Self-Directed IRA Investment Myths: Busted! Shedding Light on SDIRA Misconceptions

Written By: Daniel Gleich

Key Points

- Self-Directed IRAs (SDIRAs) are legal retirement accounts and are simple to set up.

- Self-Directed IRAs allow account holders to invest in alternative assets that can potentially provide steady returns such as real estate, promissory notes, and precious metals.

- Like any investments, alternative investments involve risk, but greater risk often comes with greater reward.

- Madison Trust’s friendly and knowledgeable Self-Directed IRA Specialists can answer all your questions about self-directed investing.

With the increased desire to have control over investments and hedge against inflation, Self-Directed Individual Retirement Accounts (SDIRAs) have gained popularity. This rise in popularity, however, has brought about some misconceptions. Luckily, we’re here to help set the record straight.

In this blog, we aim to debunk some of the most common Self-Directed IRAs myths and provide reliable information for your retirement planning.

1. Are Self-Directed IRAs Legal?

Myth: Self-Directed IRAs are illegal according to the IRS and can be considered a scam.

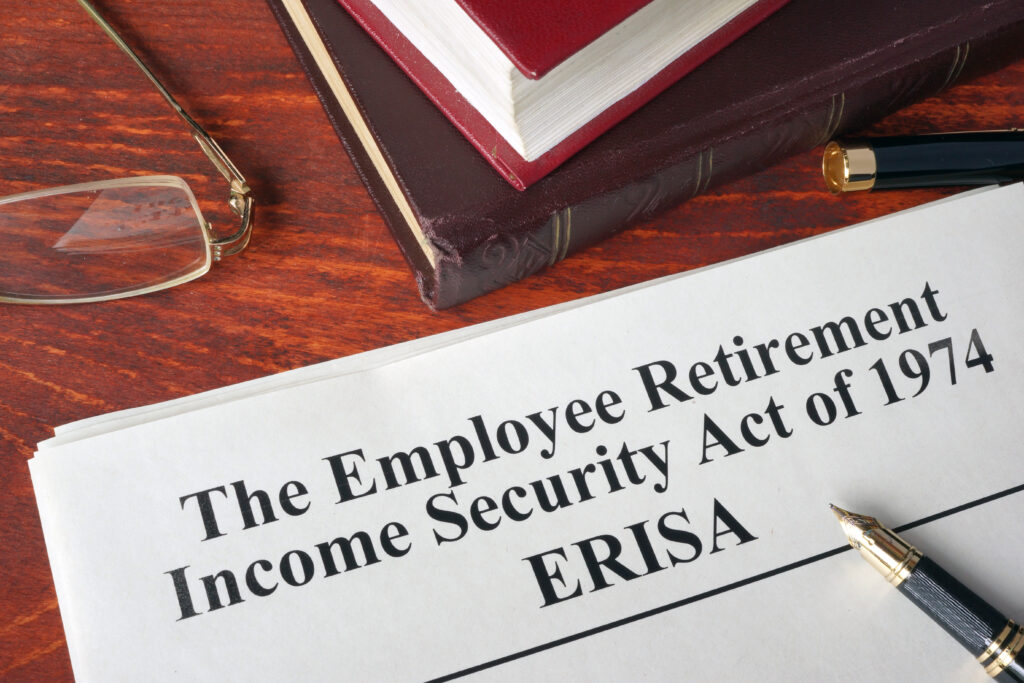

The Truth: Self-Directed IRAs are legal! Self-Directed IRAs were established as part of the Employee Retirement Income Security Act of 1974 (ERISA). SDIRAs are regulated by state and federal law, and must stay compliant with IRS rules and regulations. Self-Directed IRA custodians (who hold custody of SDIRA assets) are overseen and regularly audited by their regulating state. Madison Trust is regulated by the Division of Banking of South Dakota.

2. Is a Self-Directed IRA a Good Idea?

Myth: Self-Directed IRAs are riskier than standard IRAs.

The Truth: Like any investment, there is potential risk involved with self-directed investing. The misconception may stem from the responsibility of Self-Directed IRA investors to conduct due diligence for their investment.

When you invest in stock market products, your return generally depends more on the selection and timing of your investment. On the other hand, when you invest in an alternative investment like a rental property, you get to control certain aspects of the investment such as rental costs, property improvements, management expenses, and who you will rent to. This allows you to receive potentially more stable returns.

In addition, although there may be investments that are typically viewed as safer, such as CDs and annuities, these generally do not generate as much return as riskier investments. As it is said, “with greater risk, often comes greater reward.”

3. Do I have to be an Accredited Investor to Invest with an IRA?

Myth: Only accredited investors can invest with Self-Directed IRAs.

The Truth: Like standard IRAs, anyone can open a Self-Directed IRA. You can open an account and then transfer or rollover funds from an existing retirement account such as an IRA or 401(k), or contribute earned income.

