Self-Love is Self-Preservation: You Deserve Financial Wellness

Written By: Daniel Gleich

Key Points

- It’s generally seen as essential to tend to your personal finances as it is to take care of your overall wellbeing.

- Through planning and preparation, you can implement a self-care routine in conjunction with a strategy to improve your financial wellness.

- The present you and the future you both rely on the rituals employed in your today. You have the power to nourish your health in every capacity, while additionally creating a potentially more comfortable future and retirement.

Upon hearing the words “self-care,” you may mentally evoke imagery of bubble baths and vanilla scented candles. While caring for oneself does at times involve indulgences, it usually refers to what lies beneath the surface. Self-love has a lot of working parts, but one that tends to be overlooked is acquiring financial wellness.

Financial wellness is typically realized by establishing an understanding of the amount of money you hold, and where you’re fiscally going. Consider this more of an intentional practice and an additive to your lifestyle – not a destination you should seek to reach. For methods on potentially improving your good fortune – mentally, spiritually, and monetarily – lets voyage into tendering territory.

The Genuine You and Financial Wellness

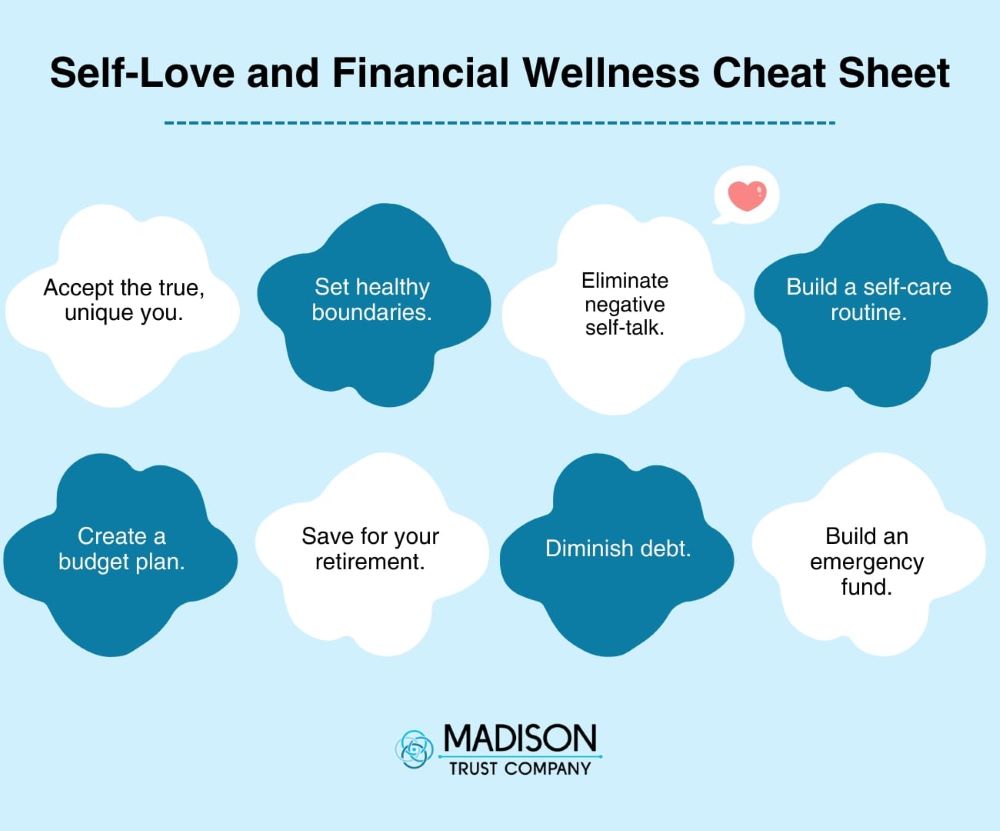

The first step to emerging into an authentic and therefore exemplary version of you, is by accepting the true, unique you and all that you encompass. If you haven’t done so yet, you could greatly benefit from spending time with yourself and getting to know who you are at your core. This includes your interests, what makes you feel your most relaxed and confident, and the conditions you need to feel rejuvenated and best equipped to take on the world.

