How Investing in Promissory Notes Can Hedge Against Inflation

Written By: Daniel Gleich

Key Points

- One way you can offset the effects of inflation is to invest in alternative assets with a Self-Directed IRA (SDIRA).

- Promissory notes are a popular Self-Directed IRA investment due to their potential for steady returns, tax benefits, and their tendency to be low maintenance.

- Madison Trust streamlines the promissory note investment process so you can have a pleasant journey to a richer retirement.

Consumers have seen an inflation surge peaking last June, with worker wages consistently behind the cost of living. This June, the annual inflation rate in the U.S. has slowed, but is set to increase in July and August. Central bank policymakers still see core inflation running well above the 2% annual target.

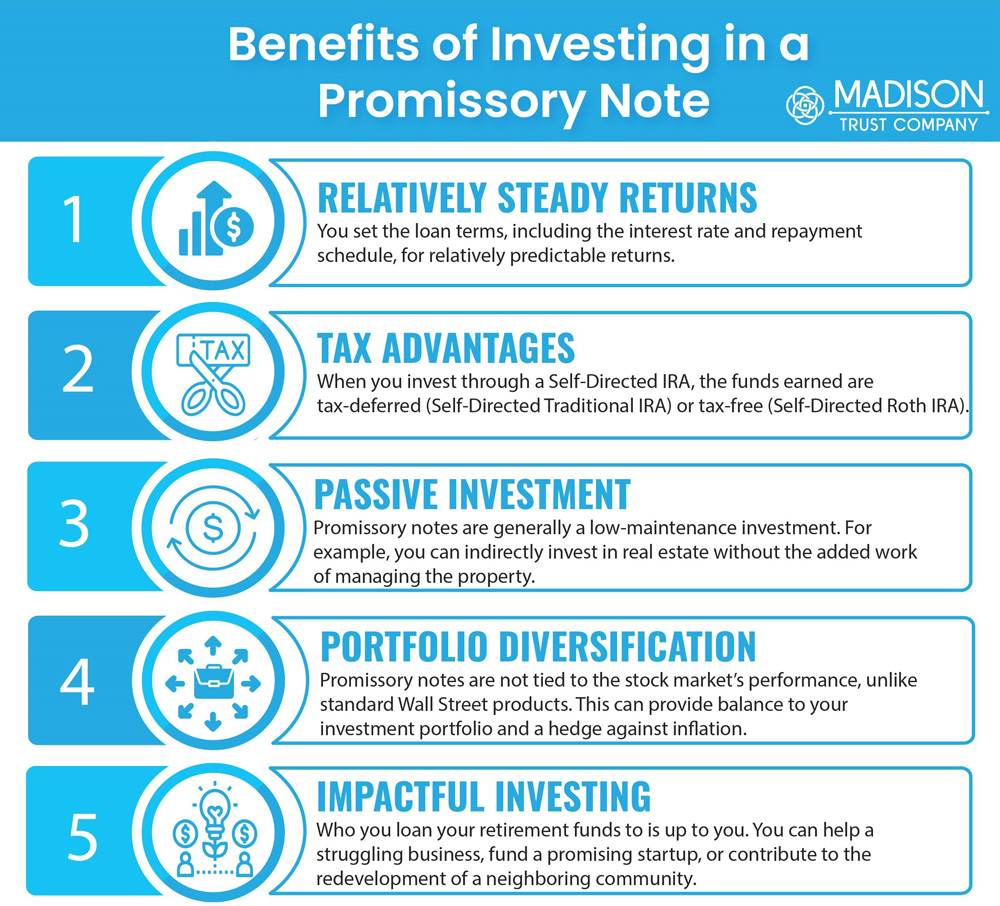

To hedge against inflation, many investors turn to alternative assets, with promissory notes being a popular investment choice. The savviest investors buy promissory notes with Self-Directed IRAs due to their potential for steady returns, tax benefits, and their tendency to be low maintenance. Let’s explore more about investing in promissory notes and how adding them to your portfolio can help offset the impact of inflation.

What is a Promissory Note?

A promissory note, which is a type of private lending, is a written agreement and legal contract that accompanies a loan. It is a signed promise to pay the loan amount by a specific date and typically includes details such as interest rates, a repayment schedule, collateral, and any other relevant terms.

To simplify, picture yourself as a bank. You are the lender. You get to set the loan terms, interest rates, collateral, and loan amounts. You also get to decide who you are willing to lend money to and when you will receive interest and installments on the loan.

Investing in a promissory note can be rewarding. You can support a small business and see it flourish with the help of your funding. Plus, with the relative predictability of the loan’s repayment, you typically receive a steady cash flow to your Self-Directed IRA.

What Types of Promissory Notes Can I Invest In?

1. Notes Secured by Real Estate

Secured notes are promissory notes backed by the borrower’s collateral. For example, let’s say you invested in a promissory note that was secured by a vacation home owned by the borrower. In the event of default by the borrower, as the lender you are entitled to the vacation home as repayment of the note.

