Legacy Planning: Self-Directed IRA Beneficiaries

Written By: Daniel Gleich

Key Points

- A beneficiary is an individual or an entity that will inherit the legal rights to your IRA assets upon your passing.

- It is important to update your Self-Directed IRA beneficiary designation after major life events so your assets are passed on as you wish.

- Madison Trust’s Specialists are here to guide you through the process of designating IRA beneficiaries and self-directed investing.

In addition to saving for retirement, Self-Directed IRAs (SDIRAs) give their account holders the power to pass on their assets and/or funds to loved ones or charities. Those nearing retirement may especially want to consider how they would like to see their assets passed to the next generation. Let’s explore how to designate beneficiaries for your Self-Directed IRA.

Who Can Be a Self-Directed IRA Beneficiary?

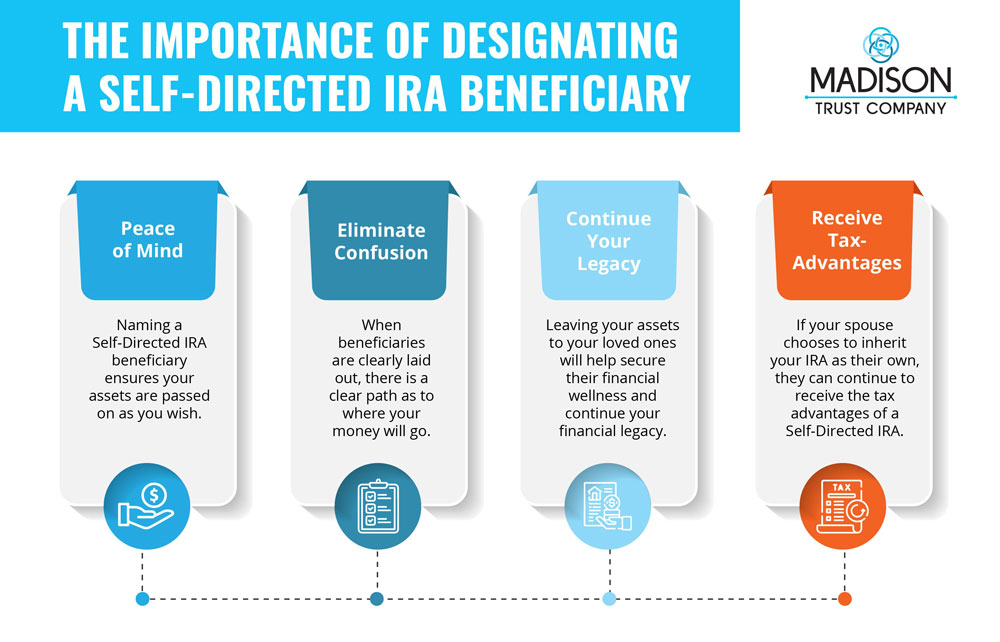

According to the IRS, a designated beneficiary is “any individual designated as the beneficiary of an IRA or retirement plan”. When you name beneficiaries for your IRA, the legal rights to your IRA assets will pass directly to your beneficiaries in the case of your passing. It is important to name a beneficiary for your Self-Directed IRA to ensure your assets are passed on as you wish.

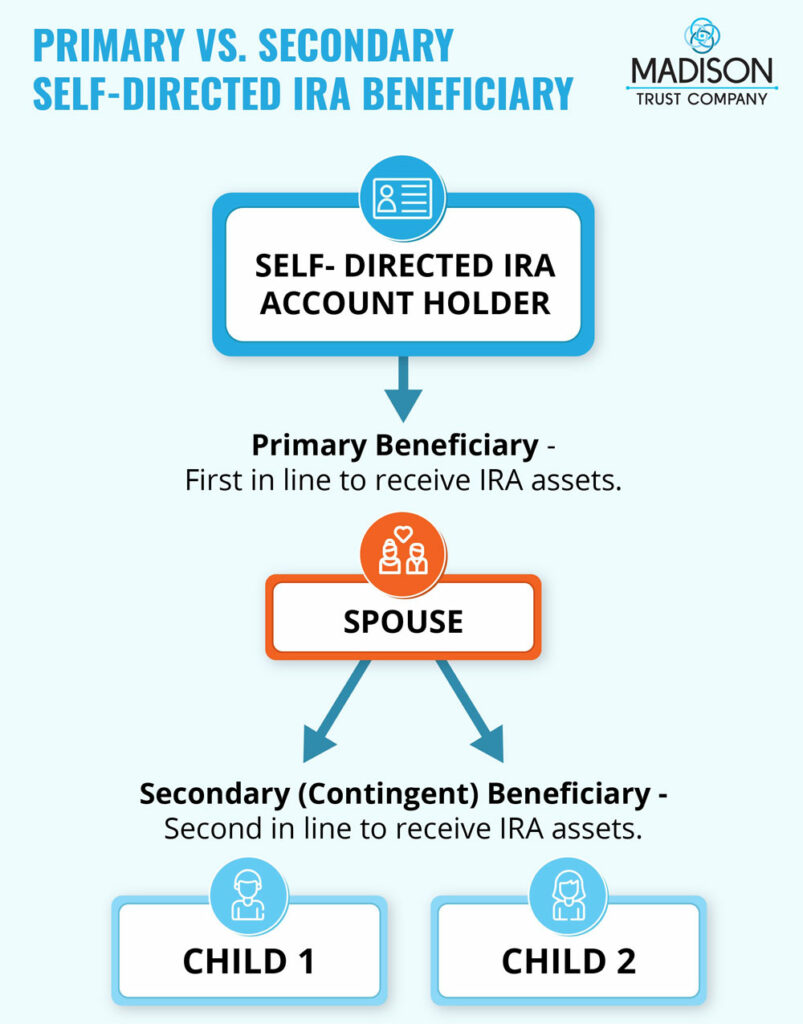

One option is to name an individual as your beneficiary. Many account holders choose to designate their spouse, while others choose to name a child or grandchild as their IRA beneficiary. You may also choose to name multiple beneficiaries, deciding on the percentage that each person will receive. Another option is to designate an entity, such as a charity or a trust as your IRA beneficiary.

