Be Actively Grateful by Giving Back This Thanksgiving: Using Your SDIRA for Donations

Written By: Daniel Gleich

Key Points

- Donating to charity may grant tax breaks on your Required Minimum Distributions (RMDs).

- Numerous investment opportunities can align with charitable initiatives, including startups and real estate.

- A Self-Directed IRA (SDIRA) can assist in cementing your legacy by allowing you to donate to the charity of your choosing.

During Thanksgiving, we tend to reflect on our place in the world and wonder what actions we can take to help others in need. Many are unaware that they can bring their Self-Directed IRA into play. Investors and good Samaritans alike can implement positive change with their retirement savings. Here’s how:

Required Minimum Distributions (RMDs) Are Tax-Free When Donated

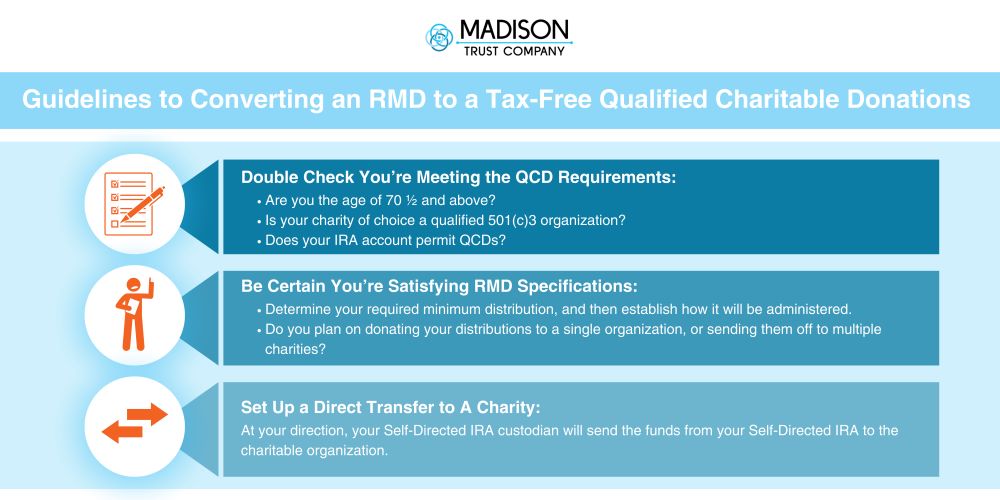

Once a Self-Directed Traditional IRA owner turns 73, they must start taking out their RMDs. A tax-free way to satisfy your RMDs is by donating them to a qualified 501(c)3 organization. This converts your RMDs into qualified charitable distributions. QCDs are direct transfers of your IRA funds to a qualified charity, performed by your Self-Directed IRA custodian.

In order to take a QCD, the account holder must be age 70 ½ or older, and have a Traditional IRA, Inherited Traditional IRA, an inactive SEP IRA, or a SIMPLE IRA (inactive plans only).

For those still garnering income or who have supplemental savings, donating their SDIRA distributions may be an ideal choice. This is also preferrable for those in retirement who still want to participate in charitable acts.

At your direction, your Self-Directed IRA custodian will directly transfer your distribution to the qualified charity of your choice. Those who are age 70 ½ and above can contribute up to a total of $100,000, tax-free. This deduction of your distribution potentially lowers your Adjusted Gross Income (AGI).

Consult a Self-Directed IRA custodian, like Madison Trust, prior to initiating a charitable transfer. Our specialists can also discuss how retirement savings can lower your current tax bill.

Start Your Self-Directed IRA and Start Something Good

For those seeking alternative investment opportunities, there are several altruistic avenues to explore. Investing in a startup with a positive initiative could be a desirable route. Plenty of philanthropic startups are currently pursuing investors, and the amount of these organizations will likely continue to expand. Through research and due diligence, you may discover a startup that merges your worldly vision with your retirement savings.

Home Own for Humanity

Real estate is another surprising sphere that combines benevolence with potential earnings. Through the act of purchasing a property through your Self-Directed IRA, you can help your community. Possible opportunities are rehab facilities, nursing homes, soup kitchens, and group homes for veterans.

Another possibility is to invest in farmland. By purchasing acres of agriculture, you could grow food that fuels the hungry and less fortunate. If you’re an animal lover, consider investing in an animal sanctuary.

Let Your Self-Directed IRA Leave Your Legacy

Perhaps you want to leave something behind as representation of your life and values. Designating a charity as a beneficiary will grant the organization your desired percentage of your account’s investments.

If you intend on authorizing both family/friends and charity as beneficiaries, inheritors will not be liable for the income taxes associated with the charitable distribution. This is a fantastic way to leave your mark and to guarantee a cause you care deeply about still receives support.

Conclusion: Feel Good While Planning for the Future

Using your Self-Directed IRA for charitable donations can assist in improving our society. The bonus: simultaneously, you’re focusing on your retirement.

An SDIRA typically gives the account owner the opportunity to pick a cause they strongly stand behind. You can choose the charity you’d like to support by satisfying your required minimum distributions into qualified charitable donations. You can also choose to invest in a benevolent alternative investment. With potential tax breaks and a possible growth of income, using your SDIRA for charitable purposes may be rewarding.

Want to Learn How You Can Use a SDIRA to Pay it Forward?

Madison Trust can provide further information on donating to charity through a Self-Directed IRA QCD. Together, we can strive to lend a helping hand. Are you interested in learning more about self-directed investing? Speak with a Self-Directed IRA Specialist to get your questions answered.