Why Use a Self-Directed IRA?

Written By: Daniel Gleich

Key Points

- A Self-Directed IRA (SDIRA) offers the opportunity to invest in alternative assets beyond stocks and bonds, allowing for greater diversification and potential growth.

- With a Self-Directed IRA, you have the freedom to explore various investment opportunities, enabling you to align your investments with your interests and potentially discover lucrative avenues.

- While a Self-Directed IRA provides more control and flexibility in investment decisions, it's important to conduct thorough due diligence and seek professional guidance so you have the information you need for informed choices.

A Self-Directed IRA (SDIRA) takes you beyond Wall Street and gives you more freedom to invest your retirement funds in line with your interests and passions. Here are a few reasons why you might consider opening a Self-Directed IRA and what to keep in mind when doing so.

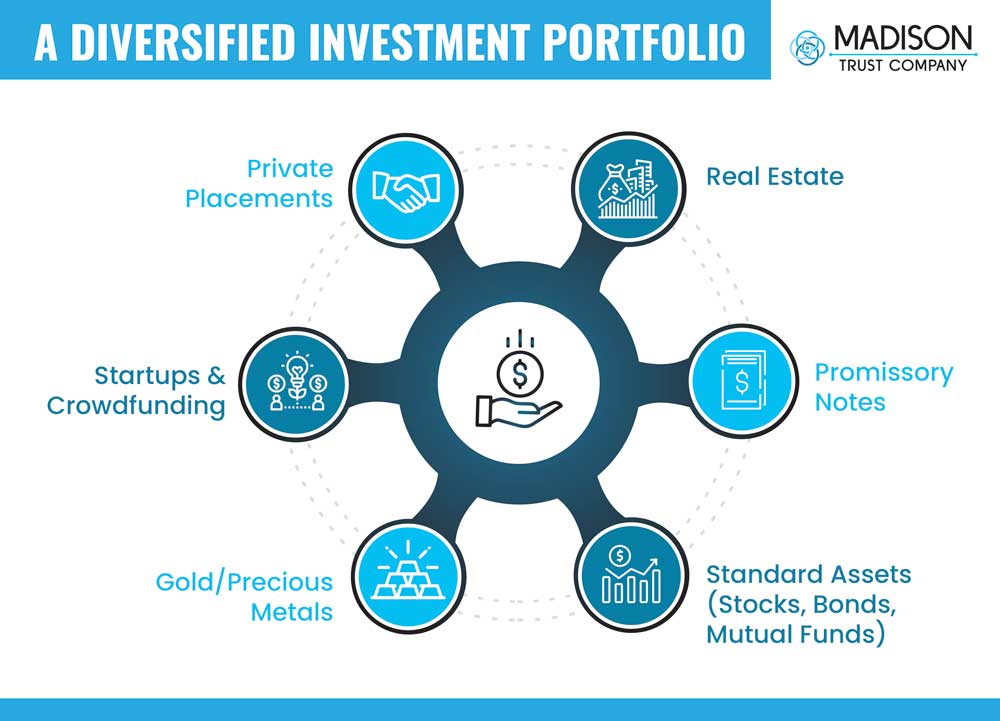

Alternative Assets

The most noteworthy benefit of having a Self-Directed IRA is the ability to invest in alternative assets that are typically not offered in standard IRAs. With a Self-Directed IRA, you have the ability to invest in real estate, private businesses, precious metals, and more. Those are just the most popular ones, too. A Self-Directed IRA allows you to get extremely creative with your investing. From food trucks to parking garages to movie productions, the alternative asset landscape is expansive and exciting.

Greater Freedom

As the name suggests, a Self-Directed IRA puts you in the driver's seat when it comes to investment decisions. While the Self-Directed IRA custodian handles the administrative tasks, you call the shots. You have the autonomy to choose the assets you want to invest in, conduct your due diligence, and direct the custodian to execute the investment transactions on your behalf. This level of control allows you to align your investments with your personal goals, values, and risk tolerance. However, the term, “self-directed,” doesn't necessarily equate to investing alone. It's wise to seek guidance and leverage the knowledge of experienced professionals to navigate the nuances of self-directed investing.

Diversified Portfolio

Generally, diversification is considered a key principle of investing. A Self-Directed IRA provides an excellent avenue for building a diversified retirement portfolio, so you can reduce your exposure to market volatility and potentially enhance your returns. Diversification allows you to spread your investments across different asset classes, which helps to mitigate possible risks associated with any single investment.

However, it's essential to approach diversification with careful consideration and professional guidance. While a Self-Directed IRA custodian can facilitate your investment transactions, they cannot provide specific investment advice. Consider consulting with a qualified financial professional to design a diversified portfolio tailored to your individual goals.

All With Tax Advantages

A Self-Directed IRA expands your investment choices with the added benefit of tax advantages associated with Traditional and Roth IRAs. Just like standard IRAs, a Self-Directed IRA offers tax-deferred growth or tax-free growth, depending on whether it's a Self-Directed Traditional or Self-Directed Roth account. Your investments can grow without immediate tax implications, allowing your retirement savings to potentially accumulate and compound over time.

Are you ready to take a whole new perspective on your financial future? Learn more about opening a Self-Directed IRA and call to speak with one of our knowledgeable Self-Directed IRA Specialists today!