The Insider’s Guide to Real Estate Investing: Using a Self-Directed IRA to Invest in Warehouses

Written By: Daniel Gleich

Key Points

- Self-Directed IRAs (SDIRAs) empower retirement investors to diversify their portfolios by investing in alternative assets like industrial real estate warehouses and manufacturing facilities.

- Real estate investments with a Self-Directed IRA provide the potential for steady income, long-term leases, and tax benefits.

- Madison Trust simplifies the Self-Directed IRA setup process so you can invest in industrial real estate with ease.

In the realm of retirement planning and portfolio diversification, savvy investors are constantly seeking out new, exciting alternative assets. An investment opportunity that’s gaining traction is utilizing a Self-Directed IRA (SDIRA) to invest in warehouse properties. Let’s dive deeper into why investors consider investing their retirement funds into industrial properties and how a Self-Directed IRA can be your ticket to growing retirement savings.

Understanding Self-Directed IRAs and Real Estate Investing

Similar to standard IRAs, Self-Directed IRAs are individual retirement accounts with tax advantages. However, what sets Self-Directed IRAs apart from standard IRAs is that it empowers investors to broaden their portfolios beyond stocks and bonds. SDIRAs open the door to alternative investments, including real estate, precious metals, private businesses, promissory notes, and more. A Self-Directed IRA can give you more control of your retirement investing by allowing you to align your portfolio with your interests, including in areas such as industrial real estate.

What Is Industrial Real Estate?

Under the Self-Directed real estate investment umbrella, you can invest in residential, commercial, and industrial properties.

Law Insider defines industrial property as “property used for a branch of trade or manufacturing, production, assembly, or processing of finished or partially finished products from raw material or fabricated parts or the holding thereof in respect of which capital and labor are involved.”

Types of Industrial Real Estate You Can Invest in with a Self-Directed IRA

- Distribution Warehouse – a type of industrial property that holds inventory and fulfills orders by distributing goods. E-commerce websites often have distribution warehouses around the country to execute orders as quickly as possible.

- Storage Warehouse – a warehouse that companies own to store additional inventory that is not being rapidly processed or shipped. Typically, well-established companies open storage warehouses with the intention of long-term storage needs, making this a potentially suitable investment for retirement.

- Manufacturing Facility – a factory that develops products. Depending on the machinery the manufacturing facility may be described as heavy or light.

- Flex Space Building – a large, warehouse-style real estate space that can be customized to suit retail, office, and warehouse needs often all at once. Research centers and data centers are types of flex spaces.

Why Invest In Warehouses with a Self-Directed IRA?

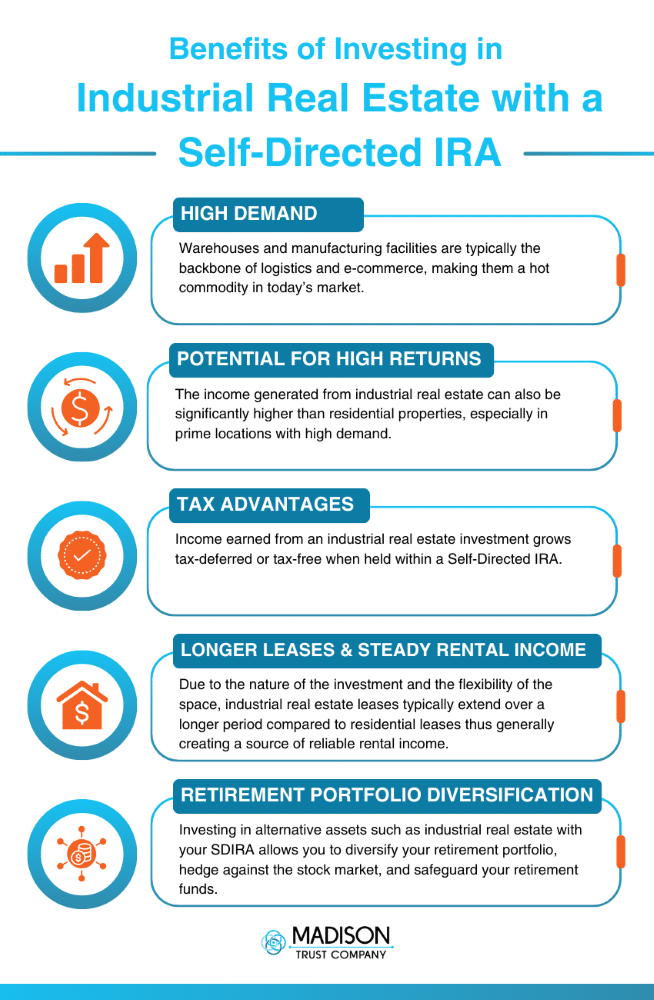

Warehouses are typically the backbone of logistics and e-commerce, making them a hot commodity in today’s market. There is a demand for storage and distribution spaces, which propels warehouse properties into a potentially lucrative investment opportunity.

Whether it be a warehouse or manufacturing facility, industrial real estate generally returns steady rental income. This income can also be significantly higher than residential properties, especially in prime locations with high demand. This income grows tax-deferred or tax-free if held within a Self-Directed IRA.

In addition, due to the nature of the investment and the flexibility of the space, industrial real estate leases typically extend over a longer period compared to residential leases. This can potentially provide stable and predictable income.

Investing in industrial real estate with your SDIRA allows you to diversify your retirement portfolio, hedge against the stock market, and can safeguard your retirement funds.

Benefits of Investing in Industrial Real Estate with a Self-Directed IRA

How To Get Started Investing in an Industrial Property with a Self-Directed IRA

The process to invest in an industrial property at Madison Trust is simple:

1. Open a Self-Directed IRA with Madison Trust by completing our easy online application.

2. Fund your Self-Directed IRA by transferring or rolling over all - or a portion of - your funds from an existing retirement account, such as an IRA or 401(k), or by making an initial contribution.

3. Invest in the Real Estate of Your Choice by instructing Madison Trust to send your IRA funds by writing a check or sending a wire directly to your investment.

Navigating Using a Self-Directed IRA to Invest in Industrial Properties

As with any investment, industrial real estate involves strategy, knowledge, and conducting due diligence. It is considered best practice to look at factors such as location, property type, and market trends that can impact the success of an investment. Also keep in mind that real estate typically requires active management, including maintenance, tenant relations, and adherence to legal and regulatory requirements. Consider hiring a professional property manager.

Additional things to keep in mind when investing in real estate with an SDIRA include:

- The property is owned by your Self-Directed IRA, not you personally. The title is held in the name of the custodian for the benefit of the IRA.

- The investment property is meant for investment purposes only, be mindful of prohibited transactions.

- All income and expenses associated with your self-directed real estate investment must flow to/from your Self-Directed IRA.

Investment transactions within a Self-Directed IRA are facilitated and completed by the Self-Directed IRA custodian, such as Madison Trust, at the account holder’s direction. If you seek greater control of everyday transactions without custodian involvement once the SDIRA is set up, you may consider upgrading to a Checkbook IRA. Checkbook IRAs are ideal for transaction-heavy investments such as real estate. You can learn more about opening a Checkbook IRA at Madison Trust’s sister company, Broad Financial.

Conclusion: Let’s Tie It All Up

Warehouse investments with a Self-Directed IRA are a compelling opportunity for potential retirement portfolio growth. The unique benefits of a Self-Directed IRA allow you to potentially receive robust returns while diversifying your retirement portfolio.

You Have Questions. We Have Answers!

Start your self-directed investment journey by scheduling a call with one of our Self-Directed IRA Specialists today!