Carving Your Financial Future: Comparing Self-Directed IRAs and Jack-O’-Lanterns

Written By: Daniel Gleich

Key Points

- With preparation, personalization, and the ability to adapt to changing circumstances you can achieve a beautiful carved pumpkin and fulfilling retirement.

- A Self-Directed IRA (SDIRA) gives you the freedom to invest in alternative assets to create a well-diversified retirement portfolio.

- Madison Trust’s Self-Directed IRA Specialists strive to help you on your journey to a richer retirement.

Autumn is in the air! A season of hayrides, cider tastings, warm flannels, apple pie, pumpkin spice lattes, and more. Another classic fall pastime is carving a pumpkin! Pick a unique pumpkin from the patch, carve your design, and admire your creation glowing on your front porch. It's an autumn activity all ages can enjoy!

Although an unlikely pair, Self-Directed IRAs (SDIRAs) and carving a pumpkin have a lot in common. Let’s explore how investing with a Self-Directed IRA is like carving a pumpkin.

1. Variety of Pumpkins in the Patch / Variety of Self-Directed Account Types to Choose From

The first step to carving a pumpkin is to travel to a pumpkin patch or a farm stand to select a pumpkin of your liking! Some may choose a pumpkin based on its size, shape, or shade of orange. Consider checking out the farm’s reviews or social media to see what others thought of this year’s harvest.

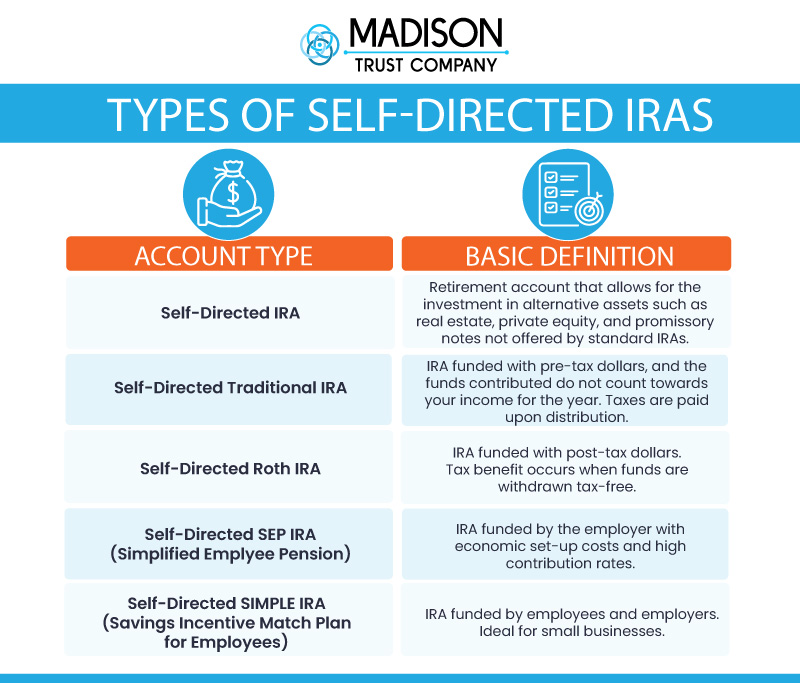

Likewise, the first step to saving for retirement with a Self-Directed IRA is to open an account type that best suits your financial goals and preferences. When researching Self-Directed IRAs, consider asking yourself what types of investments you would like to buy, when you would like to receive tax benefits, and what features you want in a custodian.

Based on your preferences, you may choose to invest with a Self-Directed Traditional IRA, Self-Directed Roth IRA, Self-Directed SEP IRA, or Self-Directed SIMPLE IRA. A popular way to decide which account type and custodian are the best is by comparing Self-Directed IRA custodian reviews.

2. Plan Your Pumpkin’s Design / Control Your Retirement Portfolio Design

Carving a pumpkin and self-directed investing both benefit when you think ahead, set goals, and make informed decisions.

Once you have selected your pumpkin, it’s time to decide how you’d like to design it. What will you carve into the pumpkin? Will you be using a stencil or are you going to freehand the design? Will you look up design ideas online or do you already have something in mind? Do you have the proper tools needed to achieve your design?

In a similar manner, once you open your Self-Directed IRA, you can start to strategize how you would like to diversify your retirement portfolio. A Self-Directed IRA opens up your investment possibilities to alternative assets like real estate, precious metals, private businesses, and promissory notes.

It’s considered best practice to have a balanced portfolio with investments that perform inversely with each other to weather market volatility. For example, if the value of the stock market decreases, typically the value of precious metals increases (and vice versa). Therefore, adding gold to a retirement portfolio can provide insurance against inflation and economic crisis.

3. Adapt to Changing Circumstances / Adapt to the Market Conditions

Depending on the size, shape, and condition of your pumpkin – you may have to adapt your design and carving technique. Whether your pumpkin has a soft spot or way too many seeds, you can modify your design based on the different variables.

Similarly, your Self-Directed IRA investing strategy may need adjusting based on the financial market, your risk tolerance, and your time horizon. In general, young investors tend to focus on growth investments, while those nearing retirement may focus on capital-preserving investments.

For example, real estate rental property investments typically provide a reliable revenue stream. In addition, gold generally acts inversely with the stock market. These alternative assets can keep your portfolio performing well despite current market conditions. It is recommended to speak with the appropriate tax, legal, and investment advisor to ensure your investments align with your financial goals.

4. Add Your Own Personal Touch / Strategize Based on Your Ideal Retirement

Just like snowflakes and fingerprints, no two pumpkin carvings are exactly alike. Your finished jack-o'-lantern reflects your own personal creativity and style.

Likewise, your self-directed investing journey and retirement years will not look like anyone else's. Take a moment to picture your ideal retirement. Where will you be and how will you spend your time? More importantly, how much annual income will you need to achieve your ideal lifestyle? The answers to these questions likely differ your friends'. Thinking about your future plans now will help you make investment decisions now and determine a rough estimate of how much to save.

5. Enjoy Your Pumpkin All Season / Enjoy Long-Term Results in Retirement

A beautifully carved pumpkin brightly lighting up the cool night can be a source of pride and enjoyment during the fall season. Similarly, a well-crafted retirement strategy within a flexible account like a Self-Directed IRA can potentially lead to long-term financial security and satisfaction in your retirement years.

Conclusion: Let’s Tie It All Up

Both carving a pumpkin and planning for retirement with a Self-Directed IRA can lead to rewarding results. With preparation, personalization, and the ability to adapt to changing circumstances you can achieve a beautiful pumpkin masterpiece and fulfilling retirement.

Are you interested in learning more about self-directed investing? Speak with a Self-Directed IRA Specialist to get your questions answered.