Certain investments, such as specific private equity investments, may require you to be an accredited investor. However, other alternative assets such as precious metals and promissory notes generally do not have an income or net worth requirement to invest. In addition, there are investment options such as crowdfunding and REITs that pool capital together from several investors to purchase a more costly investment. This benefits those looking to diversify their portfolio but cannot afford to do so with solely their own IRA funds.

4. Do I Need a Custodian for My Self-Directed IRA?

Myth: Self-Directed IRAs do not need a custodian.

The Truth: The Internal Revenue Code (IRC) Section 408 requires all Self-Directed IRAs to be held by a custodian, such as a bank or a trust company. The IRA custodian’s responsibility is to administer the account and hold custody of the IRA’s assets. It is the Self-Directed IRA account holder’s job to instruct the custodian to place an investment.

5. Self-Directed IRAs are Too Complicated to Manage

Myth: Self-Directed IRAs are too complicated to set up and manage.

The Truth: A Self-Directed IRA can be set up at Madison Trust by completing our easy online application. From there, you can transfer or rollover funds from an existing retirement account or contribute funds. Then, simply instruct Madison Trust to place your investment.

When managing your SDIRA, it’s important to note that Self-Directed IRAs are governed by the same rules as standard IRAs. They have the same contribution limits and distribution rules. SDIRA account holders must be aware of prohibited transactions, as well as when UBIT and UDFI may apply.

Although it may seem intimidating at first, Self-Directed IRA rules are simple to understand. Visit our information center, webinars, and blogs for more information.

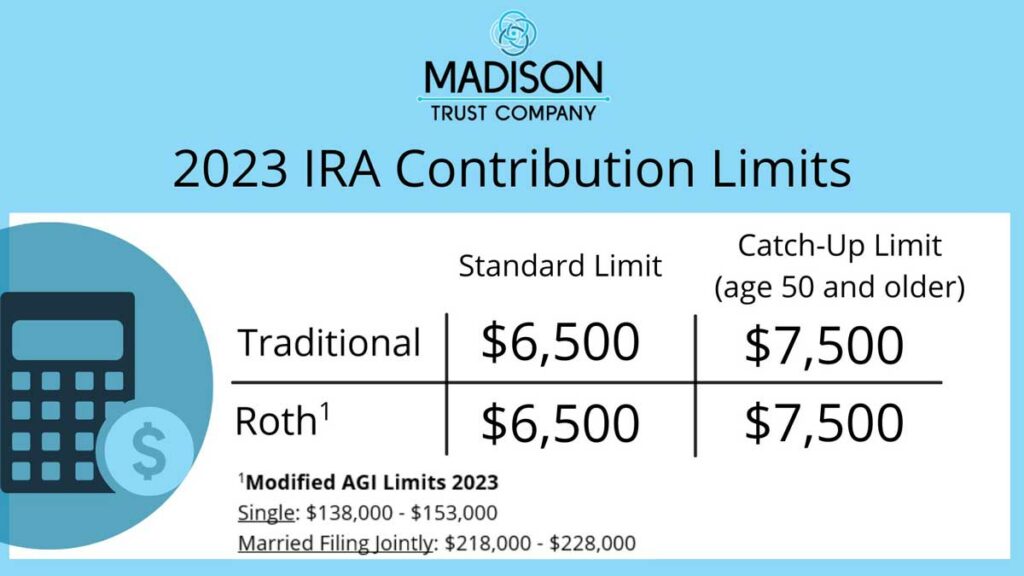

6. Can You Contribute To a 401(k) and an IRA?

Myth: You cannot contribute to more than one retirement account at a time.

The Truth: You can contribute to both a Self-Directed IRA and a 401(k). The limitation applies to how much you can contribute to each account each year. You can contribute $6,500 ($7,500 age 50+) to a Self-Directed IRA in 2023. The 2023 401(k) contribution limits are $22,500 ($30,000 age 50+).

In fact, contributing to both an IRA and an employer-sponsored plan allows you to potentially maximize your savings while receiving tax advantages.

In addition, it is possible to have and contribute to both a standard IRA and a Self-Directed IRA. If you choose this retirement savings route, it is important to keep in mind that your total IRA contributions for the year can’t exceed the contribution limit set by the IRS.

7. Do I Need an LLC for My Self-Directed IRA?

Myth: A single-member LLC is needed for a SDIRA.

The Truth: You are not required to have an LLC to experience the tax advantages of a Self-Directed IRA. Self-Directed IRA LLCs may make sense if you are interested in transaction-heavy investments such as rental properties and fix-and-flips. This is because an IRA LLC avoids everyday transaction fees and allows for real-time investing.

Conclusion: Let's Tie It All Up

Now that we have debunked some common misconceptions about Self-Directed IRAs, you can use this knowledge to open your investment possibilities.

Have Questions? We Have Answers!

Do you have additional questions about Self-Directed IRAs? Schedule a call with one of our Self-Directed IRA Specialists to get the answers you need.