You, Your Best Friend, and Your Self-Directed IRA: Refer a Friend Program

Written By: Daniel Gleich

Key Points

- National Best Friend Day is the perfect time for you to recommend a Self-Directed IRA (SDIRA) to your friend(s).

- A Self-Directed IRA allows account holders to diversify their portfolio, have stability when the stock market fluctuates, and control their retirement investing.

- When you refer a friend to Madison Trust, you will receive $100 when they fund their account!

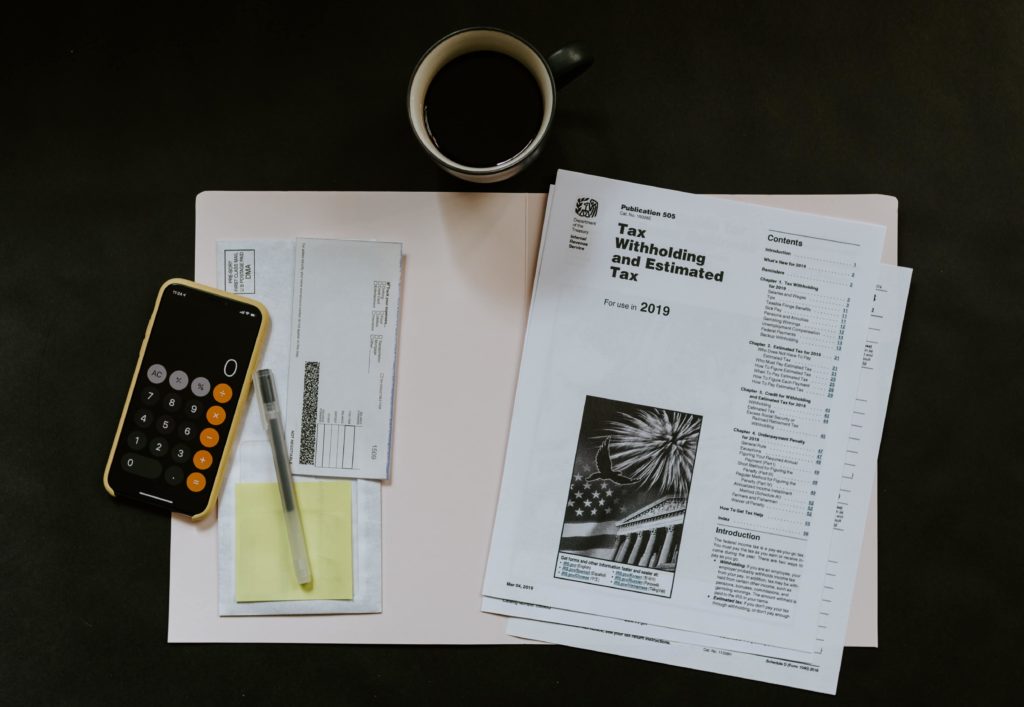

Supportive. Trustworthy. Fun. Humorous. Honest. These are just a few qualities that can be used to describe a best friend. If you are fortunate to have someone in your life who embodies these qualities, you may want to keep in mind that National Best Friend Day is on June 8.

Think about how you can show appreciation to your best friend and give a gift that can last a lifetime. Consider giving your best friend the gift of being able to build wealth and invest in alternative assets such as real estate, precious metals, promissory notes, private businesses, and more in a Self-Directed IRA.

Why are Self-Directed IRAs Not as Well Known?

It may seem that Self-Directed IRAs are a well-guarded secret, known only to the savviest of investors. This is because the majority of Americans hold their IRAs in large brokerage houses that typically allow their account holders to invest their IRAs only in stocks, bonds, and mutual funds. In general, brokerage houses do not accommodate alternative investments due to the administrative tasks involved and their loss in commission. This results in Self-Directed IRAs, their benefits, and alternative investment opportunities being widely unknown.

