Secret Real Estate Loophole: Living on Your Own Investment Property

Written By: Daniel Gleich

Key Points

- In-kind distributions are a payment method achieved through a form of securities or property as opposed to cash.

- When assets are not easily liquefiable, in-kind distributions may be the favored option.

- Through in-kind distributions, you’re able to swap the ownership of real estate from your retirement account to your personal name.

Real estate is a timeless choice of investment. It remains an alternative asset that continues to amass growth potential, despite the ever-changing current of the market. It’s no wonder many Self-Directed Real Estate IRA investors have opted to invest their retirement funds in real estate.

It’s common knowledge that a Real Estate IRA owner cannot benefit from or live on their invested property. Doing so would result in a prohibited transaction. Unbeknownst to a large portion of investors, there is a way around this.

Distributing your property to yourself over a set number of years can allow you to live on your property. Let’s take the plunge into what may be the best kept enigma: in-kind distributions.

Conquering the Basics of In-Kind Distributions

Distributions of in-kind, also known as distribution-in-specie, is a method of payment made through assets. Typically, this transaction is done with securities like stocks, bonds, dividends, or mutual funds. Many retirement accounts permit in-kind distributions, including Traditional IRAs, Roth IRAs, Inherited IRAs, 401(k)s, Roth 401(k)s, SEP IRAs, and SIMPLE IRAs.

A Preferred Payment Approach Among Organizations & Individuals

A plethora of companies tend to opt for the distribution in-kind method. It can reduce their tax liabilities and typically caps capital gains tax from the asset increasing in value. In-kind distributions allow securities to be removed from an account and distributed without liquidating them. This indicates these securities still could appreciate, rather than taking on the amount at face-value.

This is beneficial for individuals as well, as their accounts remain completely invested. Investors are only required to document their profit earned from share price appreciation as a capital gain. This is taxed at a significantly lower rate than conventional income.

Fold in the Real Estate

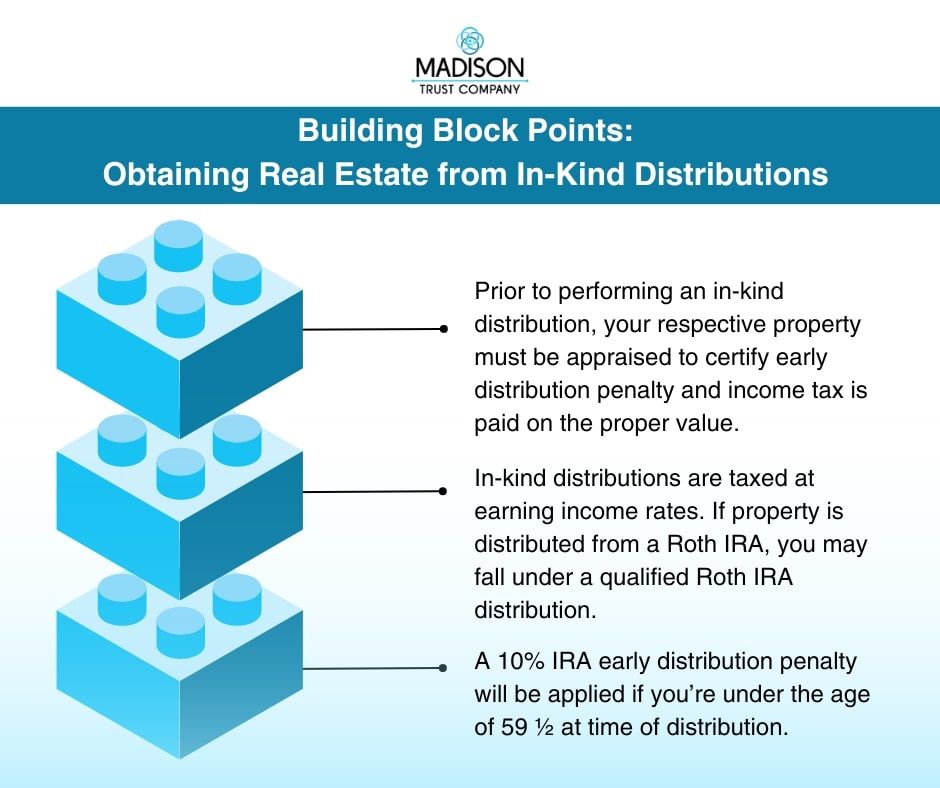

Your Self-Directed IRA or a 401(k) can use in-kind distributions to relinquish real estate from your account. This will switch the ownership title from your retirement account to your name. You can avoid early withdrawal penalties so long as you’re of age 59 ½ and above.

Please note a few points to consider if you’re contemplating distributing your real estate:

To transfer your property from your retirement account to your name, you must re-record it with your county recorder. Once the property is in your personal name, you now have acquired full flexibility. You’re entitled to use it for business or for personal use. This is how you could turn your real estate investment into your home.

Not Business as Usual

Though this process is relatively seamless, one kind of IRA requires an extra step: the IRA LLC. Before you initiate the process of in-kind distributions, you must first change your IRA LLC back into an SDIRA.

Distributions must be taken from an IRA and not your IRA LLC’s checking account. Acquiring a distribution from this LLC would result in a prohibited transaction. It’s important to speak with a financial advisor before making any distributions. Confirm you’re ready to convert your LLC back into an SDIRA before moving forward with in-kind distribution transactions.

Conclusion: This Loophole Gives a Racetrack a Run for Its Money

In-kind distributions give investors the opportunity to take real estate within their Self-Directed IRAs as distributions without liquefying them. Gaining real estate typically presents lower taxes than selling property and earning cash. In-kind distributions can possibly present excellent tax advantages and can satisfy your RMDs. It’s a tremendous comfort knowing the property you’ve invested in could potentially become your residence through in-kind distributions.

Discover the Best Route for You

A Self-Directed IRA custodian is easily accessible and prepared to help you draw the retirement savings conclusion that you deem appropriate. Are you hoping to start investing in real estate, or interested in learning more about other alternative assets?

Madison Trust has the right resources. Discover the best route for you. Schedule a free discovery call today.