Preparing Children for the Future with a Custodial Self-Directed IRA

Written By: Daniel Gleich

Key Points

- A Custodial Self-Directed IRA (SDIRA) is a vehicle that can help your children and grandchildren save for retirement or other major expenses.

- A Self-Directed Roth IRA is a particularly rewarding retirement account as it offers an abundance of benefits for young investors.

- As long as your child is earning some sort of income, they are eligible to contribute to their own Custodial Self-Directed IRA.

- Adults can contribute to their child’s SDIRA, but they must ensure they do not exceed their child’s yearly earned income.

Younger generations can enjoy the benefit of ample time on their side regarding saving for their retirement. A savings vehicle that may be overlooked is the Self-Directed IRA. Aside from being a great instrument geared towards financially savvy adults, this can also be utilized as a savings mechanism for children.

In an SDIRA, incoming revenue receives tax advantages. Presumably, there are quite a number of years between the present day and your child’s chosen date of retirement. Your child may gain a reasonably comfortable retirement due to the magnificent combination of tax-free growth and time. Let’s discuss how your child could relish the advantages and typical profits from a Self-Directed IRA.

The Fundamental Choice: Self-Directed Traditional IRA or Self-Directed Roth IRA

A Self-Directed Traditional IRA and Self-Directed Roth IRA both retain tax advantages with their own specialized benefits. Deciding which account to invest with is dependent on your particular goals and budget plan.

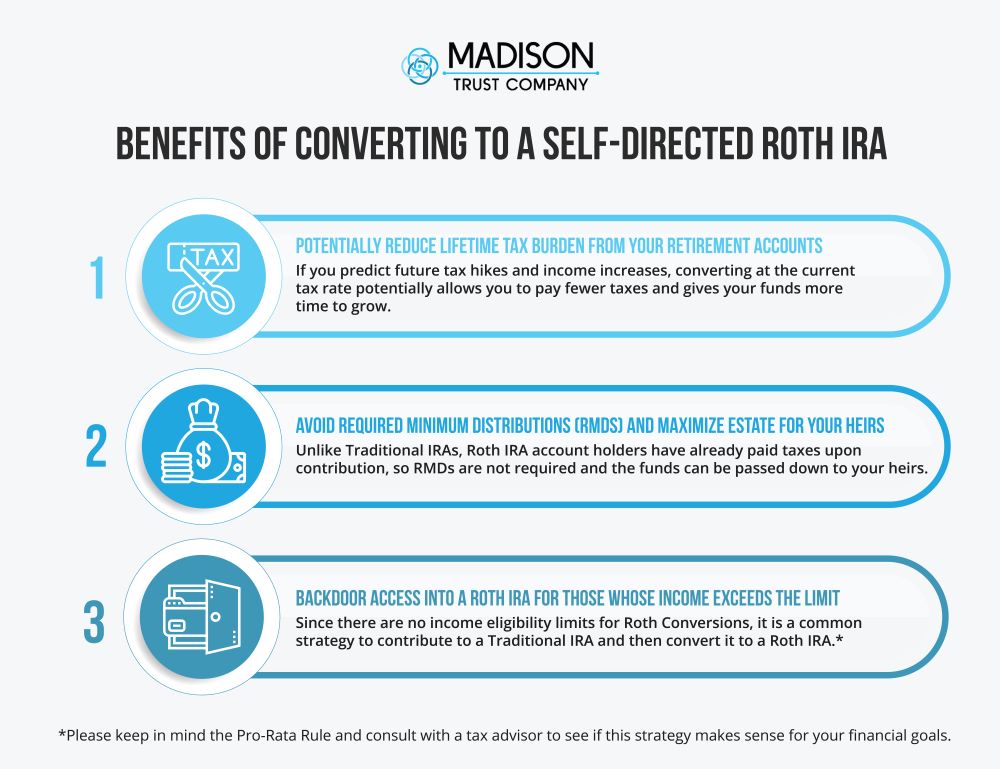

The differences between the two accounts pertain to the paying of taxes. Self-Directed Traditional IRAs have you pay taxes when you make distributions from the IRA. Funds in a Self-Directed Traditional IRA grow tax-deferred. A Self-Directed Roth IRA requires you to pay taxes when you contribute funds to your account, which allows the funds to grow tax-free.

It’s possible you’d like to create a savings account that won’t oblige your child to make any forms of payment when they are able to withdraw funds. Because of this, a Self-Directed Roth IRA is considered an ideal choice. When the time arrives for a child to retrieve the funds from their account, they won’t have to pay income tax on the Self-Directed Roth IRA.

Self-Directed Roth IRAs contain other distinctive perks that could enhance your child’s retirement savings. Unlike Self-Directed Traditional IRA account holders, once they reach the age of 73, they will not have to participate in required minimum distributions. This allows them to plan for their future without accounting for these otherwise mandatory transactions.

Your child most likely will be in a higher tax bracket in their adult years. Their current, limited income may not let them fully reap all the benefits of a Self-Directed Traditional IRA. Given their likely lower tax bracket now, once the time to withdraw surfaces, they will generally get to retain more of their money. Self-Directed Roth IRAs are generally opportune for those who are in a higher tax bracket later in life.

