7 Steps to Get Fit This New Year and Workout Your Retirement

Written By: Daniel Gleich

Key Points

- Improving wellness and retirement savings are possible with a Self-Directed IRA (SDIRA).

- By varying exercise routines and recipes and diversifying your retirement portfolio, you can assemble a foundation for success in both areas.

- With deliberation and prudence, you can potentially acquire supplemental income for your retirement, and enhance your overall health.

Almost all of us harbor a desire to elevate ourselves. We attempt this by either sharpening a skill or progressing some aspect of our lives. The new year is famous for the ambition it brings. There are a few common goals people tend to cling to, and they usually revolve around fitness and money.

The pursuit of wellness and a richer retirement are achievable together. Investing with a Self-Directed IRA (SDIRA) may be a large benefactor in your savings aspirations. With just these core seven steps, you can fulfill your yearly wishes by establishing potentially gratifying forthcoming years.

1. Clarify Your Intentions

Setting goals is the first step to crossing them off your list. The outline you’ll construct will depend on the specifics of what you would like to accomplish. You could be wanting to incorporate an alternate diet into your lifestyle or are hoping to lose weight. Perhaps you’ve set your sights on gaining muscle mass and getting stronger.

Everyone defines health differently just as everyone’s ideal retirement is distinct. Imagine how you would like to be spending your days and using your finances once you’re no longer actively employed. Getting a scope on what your must-haves are for the future day-to-day will make it easier to begin venturing towards a possibly prolific retirement savings.

2. Track Your Steps + Stand in Your Decisions

The CDC recommends that most adults should aim to take 10,000 steps per day or be active for 60 minutes per day. If your goal is to lose weight, the more steps you take, the greater chance you have of slimming down. A step tracker is an efficient product for this. It monitors how much you’ve done and ensures that you’re not sedentary for long stretches of time.

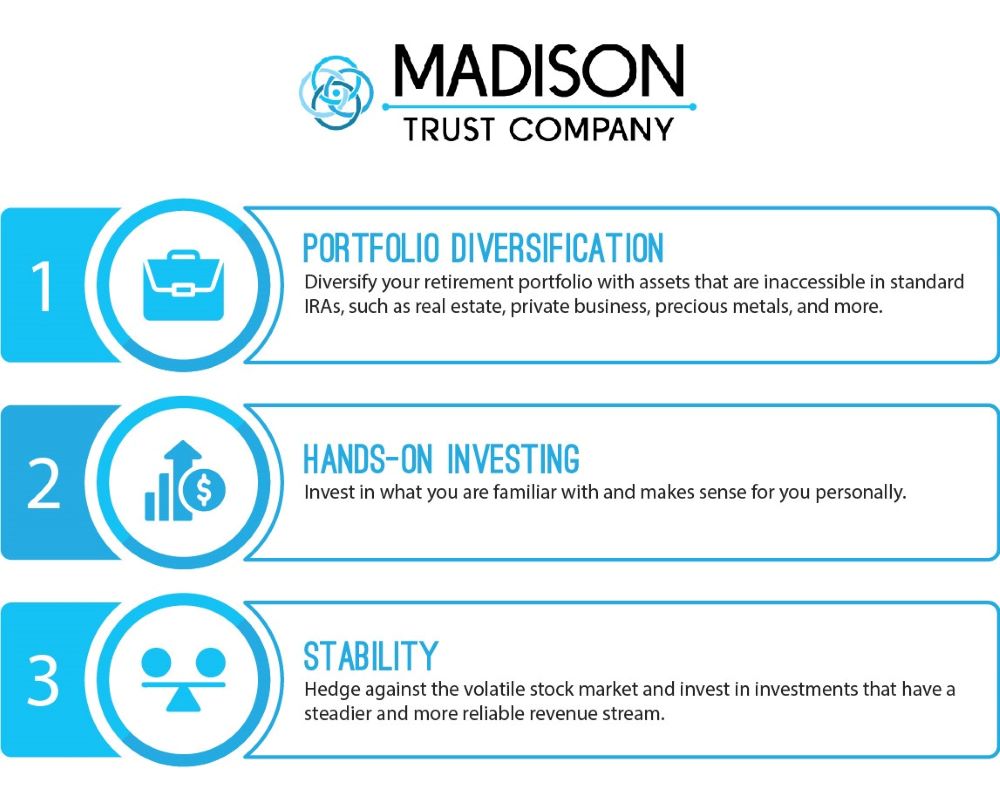

After incorporating this cardiovascular activity into your daily habits, it’s time to focus on the finer details. Self-Directed IRAs grant you the ability to invest in a variety of alternative assets. With accessible options like real estate, promissory notes, precious metals, private placements, and more, pinning down which asset is best for you typically takes analyzation.

