Self-Directed IRA vs. Standard IRA: A Quick and Simple Comparison

Written By: Daniel Gleich

Key Points

- Traditional IRAs offer tax-deductible contributions and tax-deferred growth, while Roth IRAs feature after-tax contributions and tax-free growth of your retirement funds.

- Self-Directed IRAs provide flexibility to diversify into alternative investments like real estate and precious metals.

- Madison Trust is a reliable custodian for Self-Directed IRAs, empowering clients to experience the freedom of alternative investing in a tax-advantaged retirement account.

Investing for retirement is typically viewed as a cornerstone of financial planning. In the world of retirement accounts, the Individual Retirement Account, or IRA, generally stands as a popular choice. But what about a Self-Directed IRA (SDIRA)? In this quick read, we'll explore the Self-Directed IRA and how it compares to the standard IRA to help you decide which might be the right choice for your retirement goals.

How Does an IRA Work?

There are two main types of IRAs: Traditional IRAs and Roth IRAs. The key feature of both IRA types is the ability to grow your retirement savings with tax advantages.

In a Traditional IRA, contributions are tax-deductible, reducing your current taxable income. Your investments can grow tax-deferred until you begin taking contributions after age 59 ½ (or at 73 in 2023 when RMDs kick in), at which point they are taxed as ordinary income.

In a Roth IRA, contributions are made with after-tax dollars, so they are not tax-deductible. However, your qualified distributions (after age 59 ½) in retirement are tax-free, including the growth on your investments.

What Are the Benefits of an IRA?

IRAs offer a simple and tax-advantaged way to save for retirement, providing individuals with the potential for long-term growth and financial stability.

While IRAs offer a good degree of flexibility in terms of investment choices, they are typically used for investing in Wall Street products like stocks, bonds, and mutual funds. This is typically the more widely-known approach to long-term wealth accumulation.

IRAs are designed to help individuals potentially secure their financial future. They provide structure to retirement savings and allow individuals to save systematically over time.

How Does a Self-Directed IRA Work?

A Self-Directed IRA adds more freedom and flexibility to the benefits of a standard IRA.

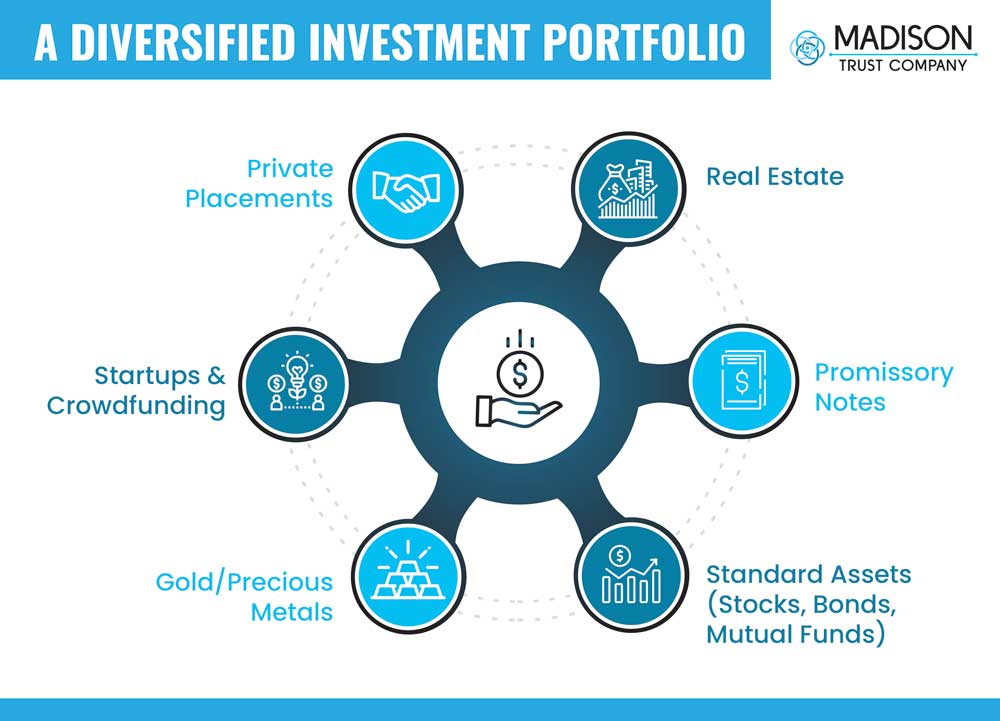

A Self-Directed IRA can be set up either as a Self-Directed Traditional IRA or Self-Directed Roth IRA. The “self directed” aspect is in the ability to invest in alternative assets. While a standard IRA is typically limited to stocks, bonds, and mutual funds, a Self-Directed IRA enables you to diversify into real estate, promissory notes, private placements, precious metals, and more.

With a Self-Directed IRA, you, as the account holder, have the ability to direct your Self-Directed IRA custodian, such as Madison Trust, to facilitate investment transactions on your behalf.

For even more control, there's a unique feature of Self-Directed IRAs called checkbook control. When you pursue a Self-Directed IRA with this feature, you will be set up with an entity, such as an LLC or trust. You will then open a dedicated checking account for your IRA LLC or Trust, at which point you can place investment transactions in real time, without going through your custodian. It's a powerful way to streamline your investment process, especially when your investments require many transactions. Learn more about checkbook control.

What Are the Benefits of a Self-Directed IRA?

Self-Directed IRAs have gained popularity because of the numerous benefits they offer. Once again, a Self-Directed IRA allows you to diversify your portfolio beyond Wall Street. Diversification generally helps spread risk, potentially enhancing your long-term returns.

Whether you're interested in real estate, private placements, precious metals, or other alternative assets, a Self-Directed IRA lets you pursue your passions and interests while offering the potential to build wealth for your retirement.

Just like standard IRAs, Self-Directed IRAs provide tax-advantaged growth, based on your choice of a Self-Directed Traditional IRA or Self-Directed Roth IRA.

Self-Directed IRA vs. Standard IRA

Begin Your Journey to a Richer Retirement

As you explore your retirement investing options, consider whether a Self-Directed IRA is the right fit for your financial goals. If you would like more information or believe a Self-Directed IRA may be the tool you’re looking for, schedule a free discovery call with our team today. Our mission is to empower our clients to retire richer and have a pleasant journey getting there.