Investing in a real estate syndication with a Self-Directed IRA can help you build an impressive retirement portfolio and protect against economic fluctuations within a tax-advantaged retirement account.

Interested in Learning More About Self-Directed Investing?

Speak with the experts at Madison Trust company or view any of our educational videos, blogs, and free webinars. We’re here to help educate you about how you can use a Self-Directed IRA to reach your retirement goals.