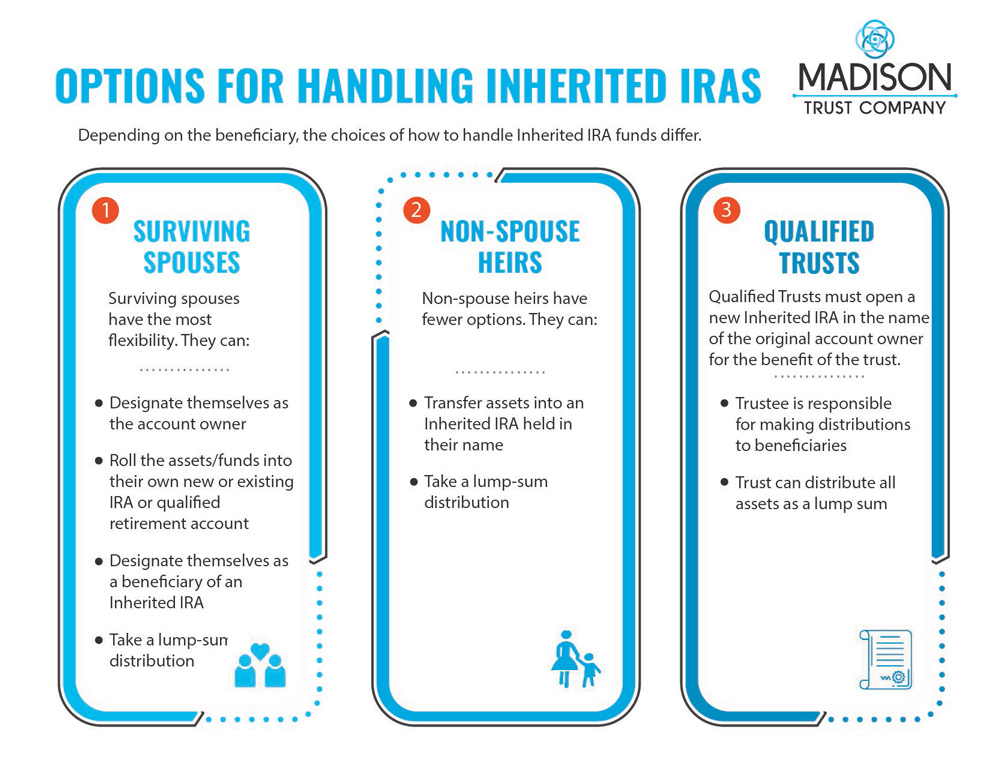

Who or what you designate as your Self-Directed IRA beneficiary can impact the flexibility your heir(s) may have. Spouse beneficiaries have the most flexibility when it comes to authority over the account. Your spouse may choose to designate themselves as the owner of the IRA. Your spouse also has the choice to treat the assets as their own and roll them into another qualified plan or act as the beneficiary without taking the role of the IRA owner. Non-spousal beneficiaries do not have as many options. Their options include transferring the assets into an Inherited IRA or taking a lump-sum distribution.

Advantages of an Inherited IRA

By designating a beneficiary, you are in direct control of who you would like to receive your assets. From there, your beneficiary can choose how they inherit the IRA. If your beneficiary decides to open an Inherited IRA, they will receive the advantages of continuing the account’s tax-deferred (Traditional IRA) or tax-free (Roth IRA) growth. They also can choose to withdraw their distributions over time, which can help them preserve the assets longer and spread out any tax liability.

How To Designate Beneficiaries

Madison Trust simplifies the process of designating beneficiaries. Simply complete the Beneficiary Designation Form. On this form, you may designate primary beneficiaries and secondary beneficiaries and the percent share that you wish them to receive.

Self-Directed IRA Beneficiary Account Maintenance

It’s a good idea to review your beneficiaries annually to ensure it is up to date with your wishes. You can update your beneficiaries at any time, but it is especially important to check your beneficiaries after a major life event such as a birth, adoption, marriage, or shift in financial situation.

Another Legacy Planning Option: Directed Trusts

Another option available when planning your legacy is a Directed Trust. This type of account is best for those looking for greater control and flexibility over their investments, distribution, and legacy. For more information, please visit Directed Trusts.

Conclusion: Let's Tie It All Up

Although it may not be on top of mind, designating a beneficiary for your Self-Directed IRA is an important step to continuing your legacy into the next generation. Take a moment to consider how you would like your assets to be passed on and speak with the appropriate tax, legal, or financial professional and a Self-Directed IRA Specialist to designate the perfect beneficiary for you and your family.

Do you have any questions about Self-Directed IRA beneficiaries? Schedule a free call with a Self-Directed IRA Specialist today for more information.

Disclaimer: All the information contained on our website is a general discussion for informational purposes only. Madison Trust Company does not provide legal, tax or investment advice. Nothing of the foregoing, or of any other written, electronic, or oral statement or communication by Madison Trust Company or its representatives, is intended to be, or may be relayed as, legal, tax, investment advice, statements, opinions, or predictions. Before making investment decisions, please consult the appropriate legal, tax, and investment professionals for advice.