The Beginner's Guide to a Multi-Family Real Estate Investment with a Self-Directed IRA

Written By: Daniel Gleich

Key Points

- Investing in multi-family real estate can be a rewarding way to diversify your portfolio and build long-term wealth.

- Investors can receive tax advantages when they invest in real estate with a Self-Directed IRA (SDIRA).

- Madison Trust has streamlined the investment process so you can start growing your retirement savings by investing in the multi-family property of your choice.

Real estate is a vast industry, as there seems to be almost an unlimited number of investment opportunities. One of the more popular types of investments is multi-family real estate. Some investors take it a step further by leveraging the tax advantages of a Self-Directed IRA (also known as SDIRA or Real Estate IRA). Plus, investing in real estate with a Self-Directed IRA can diversify your portfolio and build long-term wealth.

Before jumping into this potentially lucrative investment opportunity, it is beneficial to start with the basics. You may be wondering, “What is multi-family real estate?” and “How do I buy a multi-family investment property?” Let’s explore these topics and more below!

What is Multi-Family Real Estate?

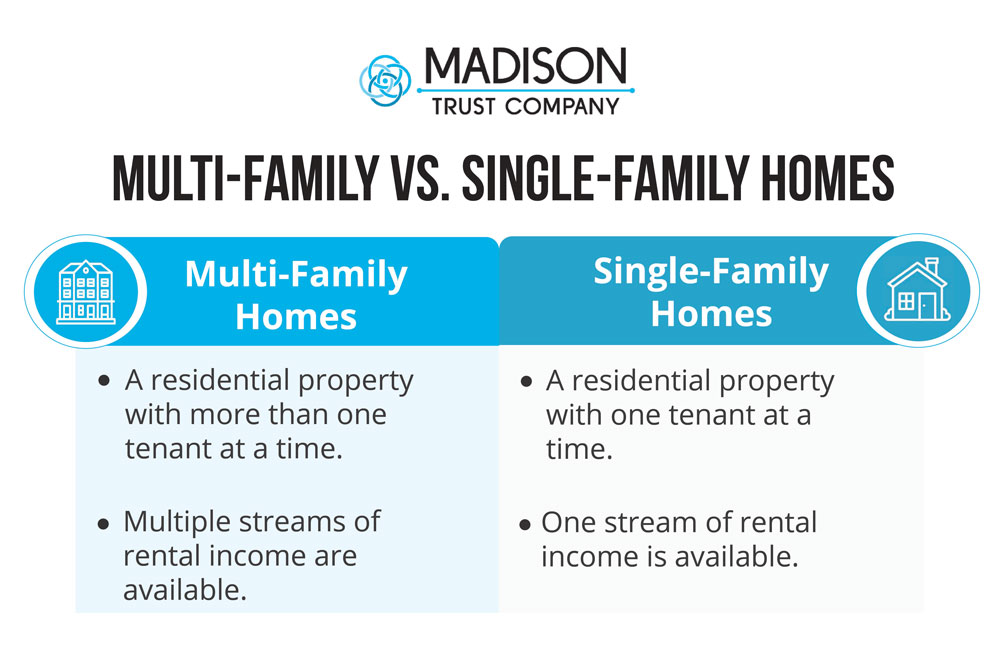

A multi-family property is a residential property that has more than one housing unit. Typically, a single building is divided so that more than one family can live in separate units. Each unit generally has a kitchen, living room, and bedroom.

Multi-Family vs. Single-Family Homes

What Types of Multi-Family Properties Can I Invest in with a Self-Directed IRA?

There is a variety of multi-family properties that a self-directed investor can purchase, including:

- Duplexes, Triplexes, Fourplexes, etc.

- Apartment Buildings

- Townhomes

- Condominiums

- Multi-Family Investment Syndications

- And any other IRS-compliant real estate investment!

Benefits of a Multi-Family Property Investment in a Self-Directed Real Estate IRA

Diversification Strategy

As opposed to Wall Street investments, real estate’s value is not dependent on the stock market’s fluctuations. It can serve as a hedge against inflation and balance out the potential risks of stock market investments.

Potential for High Returns

With more tenants in a multi-family property, there is the potential for more cash to flow into your IRA every month. You can receive multiple streams of rental income, as opposed to one stream that comes with a single-family rental. Also, real estate is a tangible asset, so it typically never reaches a zero-dollar value.

