Investing in Real Estate with a Self-Directed Roth IRA

Written By: Daniel Gleich

Key Points

- You can grow your retirement savings through real estate investments with a Self-Directed Roth IRA.

- If you use a Self-Directed Roth IRA to invest in real estate, you can invest in what you know and believe in while enjoying tax-free growth of your retirement funds.

- By choosing a reputable and knowledgeable Self-Directed IRA custodian like Madison Trust, you can remain compliant while potentially maximizing your returns.

Wouldn’t it be exciting if you could invest in real estate and save for retirement at the same time? With a Self-Directed IRA, you can do just that. A Self-Directed IRA (SDIRA) is a lot like a standard IRA—you open and fund your IRA and watch your investments grow over time with the ultimate goal of a richer retirement. But unlike a standard IRA (which typically limits your investment options to stocks, bonds, and mutual funds) a SDIRA allows you to invest in a variety of alternative assets, including real estate.

You can open a Self-Directed IRA as either a Self-Directed Traditional IRA or a Self-Directed Roth IRA. This article takes a deep dive into the benefits of investing in real estate with a Self-Directed Roth IRA.

Self-Directed Traditional IRA vs. Self-Directed Roth IRA

A Self-Directed Traditional IRA will save you money on taxes when you contribute to your account, as you pay taxes when you make your Required Minimum Distributions (RMDs). This account type allows the IRA owner to enjoy tax-deferred growth of their retirement funds. On the other hand, a Self-Directed Roth IRA offers tax-free growth, as you pay taxes when you contribute to your account. Account holders with this account type can save on taxes later when they make their distributions in retirement.

Popular Real Estate Investments

With a Self-Directed Roth IRA, you can turn your passion for real estate into profits. You’re able to invest in a variety of real estate, including:

- Single-family and multi-family homes

- Fix-and-flips

- Commercial properties

- Raw or undeveloped land

- Farmland

- Mobile homes

Benefits of Investing in Real Estate with a Self-Directed Roth IRA

Investing in real estate with a Self-Directed Roth IRA can give you the opportunity to grow your retirement savings and possibly meet (or even exceed) your financial goals. Here are several reasons why you may consider investing in real estate with a Self-Directed Roth IRA:

Maximize Profits

The beauty of investing in a property with a Self-Directed Roth IRA is that this strategy combines the income potential of real estate with the tax-free growth of your retirement funds. With a Self-Directed Roth IRA, you can receive rental income or hold property that can potentially appreciate over time with the added benefit of saving on taxes when making distributions in retirement.

Diversify Your Portfolio

By diversifying your retirement portfolio with real estate held in your Self-Directed Roth IRA, you can likely mitigate risk across different asset classes. This may lead to higher returns in the long run. Alternative assets generally perform inversely to Wall Street products. A well-diversified portfolio typically allows you to get the most out of your investments and continue to grow your retirement savings despite market conditions.

Invest in What You Know

A Self-Directed Roth IRA is ideal if you’d like the freedom to invest in the type of real estate that makes the most sense for you, your investing strategy, and your risk tolerance. Different people have different strengths and expertise, and it makes sense that their investments should reflect their strengths.

Real Estate Investing Rules to Know

If you decide that investing in real estate through a Self-Directed Roth IRA is right for you, be sure to keep these important rules in mind.

Expenses are Paid Only with Your Self-Directed Roth IRA’s Funds

All expenses related to your real estate investment must be paid through your Self-Directed Roth IRA. These expenses might include management and leasing fees, utilities, maintenance costs, property taxes, and HOA fees.

Income Flows into Your Self-Directed Roth IRA

Any income you generate from your real estate investment, including rental income, must be paid to your Self-Directed Roth IRA directly.

Title the Property in the Name of Your Self-Directed Roth IRA

To invest in real estate, your Self-Directed Roth IRA (rather than you personally) must own the property. All documents associated with your property, including the title, must be in the name of your Self-Directed Roth IRA.