Self-Directed IRAs: Discernment & Deliverance

Financial literacy is vital; it’s likely a language many wished they learned during childhood and adolescence. Having an SDIRA at a young age can result in positive spending and saving habits. Furthermore, creating a Self-Directed Roth IRA can be an introduction to investing for your child. Knowledge of the investment realm can help your child prepare for their retirement and understand compounding.

Setting up a Roth IRA can help to shine light on trying times. In the event your child has to access extra funds to afford large expenses such as higher education, residency, or a sudden emergency, your child can access the funds in their SDIRA. Once a Self-Directed Roth IRA has been active for five years, the account holder is allowed to withdraw contributions. The availability of this in itself is a fantastic teaching tool regarding the importance of saving and investing.

Fostering Your Child’s Retirement Savings

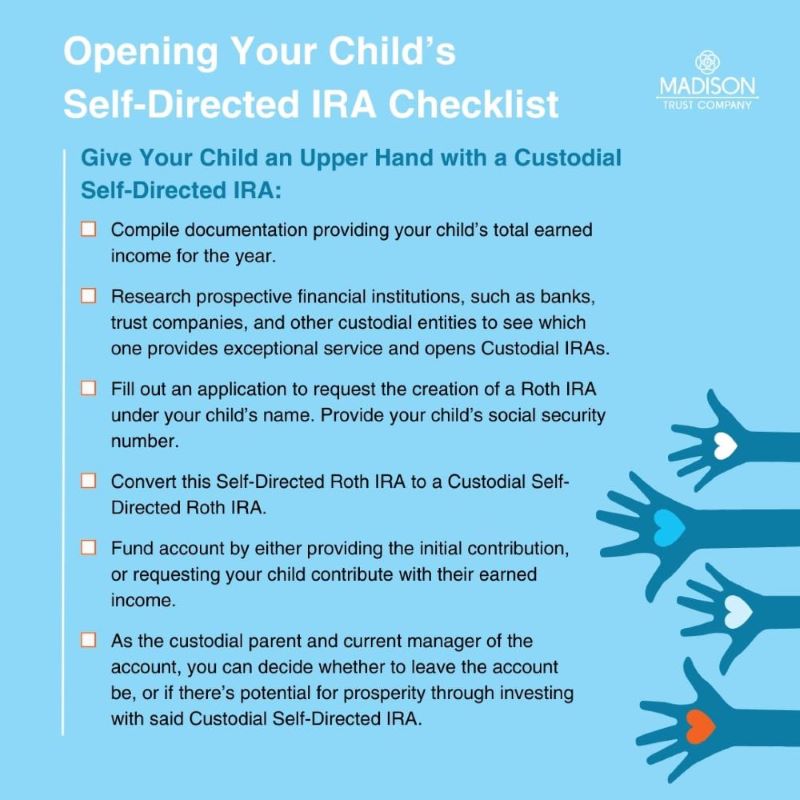

Opening a Self-Directed Roth IRA is an easy process, and doing the same for your child is just as seamless. The main discrepancy is that your child’s IRA will be a custodial or guardian account. This is required if your child is a minor (which differs by state of residence) and their account is under your control, as the fiduciarily responsible adult. This signifies you will be making all investment decisions on behalf of your child, up until they turn their state’s adult age.

To successfully open a Custodial Self-Directed IRA for your child, just provide their name for the account as well as their social security number. Prior to choosing a trust company or custodian, ensure that they allow custodial accounts.

Funding Their Future

If you choose to open a Self-Directed Roth IRA, your child must have some sort of gross income. Preferably, this income will be produced through the means of W2 or 1099.

If your child is not of legal working age, there are still ways to obtain income. Your child may receive compensation for goods and services such as mowing neighbors’ lawns, running a summer lemonade stand, or walking dogs in their town. The amount of income received performing these tasks can be reported. Keep a record detailing the work, where/when it was performed, and how much they received.

The rules and regulations standard IRAs follow must also be adhered to by Custodial Self-Directed IRAs. The maximum contribution amount for 2024 is $7,000 for both Traditional and Roth accounts. Your child can contribute $7,000 to their own account so long as they have earned at least $7,000 for the year. If their income happens to be above that amount, they still are only permitted to contribute up to the contribution limit.

Surplus Savings and a Salute by You

Both your child and family members are capable of contributing to their Custodial Self-Directed IRA. The total amount contributed can match the total amount of earned income your child made for the year, but it cannot exceed that number. If you’re an adult, it’s best to be conscientious of how much money has been contributed already to the child’s IRA, as you will only be permitted to contribute up to the remaining sum.

Some parents who open a Custodial Self-Directed IRA on behalf of their child choose to do all the contributing. If their child earned $2500 this year, they would contribute the equivalent. Some opt to have their children invest some of their own earned income for early financial education. Either way, your child is being set up for a potentially robust retirement.

Change Your Familial Tides in Finance

You can give the gift of financial literacy and preparedness to your children. If opening a Custodial Self-Directed IRA is something you’d like to pursue, Madison Trust is here to break down all the details. Set up an exciting exchange with one of our Self-Directed IRA Specialists to learn more.