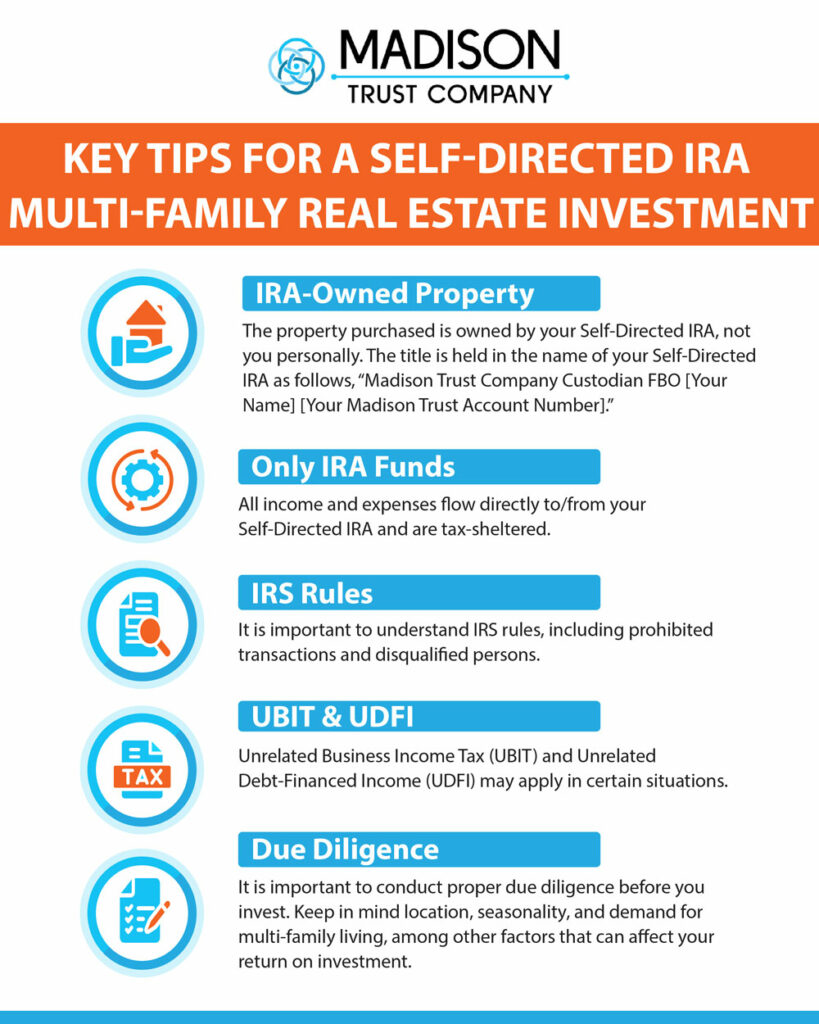

Tax Advantages

When you invest in real estate in a SDIRA, all the income generated goes directly into your retirement account. You can choose to have your gains be tax-deferred, through a Self-Directed Traditional IRA. Or you can select to pay taxes upon contribution and receive tax-free gains, through a Self-Directed Roth IRA.

Lower Risk of Vacancies

Unlike a single-family rental property, a multi-family investment has multiple renters at once. This may minimize the impact of losing a renter since you still will have other rental incomes coming in.

For example, assume you invest your Real Estate IRA in a 30-unit apartment complex with currently five vacant units. In this case, you are still receiving rental income from 25 units. On the flip side, losing a tenant at your single-family rental can halt your investment income until you find another renter.

Key Tips for a Self-Directed IRA Multi-Family Real Estate Investment

What is a Real Estate Syndication and How Does It Work?

Investors researching multi-family investment properties may be taken aback by the cost of investing in one by themselves. Luckily, there is a more affordable way to invest in a multi-family property, which is through a real estate syndication.

A real estate syndication is when investors pool funds together to purchase a larger, more lucrative property. Generally, real estate syndicates take the form of a limited liability company or a partnership. In this case, an investment sponsor is responsible for most of the hands-on work of the investment such as identifying the investment property, negotiating a purchase, obtaining financing, and managing the property.

In a real estate syndication, your Self-Directed IRA typically participates as a limited partner. It essentially acts as a financial investor and uses the expertise of the investment sponsor. As a Self-Directed IRA account holder, you are responsible for conducting thorough due diligence on the investment, investment sponsor, and IRS rules.

Conclusion: Let's Tie It all Up

Multi-family real estate has the potential to be a lucrative investment when you have the right property and steady tenants. Plus, when you invest in multi-family real estate in a Self-Directed IRA, all your gains flow into your tax-advantaged account and can contribute to long-term wealth creation.

Whether you are an experienced self-directed real estate investor or are just beginning your retirement saving journey, Madison Trust is here to support you throughout the process. Schedule a call today with one of our Self-Directed IRA Specialists and unlock the potential to diversify and grow your retirement portfolio with real estate.