Prohibited Transactions (Disqualified Persons)

When you invest with a Self-Directed Roth IRA, your IRA benefits from the investment, rather than you personally. Your IRA’s investment cannot benefit you or any other disqualified person, as that would result in a prohibited transaction. The following people are considered disqualified persons to your IRA:

- You (the SDIRA account holder)

- Parents

- Grandparents

- Spouse

- Children

- Children's Spouses

- Grandchildren

- Grandchildren's Spouses

In addition, these disqualified persons are not allowed to do the following:

- Live on, rent, or use the property

- Lease the property for any business you or they own 50% or more of

- Personally conduct repairs on the property

- Hire a business you or they own 50% or more of to perform any repairs

Discover more about prohibited transactions.

UBIT and UDFI

UBIT, or Unrelated Business Income Tax, applies to the profits of an active business owned by a tax-exempt entity, such as a qualified retirement plan. If your real estate investment is a short-term rental, UBIT may kick in in the following scenario:

If an individual is renting your property for a period of time that is shorter than seven days, the investment may be considered active as opposed to passive. If you feel your investment may incur UBIT, consider reaching out to a financial advisor for more information.

UDFI, or Unrelated Debt Financed Income, may apply to investment income generated from a financed rental property held by a Self-Directed Roth IRA. Please keep in mind that when an IRA uses leverage to purchase an investment, the loan must be a non-recourse loan.

Even if your investment is subject to UBIT and UDFI, investing in real estate is often still worthwhile as the growth potential usually outweighs the taxes incurred.

Roth IRA 5-Year Rule

Per the Roth IRA five-year rule, you can’t withdraw earnings from a Roth IRA unless five years have passed since the account was set up, and you have reached age 59 ½. Just like most tax regulations, the five-year rule comes with a lot of caveats, situation-dependent regulations, and exceptions. To learn more about the Roth IRA five-year rule, read our article.

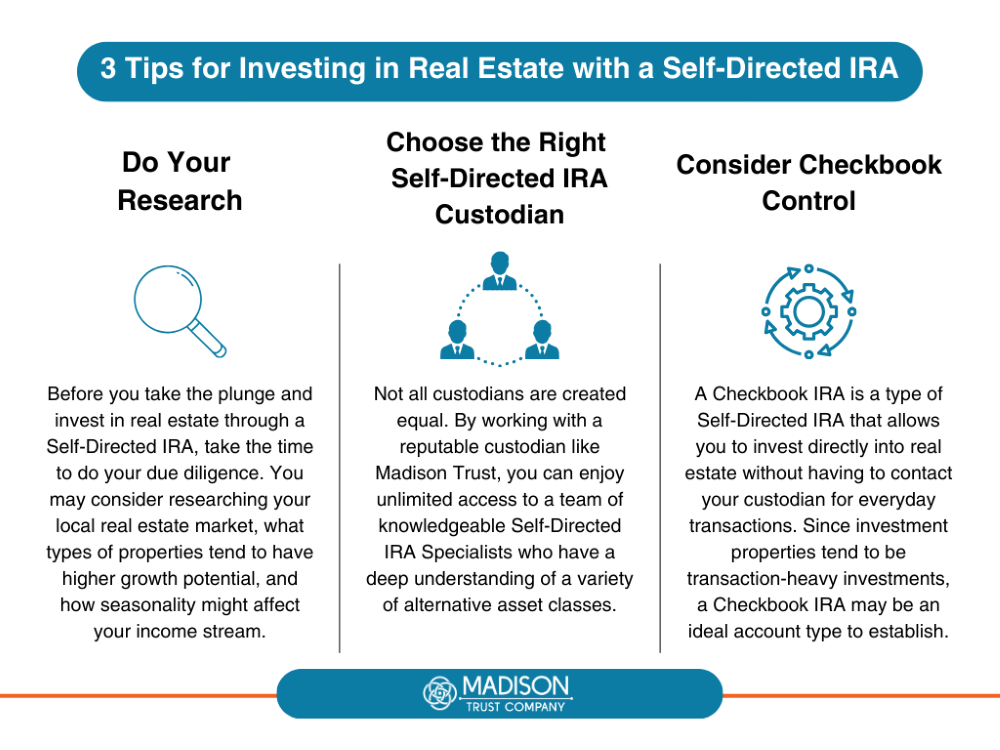

3 Tips for Investing in Real Estate with a Self-Directed IRA

Get Started Today

The easiest way to find out more about investing in real estate through a Self-Directed Roth IRA is to schedule a discovery call with Madison Trust. We look forward to hearing from you!