Self-Directed IRA (SDIRA) vs. 401(k): Don’t Let the False Dichotomy Fool You!

Written By: Daniel Gleich

Key Points

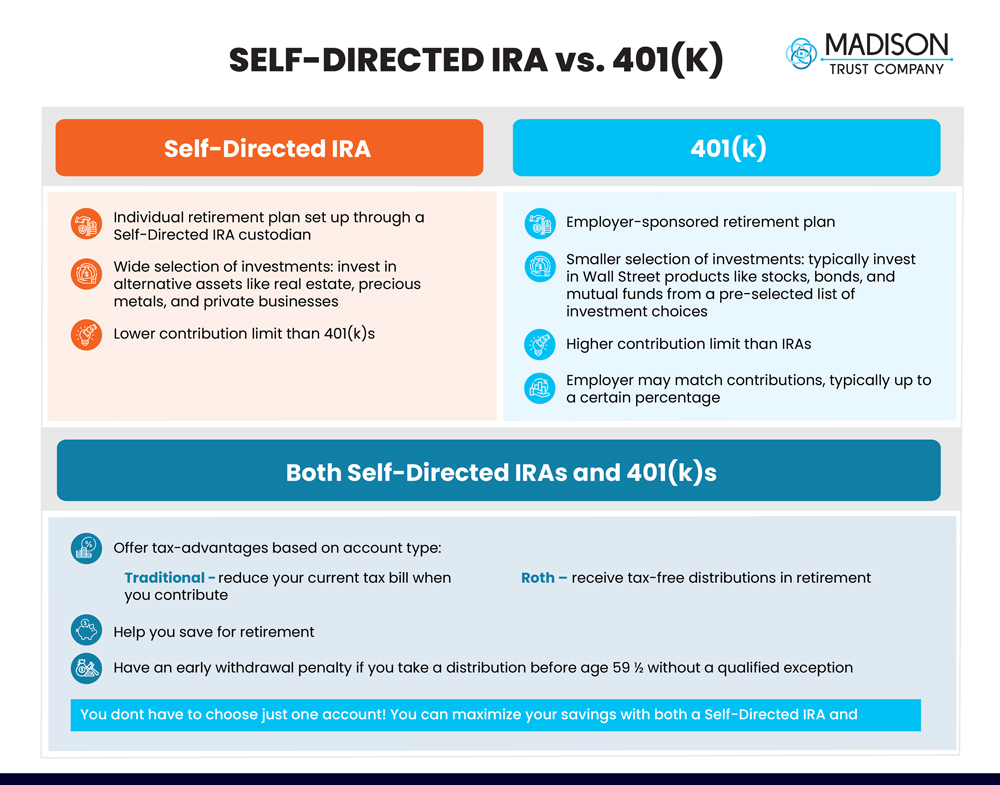

- A Self-Directed IRA is a retirement account that allows you to invest in alternative assets. A 401(k) is an employer-sponsored retirement plan to which you can contribute a portion of your earnings.

- A Self-Directed IRA and 401(k) each have their advantages, and you can choose to have both as part of your retirement portfolio.

- If you prefer a Self-Directed IRA in place of your current 401(k), you can roll over funds from the 401(k) to a newly opened Self-Directed IRA.

When it comes to retirement planning, there are many options available for saving and investing. Two of the more popular choices are a 401(k) and an IRA (individual retirement account)—but there’s another intriguing option to consider. It’s called a Self-Directed IRA (SDIRA), and it opens many new and exciting investment opportunities in a tax-advantaged retirement account.

What’s the difference between a Self-Directed IRA vs. 401(k)? Understanding the basics will help you decide what option is right for you—and it doesn’t necessarily need to be one over the other!

401(k) vs. Self-Directed IRA

A 401(k) is an employer-sponsored retirement plan that allows you to contribute a portion of your salary and wages directly into a retirement account invested in stocks, bonds, and mutual funds selected by the employer. A 401(k) can be especially attractive when the employer chooses to match contributions, usually up to a certain percentage. In setting income aside for retirement, you’re also simultaneously reducing your current tax burden.

A Self-Directed IRA allows you to invest in alternative assets like real estate, precious metals, and private businesses. 401(k)s and Self-Directed IRAs can be opened as Traditional or Roth accounts. In either account, the Traditional option allows your contributions to grow tax-deferred, while the Roth option lets them grow tax-free. You can choose to have both a 401(k) and Self-Directed IRA if you determine that’s the right strategy for you. If you’re self-employed as a sole proprietor, you may also consider a Solo 401(k).

While an IRA does have similarities to a 401(k), there are some differences that set the two apart. The main difference is that a Self-Directed IRA is not employer-sponsored or selected. You can open a Self-Directed IRA with a Self-Directed IRA custodian like Madison Trust and gain more control of and investment options in your account. The other key difference is that 401(k)s have significantly higher contribution limits than IRAs, allowing you to save at an accelerated pace if desired.

Self-Directed IRA + 401(k)

You can choose between a 401(k) and Self-Directed IRA—or, once again, you can have both! Pairing a 401(k) with a Self-Directed IRA can be an effective strategy to leverage the high contribution limits of a 401(k) and the unique investment opportunities of a Self-Directed IRA simultaneously. Just note that if you have both a Self-Directed IRA and standard IRA, your IRA contribution limit applies to both accounts combined. Read more about the 401(k) and Self-Directed IRA power combo.

401(k) to Self-Directed IRA Rollover

Many people, upon first discovering the concept of a Self-Directed IRA, want to open an account but don’t have additional funds to invest. If you currently have a 401(k), you have the option to roll over some or all of your 401(k) funds into your newly opened Self-Directed IRA.

Funding a Self-Directed IRA with your 401(k) can be easy and seamless, with no taxes, when you go the direct rollover route. A direct rollover occurs when your funds are moved directly from your existing 401(k) into your new Self-Directed IRA. You will initiate your rollover with your plan administrator and complete the required paperwork to roll over your funds into your new Self-Directed IRA.

When comparing a 401(k) vs. Self-Directed IRA, there’s no need to pit them against each other. Consider speaking with your financial advisor to develop a diversified and personalized investment strategy. If that strategy includes a Self-Directed IRA, we’d love to be your custodian of choice. Learn more about the Madison Advantage and schedule a call with us today!

Disclaimer: All of the information contained on our website is a general discussion for informational purposes only. Madison Trust Company does not provide legal, tax, or investment advice. Nothing of the foregoing, or of any other written, electronic, or oral statement or communication by Madison Trust Company or its representatives, is intended to be, or may be relayed as, legal, tax, investment advice, statements, opinions, or predictions. Prior to making any investment decisions, please consult with the appropriate legal, tax, and investment professionals for advice.