In combination with an inner understanding, it’s believed that practicing gratitude can help rewrite your thoughts. By being thankful for having breath and being present in your body, you could ultimately start to notice other simple elements of your daily life and feel grateful for them.

Economically, financial wellness encourages familiarizing yourself with the flow of your money. Keeping track of how much money you have streaming in and out on a weekly or monthly basis could help you become more mindful regarding expenditures.

Furthermore, if you analyze your spending, you could determine if you’re shelling out an amount that equates to more than what you’re earning. Consider constructing a budget plan. Allotting a monthly spending limit specifically designed around your income can possibly prevent you from spending beyond your means.

Conserving Your Energy and Preserving for the Time to Come

Arguably, a crucial component of building and maintaining personal and financial wellness is the act of self-protection. Many consider setting and applying boundaries as an essential practice to mental health development. This differs depending on the individual. Some possible examples could be reducing phone calls with friends to 30 minutes or enforcing Sundays as your self-care day of the week.

Apart from curbing potential spending habits, financial wellness typically homes in on saving and investing for your future. Some prefer to build a budget plan, sectioning out a percentage or portion of their incoming funds to transfer to a savings account. Others favor investing, with the goal of potentially expanding their savings outside of their earned income.

An excellent investment vehicle to possibly accrue supplemental retirement savings is the Self-Directed IRA (SDIRA). Through this pioneering tool, you can potentially improve your financial wellness by investing in an alternative asset that aligns with your interests, while instantaneously diversifying your retirement portfolio. This nudges you in the driver’s seat as you will act as the manager of your investments, independent of the stock market and Wall Street products. This can coincide with growing your confidence and influence initiation in other areas of your life you hope to fulfill change.

Eliminating Negative Self-Talk and Diminishing Debt

As we are a product of our environment, we should try to surround ourselves with sources promoting positivity. By listening to motivational podcasts or reading inspiring literature, we can grab slices of thought-provoking segments and institute these practices into our work or routine. Positive affirmations can be useful to you, just as journaling tends to put things in perspective for someone else. Maintaining relationships with those who advocate for your joy can also immensely contribute to a healthier mentality.

It's hard to avoid the topic of debt when discussing financial wellness. Though debt can arrive at your doorstep, you can garner control and seize its advancement through intention and deliberation. One popular approach is to start with paying off credit cards or loans containing the highest interest rate. Another potential strategy is to pay off the debt with the smallest balance and work your way through.

Preparation is typically key when it comes to conquering debt for financial wellness. Through the aforementioned budget plan, you can similarly choose to allocate funds and designate them for debt payments. After a few months of executing this fiscal process, it may become second nature and distinctively less overwhelming.

Financial Wellness and Personal Wellness Love a Good Game Plan

Composing a blueprint as a guide to both your personal wellness and financial wellness is one of the easiest ways to ensure you stay on course. It’s important to schedule time to participate in activities that stimulate you and bring you back to yourself. This could include engaging in a creative pursuit, meditation, nature walks, religious practice, or a particular exercise. Marking a monthly or weekly calendar date with your self-care task helps you stick to the plan and not let external factors blur into your personal time.

Financial wellness not only entails comfort during the present day but involves preparing for your future. It’s considered ideal to begin developing an emergency fund as soon as you have the resources. This grants you peace of mind if you’ve unfortunately encountered unemployment or a sudden monetary strain.

Conclusion: Financial Wellness is Self-Care

If you’re hoping to become a more well-rounded version of yourself, nothing aids in satisfying your ambitions faster than incorporating self-love and financial wellness into your lifestyle. Many who are eager to embody self-improvement should also consider practicing the incredible power of balancing your checkbook and getting your finances in order. By doing so, the non-monetary parts of you can become empowered, resulting in you tending to them.

Have you been hoping to step into self-directed investing?

Utilizing the innovative Self-Directed IRA (SDIRA) could be a wonderful way to save for your retirement. Start a conversation with one of our specialists and treat yourself to a part of financial wellness.