Celebrating Small Business Month: Investing in a Small Business with a Self-Directed IRA (SDIRA)

Written By: Daniel Gleich

Key Points

- May is Small Business Month! It’s a time to recognize the role small businesses play in our economy and how we can help contribute to their success.

- A Self-Directed IRA (SDIRA) allows for the investment in alternative assets, including private businesses, with your retirement funds.

- Investing in a private business with a SDIRA has benefits, including having a diversified retirement portfolio, potentially earning high returns, and providing tax advantages.

The month of May marks the celebration of Small Business Month! As a driving factor of the U.S. economy and our communities, small businesses are small but mighty. With over 30 million small businesses in America, these companies account for 99.9% of all firms nationwide according to the U.S. Chamber of Commerce.

Consider taking time this month to explore the opportunity to invest in these entrepreneurial ventures. One powerful way to invest in a small business is with a Self-Directed IRA (SDIRA). A Self-Directed IRA is a retirement plan that allows you to use your retirement funds to invest in alternative assets beyond publicly traded companies. A few common SDIRA investments include real estate, precious metals, and private businesses.

Let’s dive into investing in a private business with a Self-Directed IRA and the benefits it can bring to both the investor and the small business owner.

What Is a Private Business?

A private business, also known as private equity or private placement, are privately held companies or small businesses that are not listed on the public stock market.

What Types of Private Businesses Can I Invest in with a Self-Directed IRA?

Here are some common private business investment opportunities you can invest in with a Self-Directed IRA:

- Limited Liability Company (LLC)

- Private Placement

- Private Hedge Fund

- Private REIT (Real Estate Investment Trust)

- Startups

- Small Business

- And many more alternative assets!

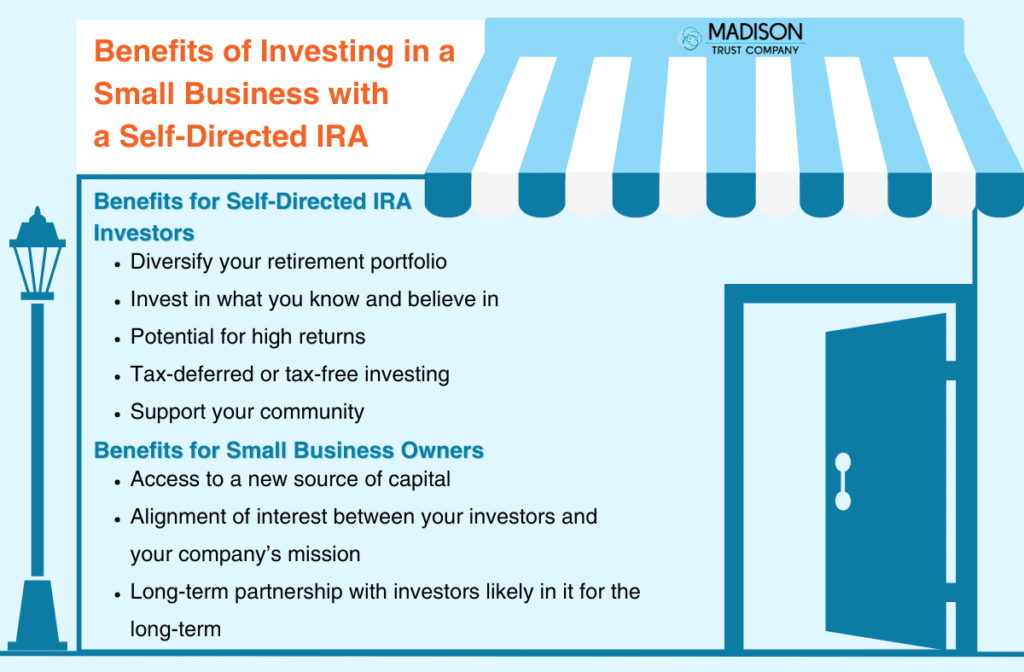

Benefits of Investing in a Small Business for Self-Directed IRA Investors

Investing in a small business typically offers unique advantages that make it an attractive investment opportunity. Here are some common reasons why you may consider investing in private business with a Self-Directed IRA:

Diversification

By investing in a small business, you can diversify your retirement portfolio beyond standard products (stocks, bonds, and mutual funds). This can help spread your risk by investing in an asset that’s typically uncorrelated with the public market.

Investment Control

You get to choose to invest in a business that aligns with your values, interests, and expertise, giving you more control over your financial future.

Potential for High Returns

Investing in a promising startup or a small business has the potential for significant growth. This can create a substantial return on your investment.

Tax Advantages

When you invest in a small business with your retirement funds, you can receive tax-deferred (Self-Directed Traditional IRA) or tax-free (Self-Directed Roth IRA) growth.

Support Your Community

Your investment provides much-needed capital to help small business ventures grow. You can improve your community by creating more jobs and contributing to its economic development, while simultaneously building your own wealth.

Benefits of Investing in Private Businesses for Entrepreneurs

If you are a small business owner, the flexibility of Self-Directed IRAs can help your business venture in several ways:

Access to Capital

Bank loans or venture capital may not always be accessible or desirable for small businesses. With a Self-Directed IRA, you gain a new source of capital to fuel your business’s growth.

Alignment of Interests

Often, Self-Directed IRA investors look to invest in what they know and believe in. In turn, these investors will likely be more interested in the success of your business since they may be passionate about your mission and may have expertise in your industry.

Long-Term Partnership

Self-Directed IRA investors are investing for their retirement, so they are likely thinking about the long-term investment horizon. You can foster an enduring partnership with these investors, providing potential stability to your business.

Benefits of Investing in a Small Business with a Self-Directed IRA

Considerations To Keep In Mind

While investing in a small business can be an exciting and potentially lucrative opportunity, it is crucial to understand how it works. Here are a few important considerations before diving in:

Rules and Regulations

SDIRAs are subject to specific rules and regulations set by the IRS, including prohibited transactions, disqualified persons, contribution limits, and distribution rules. It is considered best practice to do your research to stay compliant and avoid potential penalties.

Risk Assessment

Investing in a small business carries potential risks including business failure, market downturns, seasonality, and illiquidity. Be sure to access your risk tolerance and diversify your retirement portfolio across a variety of asset classes to mitigate risk.

Proper Titling of Investment Documents

Keep in mind that your IRA is the owner of your investments, not you personally. All documents relating to the investment should state your IRA as the owner.

Accredited Investor

Some investments require you to be an accredited investor. Accredited investors are individuals or business entities that are financially sophisticated and can participate in investments not registered with the SEC. To be an accredited investor, you must satisfy at least one requirement regarding your income, net worth, asset size, governance status, or professional experience.

Seek Professional Guidance

It is considered best practice to perform due diligence and consult the proper financial professional. This can include a CPA, attorney, financial advisor, and Self-Directed IRA custodian.

UBIT (Unrelated Business Income Tax)

When a Self-Directed IRA invests in a business that generates income unrelated to its tax-exempt purposes (such as business income from an operating company), the income may be subject to UBIT.

Checkbook Control

Another account option available is a Checkbook IRA. A Checkbook IRA gives you the power to invest in real time without the need to go through a custodian for every transaction.

Conclusion: Let's Tie It All Up

As Small Business Month unfolds, consider the possibilities of investing in a private company with an SDIRA. Whether you are an investor looking to diversify your retirement portfolio or an entrepreneur raising capital, this alternative investment provides potential to grow your retirement savings and give back to your community.