IRA Trust Basics

Written By: Daniel Gleich

Key Points

- An IRA Trust is a type of Self-Directed Checkbook IRA that enables you to invest in alternative assets in real-time.

- With an IRA Trust, you can diversify your retirement portfolio, make your everyday transactions on your own time and save on transaction fees.

- When choosing a Self-Directed IRA custodian like Madison Trust, you will experience a seamless setup process for your IRA Trust.

An IRA Trust is an upgraded Self-Directed IRA (Individual Retirement Account) that allows for investing with checkbook control. With an IRA Trust, you’ll enjoy complete control of your retirement investing, as you can invest in a variety of alternative assets in real-time.

It’s a great option if you’re looking for a retirement account that allows you to invest beyond Wall Street products. With an IRA Trust, you can diversify your retirement portfolio with real estate, private placements, precious metals, and anything else that aligns with your expertise and passion. Keep reading to learn more about what an IRA Trust is and how it can help you meet (or exceed) your retirement goals.

Benefits of an IRA Trust

The most noteworthy benefits of an IRA Trust include:

True Diversification

Why put all your eggs in one basket when you don’t have to? An IRA trust can give you the chance to diversify your retirement portfolio beyond stocks, bonds, and mutual funds. By investing in both Wall Street products and alternative investments, you can create a balanced portfolio with assets that tend to be uncorrelated in performance.

Checkbook Control

When setting up an IRA Trust, a trust is set up for your Self-Directed IRA, followed by a designated checking account. This upgrades your Self-Directed IRA to gain the power of checkbook control. You can perform your everyday transactions without the need for your custodian. You’ll simply identify an asset and write a check or send a wire to place your investment.

Confidential Investing

With an IRA LLC (the other type of Checkbook IRA) you're required to file Articles of Organization for your LLC, which are publicly available. With an IRA Trust, you are not required to do so. You can invest while maintaining complete anonymity.

Less Fees

Since you complete your everyday transactions on your own time, you save on transaction fees typically associated with classic SDIRAs. Additionally, instead of facing asset-based holding fees (which are charged based on a percentage of your account’s value), Madison Trust charges flat-rate quarterly fees. This means you never have to pay more for being successful! Furthermore, you avoid the annual state fees that usually come with LLCs.

IRA Trust vs. IRA LLC

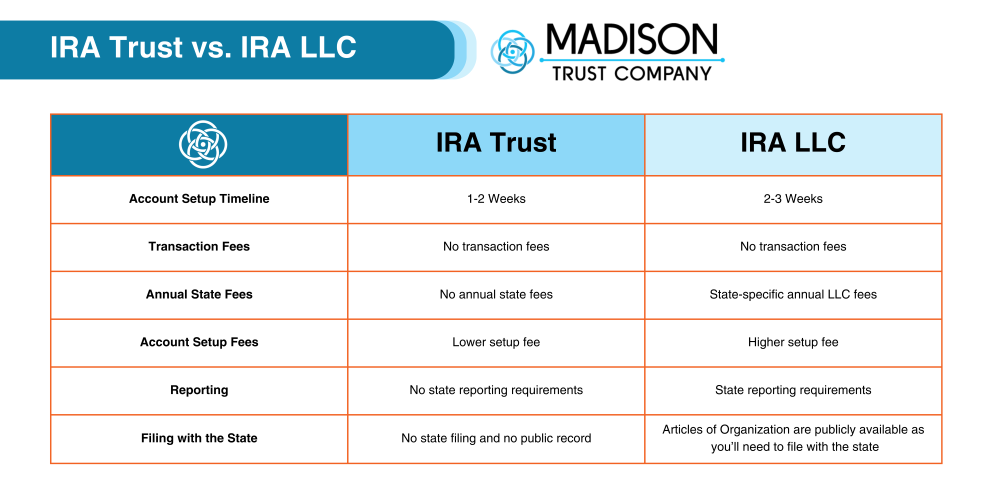

While an IRA Trust and IRA LLC both allow you to invest in alternative assets in real-time, there are several differences between the two products. By familiarizing yourself with them, you can determine the best option for your unique situation.

- An IRA Trust takes one to two weeks to set up as compared to the two to three week setup timeline of an IRA LLC.

- You’ll enjoy lower setup fees with an IRA Trust and avoid the state-specific fees that are typically required with an LLC.

- There are no state reporting requirements with an IRA Trust like there are with an IRA LLC.

- Unlike an IRA LLC, an IRA Trust allows for confidential investing as there are no Articles of Organization on public record.

Although an IRA Trust isn’t as widely known, it can be a powerful retirement savings vehicle if you’re seeking greater privacy, a faster account setup and less fees than an IRA LLC.

How To Set Up an IRA Trust

Madison Trust and our sister company, Broad Financial, make it a breeze to set up an IRA Trust. Here’s what the four step process entails:

1. Open and Fund a Self-Directed IRA with Madison Trust

Fill out Madison Trust’s easy online application. Then, we will assist you in transferring or rolling over some — or all — of your funds from an existing retirement account such as IRA or 401(k) to your new Self-Directed IRA. You can also choose to fund your account with an initial contribution.

2. Broad Financial Creates a Trust

Broad Financial will use Madison Trust’s Employer Identification Number (EIN) to create an IRS-complaint trust for your IRA. You’ll be appointed as the non-compensated trustee and gain complete control of your retirement investing.

3. Open a Checking Account

Work with the bank of your choice to open a checking account for your newly-formed IRA Trust. You will instruct Madison Trust to send the funds from your Self-Directed IRA to your IRA Trust’s checking account.

4. Invest with Checkbook Control

Now, the fun part begins! Invest freely in the assets of your choice with the power of checkbook control. All you have to do is simply write a check or send a wire from your IRA Trust’s checking account.

Schedule a Call with Madison Trust Today

If you’re intrigued and ready to learn more about an IRA Trust, we encourage you to contact us today. Our expert team is here to answer your questions.