What’s Your Small Business Style? SDIRAs vs. ROBS

Written By: Daniel Gleich

Key Points

- Utilizing your retirement savings for your private business funding can be advantageous. You will avoid accruing additional debt and dodge early withdrawal penalties.

- Both Self-Directed IRAs (SDIRAs) and Rollovers as Business Startups (ROBS) can assist in tapping into your retirement funds for business capital. Despite this, both vehicles differ tremendously.

- Determining your startup goals can help paint a better picture of which path suits your small business style.

Good news for investors itching to nosedive into a private startup or small business: you can take money from your retirement fund and embed it into a potentially promising endeavor! The tools most prominent for this are Self-Directed IRAs (SDIRAs) and Rollovers as Business Startups (ROBS).

For prospective business investors, it’s best to evaluate all the components of both plans. Let’s compare and contrast to discover your small business style!

Determine Your Starting Sources for Rollovers as Business Startups

Before you can decipher which avenue is best for you to explore, you should first be sure both account types are accessible. Rollovers as Business Startups are traditionally employer-sponsored programs. To fund your account, be sure you have a qualified retirement plan that is unrelated to your current employer. Roth IRAs and Roth 401(k)s are not eligible for ROBS, as IRS guidelines do not permit Roth accounts to be rolled over.

Is Your Preference Collaboration (SDIRA) or Independence (ROBS)?

Prior to initiating a startup investment, you should measure how much involvement you’d want with this small business. Are you hoping to behave as a passive investor, or an owner/employee?

As an SDIRA owner, aside from observing and being conscientious of your investment industry’s trends, you must be aware of prohibited transaction rules. Investing in a business that you own 50% or more of would result in a prohibited transaction. Additionally, no individual with a substantial connection to you should be in control of said organization, as they are considered disqualified persons. Your role is that of a passive investor only.

With a Rollover as Business Startup, you must have oversight of your investment. Under the regulations established with ROBS, you must be an active employee of your startup in some capacity. This indicates that you should earn your own salary through your small business once it starts accumulating revenue. With this approach, you must be willing to be an active player in the development of your investment.

Fancy What You Sew into Your Startup

An SDIRA and/or ROBS can be the needle and the thread to a small business, stitching their way towards possible prosperity. When selecting either option, you should choose the one that has the specificities better catering to your needs.

ROBS are taxed like a c-corporation as they possess the same structure. Therefore, corporate tax applies. Due to its complexity, a specialized tax or legal professional typically oversees the necessary documentation to confirm its compliance. This also implies that all money flows in as dividend income.

Self-Directed IRAs typically do not require the creation of an LLC, which means it generally costs less to keep the account maintained and likely has lower fees. All incoming revenue is considered growth of the IRA and accumulates with a tax exemption (Either tax-deferred or tax-free, dependent on whether you own a Self-Directed Traditional IRA or Self-Directed Roth IRA). Along with this, a SDIRA does not require an IRS Form 5500, which all ROBS must legally complete.

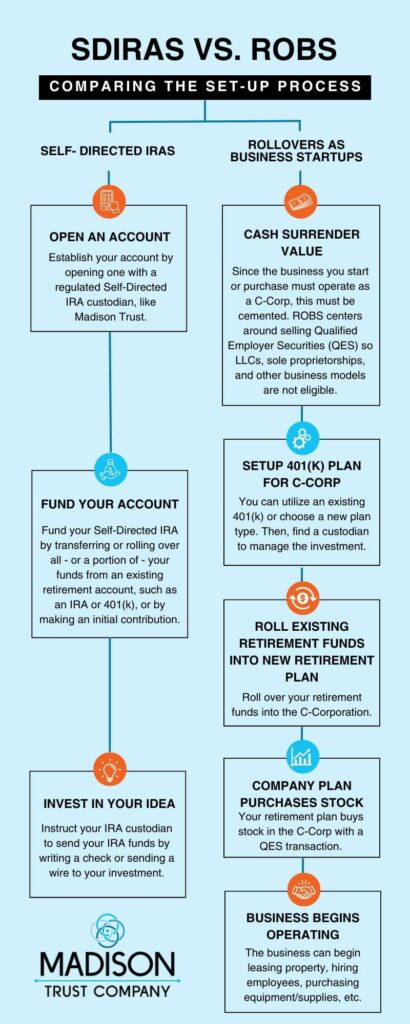

Distinctions in Opening Self-Directed IRAs and ROBS

The setup process for both SDIRA and ROBS differentiates vastly. Here are the steps to setting up either one of these startup initiators:

Conclusion: Design a Small Business Investment Geared Towards Your Taste and Flair

With a Self-Directed IRA or a Rollover as Business Startup, we’re granted the opportunity to imprint our investment with our style and technique. Deciphering which method screams ‘YOU’ is significant to the course of your small business investment.

When it comes to Self-Directed IRAs, Madison Trust is here to educate you on the entire self-directed investing process. Discover how you can potentially stylize your future for success!