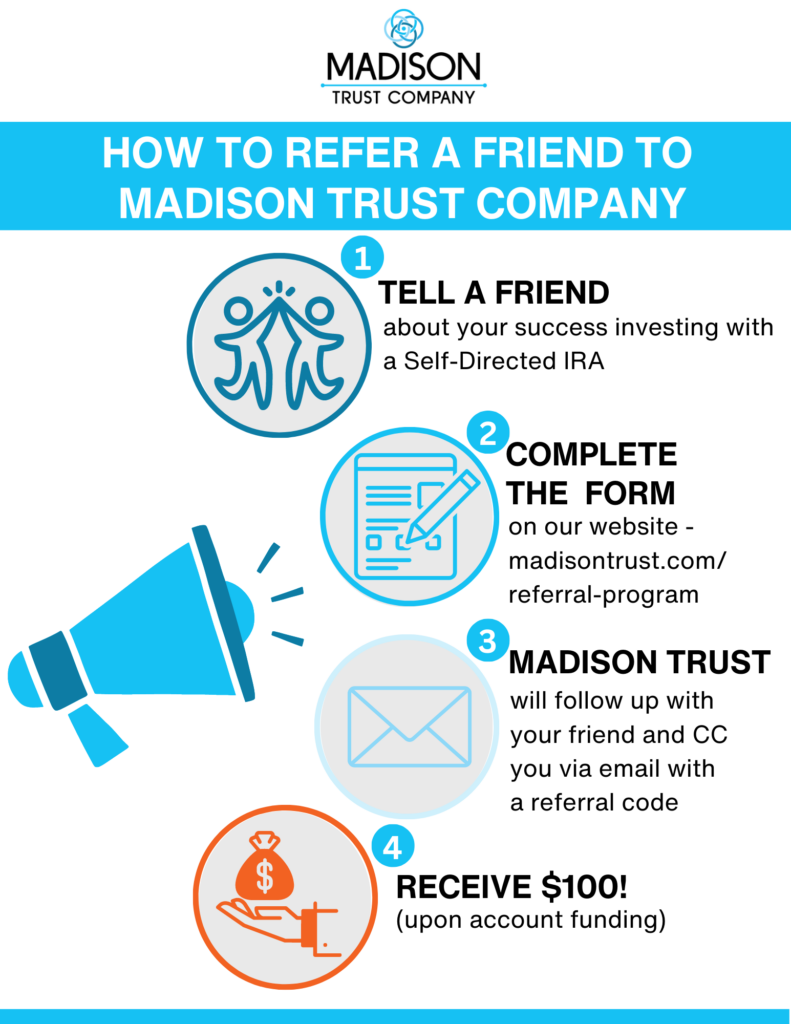

This is where you come in. Madison Trust needs your help to spread the word about self-directed investing! We created our Refer-a-Friend Program so you can easily earn $100 and help your friend(s) grow their retirement savings – that's a win-win!

Advantages of a Self-Directed IRA (SDIRA)

Diversify Your Portfolio

You have the opportunity to invest your retirement funds in assets inaccessible to standard IRAs such as real estate, promissory notes, private businesses, precious metals, and more.

Stable Returns

You can hedge against the volatile stock market and invest in assets that have a steadier and more reliable revenue stream.

Control of Investments

You instruct Madison Trust to invest your IRA funds directly in the asset of your choice. Account holders typically invest in a variety of assets that they are familiar with.

Who can I Refer a Self-Directed IRA (SDIRA) to?

Since Self-Directed IRAs are not as well known, there is no shortage of referral opportunities.

With Madison Trust’s Refer-a-Friend Program, you get rewarded for every referral.*

*Please note, this program is only offered to existing clients of Madison Trust; it does not apply to Investment Sponsors or clients who open a second account.

How To Refer a Friend - Madison Trust Refer-a-Friend Program

Why Madison Trust?

Incredible Client Support

Our purpose is to enable our clients to achieve a richer retirement and provide a pleasant journey getting there. The first step in that journey is unparalleled customer service. When you call Madison Trust, you’ll always be able to speak with a live and knowledgeable representative.

Industry Knowledge

Madison Trust Specialists complete rigorous CISP training and have a deep understanding of a variety of alternative asset classes.

Easy Account Set Up

It is three easy steps to start investing with a Self-Directed IRA: (1) Open (2) Fund (3) Invest.

Straightforward Fees

Amongst the lowest in the industry, our flat rates help ensure the profitability of your investments.

Conclusion: Let's Tie It All Up

This year for National Best Friend’s Day, let’s give your friends the gift that keeps on giving – a Self-Directed IRA. If you are lucky enough to be in retirement with your best friend, you may both be grateful that you invested beyond Wall Street and can retire richer together.

Disclaimer: All of the information contained on our website is a general discussion for informational purposes only. Madison Trust Company does not provide legal, tax, or investment advice. Nothing of the foregoing, or of any other written, electronic, or oral statement, or communication by Madison Trust Company or its representatives, is intended to be, or may be relayed as, legal, tax, investment advice, statements, opinions, or predictions. Prior to making any investment decisions, please consult with the appropriate legal, tax, and investment professionals for advice.