Self-Directed IRA vs. Self-Directed IRA LLC: What’s the Difference?

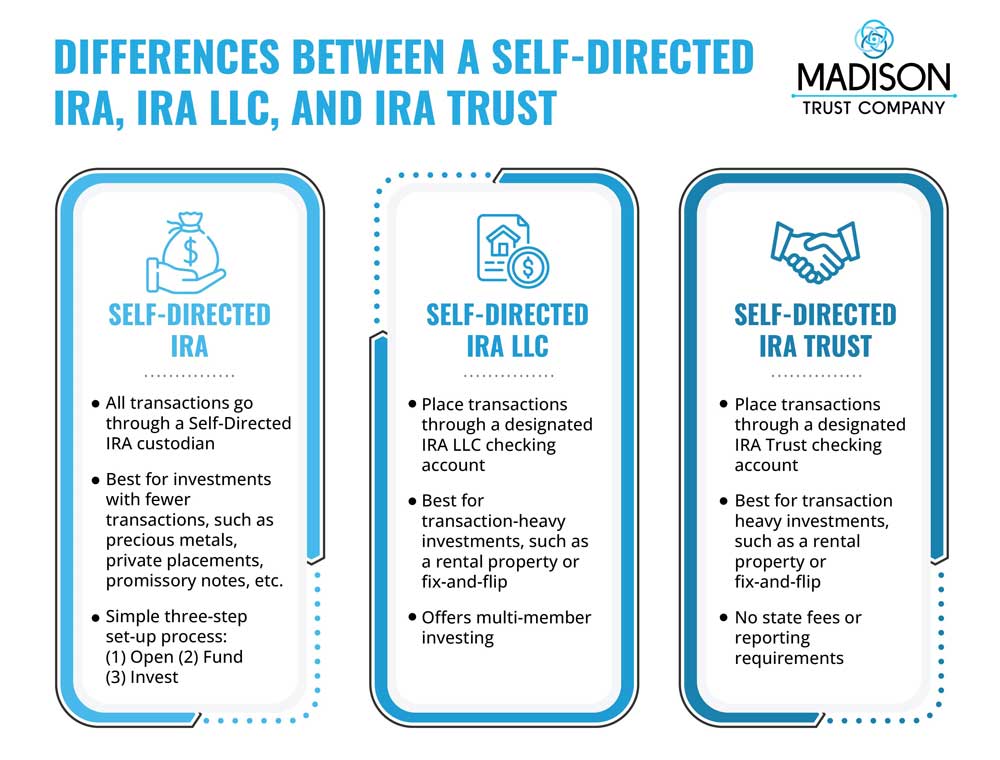

When opening a Self-Directed IRA to invest in alternative assets like real estate, precious metals, private businesses and more, you’ll notice that depending on the investment, some Self-Directed IRAs involve setting up an LLC or trust.

While all Self-Directed IRA LLCs are Self-Directed IRAs, not all Self-Directed IRAs require an LLC. If that sounds a little confusing, don’t worry. We’re going to walk through it in a way that you can easily understand and decide what the best Self-Directed IRA is for you based on your investment and retirement goals.

Self-Directed IRA Custodian Model

A Self-Directed IRA without an LLC is essentially the classic Self-Directed IRA, in which all transactions go through a Self-Directed IRA custodian such as Madison Trust. The custodian is responsible for holding the investments within the account, placing transactions on instruction from the account holder and complying with all IRS reporting requirements to keep the IRA in good standing. The main benefit of a Self-Directed IRA over a standard IRA is that you’re not limited to investing in stocks, bonds and mutual funds. Learn about the many different assets you can hold in a Self-Directed IRA, from vacation homes and rental properties to gold, startups, and many others.

Self-Directed IRA LLC

When you come across a Self-Directed IRA LLC, don’t let it trip you up. It’s still a Self-Directed IRA, but it’s one with checkbook control, also referred to simply as a Checkbook IRA. This means you can place transactions using your Self-Directed IRA funds without having to go through your custodian once the account is set up properly. To set it up properly, you need to establish either an LLC or trust for your IRA, followed by a business checking account. That will allow you to write checks and send wire transfers relating to your investments, without personally touching the funds and creating a prohibited transaction.

Why go through the extra step of setting up a Self-Directed IRA LLC or trust? Because a Checkbook IRA gives you even greater control of your retirement funds. It’s also the more ideal option for transaction-heavy investments, such as rental property or fix-and-flips. In these types of investments, a Checkbook IRA allows you to move faster and more freely, while reducing transaction fees.

Checkbook IRA LLC vs. Checkbook IRA Trust

If you’ve decided on opening a Checkbook IRA rather than a classic Self-Directed IRA under the Custodian Model, you’ll soon need to make another decision—LLC or trust? Either entity will enable checkbook control.

An IRA LLC provides more liability protection than an IRA Trust. The LLC is usually better for buying real estate with non-recourse loans because the process can get difficult with a trust. If you want your Checkbook IRA to be a multi-member account, you’ll need an LLC, as a trust cannot have multiple members.

An IRA Trust, on the other hand, is generally faster, easier and more cost-effective to establish than an LLC. At Madison Trust, we can set up an IRA Trust in as little as one week through our sister company, Broad Financial. An IRA Trust allows for less reporting and more privacy than an IRA LLC. LLCs have state reporting requirements and Articles of Organization that are public record. A trust has neither.

Do I Need a Self-Directed IRA LLC?

If you’re going with the classic Self-Directed IRA and are not interested in checkbook control, you do not need a Self-Directed IRA LLC. If you’re looking to open a Checkbook IRA, you will need either a Self-Directed IRA LLC or an IRA Trust for funds to pass through. Madison Trust can assist you with and serve as the custodian for any option you choose. Contact us to get all your Self-Directed IRA questions answered and open the alternative investment account that’s right for you.

Disclaimer: All of the information contained on our website is a general discussion for informational purposes only. Madison Trust Company does not provide legal, tax, or investment advice. Nothing of the foregoing, or of any other written, electronic, or oral statement or communication by Madison Trust Company or its representatives, is intended to be, or may be relayed as, legal, tax, investment advice, statements, opinions or predictions. Prior to making any investment decisions, please consult with the appropriate legal, tax, and investment professionals for advice.