2. Notes Secured by Other Collateral

In some cases, the borrower may choose to pledge non-real estate items to the lender. For example, they can secure the loan with factory or farm equipment and private company stocks, among other collateral. This type of promissory note may entail more risk due to variables that can impact the collateral's value, such as equipment depreciation and the success of the private company's stock.

3. Unsecured Promissory Note

An unsecured note is a promissory note that does not hold anything as collateral to secure the debt. Unsecured promissory notes typically have higher interest rates and monthly payments to reduce the risk involved in this type of note.

Who Can I Loan Money To?

As the Self-Directed IRA account holder, you get to select who/what you want to lend money to. Like any investment, it’s important to conduct due diligence. IRS rules regarding prohibited transactions and disqualified persons are also important to understand when considering who you’d like to lend money to.

What are the Benefits of Investing in a Promissory Note?

How To Invest in a Promissory Note with a Self-Directed IRA

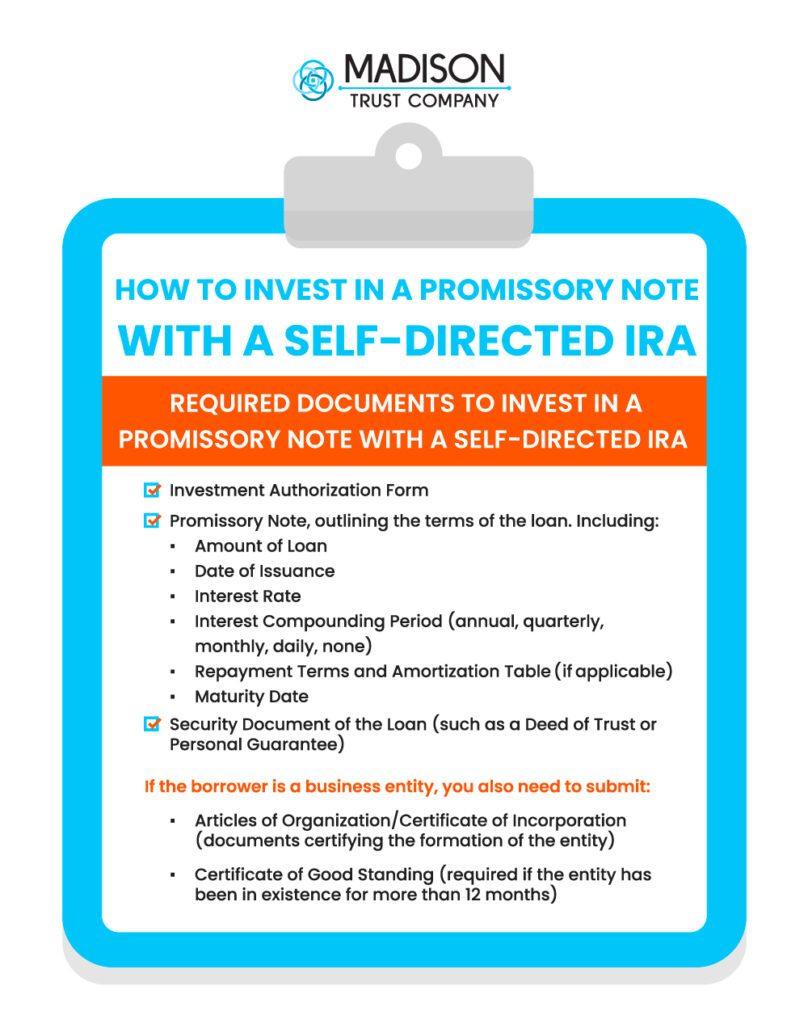

After you have opened and funded your Self-Directed IRA, you can invest in a promissory note by sending Madison Trust the following documents.

Then, the SDIRA account holder will direct Madison Trust to send the requested loan amount to the borrower. When the borrower repays the loan, the funds will go directly into your Self-Directed IRA. For more information, please see our flowchart, How to Issue a Secured Loan from Your IRA.

How To Offset Inflation with a Promissory Note

To offset inflation, your investment must achieve a rate of return higher than the inflation rate. Promissory notes’ rate of return can range from 3-4% on the lower side to 10-15% on the higher side. In general, investors who see these rates of return can potentially meet or offset inflation.

How To Title My Private Debt Investment

When you issue a promissory note from your retirement account, it must be held in the name of your Self-Directed IRA, not your name. The lender must be listed as “Madison Trust Company, Custodian, FBO [Your Name] [Your Madison Trust Account Number].

Conclusion: Let's Tie It All Up

Investing in a promissory note can be a game-changer for your retirement strategy. It offers a diversification strategy, protection against inflation, relatively predictable returns, and tax advantages.

Do you have questions about investing in promissory notes with a Self-Directed IRA? Madison Trust Specialists are here for you!