It’s considered best practice to perform your due diligence and understand your asset’s industry. Once you feel well-versed, determine if it makes more sense to invest with a Self-Directed Traditional IRA or a Self-Directed Roth IRA. Slight differences exist between the two:

3. Increase Protein & Water Intake + Mix in the Right Self-Directed IRA Custodian

Consuming a sufficient amount of protein and water is essential. According to an article published by Harvard Medical School, the Recommended Dietary Allowance (RDA) for protein is 0.8 grams of protein per kilogram of body weight, or 0.36 grams per pound. This is for baseline necessity. The amount will increase if you’re looking to preserve and build muscle.

Harvard declares that generally, most people need a minimum of four to six glasses of water per day. This changes when taking various factors into consideration. Hydration is vital for your wellness, just as a trustworthy SDIRA custodian is imperative for a seamless investment experience.

Although a Self-Directed IRA will be managed by you, a custodian administers all transactions at your direction. Consider researching trusts and banks. You may aim to invest with a company who has years of experience, prioritizes client support, and is known for their fast response time.

4. Avoid Processed Foods + Avoid Prohibited Transactions

Most of us are aware that eating processed foods is subpar to nutrient-rich whole foods. To avoid grabbing whatever is available, make meal prepping a weekly to-do. This will keep you in the know of the macro-nutrients, calories, and cholesterol that you’re consuming.

Similarly, you may consider preparing your investment by familiarizing yourself with prohibited transactions. These are typically transactions done with disqualified persons. Plan for your investments to participate solely with third party entities. Participating with people who are close to you in any capacity may render your SDIRA subject to taxes.

5. Supply Your Body with Sufficient Sleep + Contribute to Your Limit

Obtaining less than seven hours of sleep a night regularly could jeopardize your hard work. Lack of rest can contribute to weight gain. It also amps up cravings and causes an escalation in appetite. Making sleep a crucial part of your regimen is key to your overall health.

Just like you should get seven hours of sleep, Self-Directed IRAs have certain contribution limits. It’s considered best practice to budget so that you can contribute as much as possible per year to your retirement savings. Encompassing a savings habit can also help with any allotted taxes that are due at the end of the year. More reserved money typically equates to more freedom during retirement.

6. Switch-Up Your Routine + Diversify Your Retirement Portfolio

Switching up your workouts and recipes allows you to experience a variety of foods and exercises to keep it interesting when working to reach your goal. Similarly, instead of investing in only Wall Street products, consider diversifying your retirement portfolio by investing in alternative assets which are typically uncorrelated in performance with the volatile stock market. Invest in more than one asset class to have a broad spectrum of savings as you venture into a potentially prosperous future.

7. Take Vitamins and Supplements + Supplement Your Income

We all could use the assistance of a multi-vitamin in getting all the vitamins and minerals we need. Consider talking with your doctor about what supplements could aid in bettering your health. Decipher which ones are acceptable to take to help meet your fitness targets.

By adhering to Self-Directed IRA rules and organizing a plan of action, you possibly can accrue supplemental income for your retirement savings.

Conclusion: You’re the Master of Your Destiny

To enhance your strength, vigor, and physical condition, it’s important to exercise your power to make a change. This simultaneously can apply to your retirement savings. Revel in the advantages that are within your reach by utilizing a Self-Directed IRA alongside preparation and discipline.

New Year, New You

Our Madison Trust Specialists have a passion for helping our clientele learn more about self-directed investing. If you’re ready to make a change, let us assist you. Collectively, we can make this year the best one yet.