Back to School: Ways Students and Parents Can Be Financially Prepared

Written By: Daniel Gleich

Key Points

- A new school year is the perfect time for students and parents to financially prepare and save for education and retirement.

- A variety of accounts are available to help you invest, grow your savings, and pay for education expenses, such as a Self-Directed Roth IRA and Education Savings Account.

- Madison Trust’s Self-Directed IRA Specialists are here to answer any questions about self-directed investing.

As the crisp fall air and the smell of freshly sharpened pencils sweep in, many different emotions arise about the start of the school year. Excitement for a new beginning, nervousness for newcomers, and the possible concern of the responsibility of paying a tuition bill.

Here are some ways students and parents can be proactive and financially prepared for the school year.

Sharpen Your Pencils / Pinpoint Your Budget

Similar to how students may sharpen their pencils before heading to school, prior to making any financial decisions, it’s important for investors to sharpen their budgeting skills. Consider how you can assess your financial status and create a budget.

One simple way to start budgeting is to keep track of your monthly income and expenses. Consider creating an Excel spreadsheet with a column that adds up your expenses (rent, utilities, school supplies, groceries, tuition costs, etc.). Then, deduct the total expenses from your income. If spreadsheets aren’t your forte, consider downloading a user-friendly app to keep track. These strategies may allow you to see where you can cut back and where your spending can be more flexible.

Another way to stay on track with your financial planning is to create goals for yourself and/or your family. Consider asking:

- What would you like to achieve this school year? Do you want to make the honor roll or a sports team? Are there any expenses that will be necessary to achieve these goals?

- Do you want to go on any school trips, and how can you budget for it?

- If you’re a student, will you have a job that can assist in paying tuition expenses? If you’re a parent of a student, will your child work to help pay for tuition or other school-related expenses?

- How can you save money this school year? Can you participate in a carpool or ride your bike to school and other activities?

Open Your Notebook / Open a Retirement Account

Just as a new notebook comes in handy to take notes in class, a retirement account is an important tool to have when saving for retirement. There are many tax-advantaged accounts students can utilize to grow their savings and investment income.

Self-Directed Roth IRA

One noteworthy account is a Self-Directed Roth IRA. In a Self-Directed Roth IRA, the account holder’s funds grow tax-free after taxes are paid on contributions. Students can contribute the income earned from a summer job into this account and invest in a variety of assets such as real estate, private companies, promissory notes, and more.

Family members can open a Self-Directed Roth IRA and contribute funds on their child’s behalf, as long as the amount does not exceed the amount of income the child has earned. By contributing and investing early on, your child will be able to get a head start on their retirement savings.

It’s important to note that contributions to Self-Directed Roth IRAs can be taken out at any time. For earnings to be taken out tax-free, the account must be open for five years and the owner must be age 59 ½.

Education Savings Account (ESA)

An Education Savings Account (ESA), also known as a Coverdell Account, is another tax-advantaged way to save for education. Like a Self-Directed Roth IRA, taxes are paid on contributions, but the earnings are tax-free if used for education and the amount of the distribution does not exceed the beneficiary’s qualified education expenses.

ESAs can be opened on behalf of a minor and are strictly set aside for education expenses. ESA’s designated beneficiaries must be under the age of 18 during the year of contribution. However, the funds can be used to pay qualified education expenses until the age of 30. You can contribute up to $2,000 annually for each beneficiary.

For more information on Education Savings Accounts, please visit the IRS’s website.

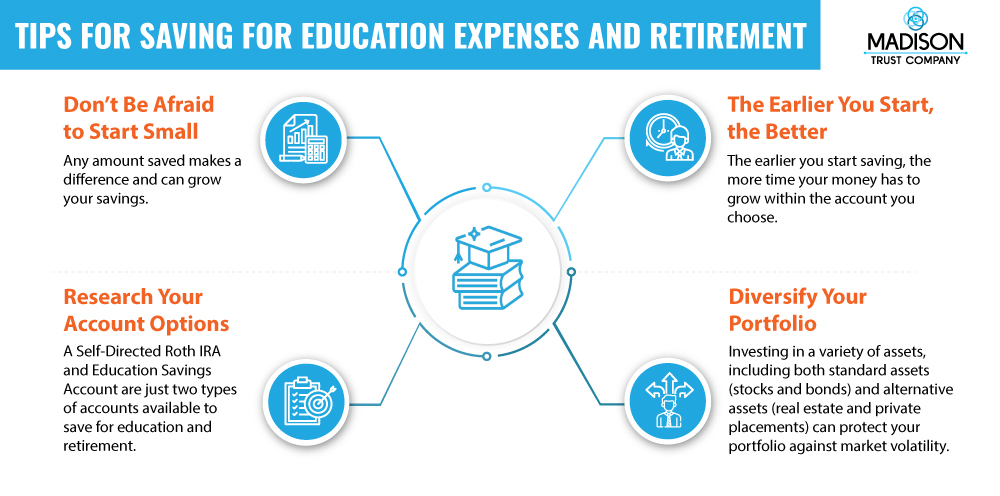

Tips for Saving for Education Expenses and Retirement

Learn / Conduct Due Diligence

Like how we go to school to learn about a variety of topics before choosing a career path, it is important to conduct thorough due diligence before selecting an account type and placing an investment. Consider speaking to a tax advisor, Self-Directed IRA Specialist, or financial advisor to discuss the rules and regulations of each account type.

Conclusion: Let's Tie It All Up

The beginning of a new school year can be an exciting time and is also a good time to think about your savings. There are a variety of accounts available to help you get started, such as a Self-Directed Roth IRA and an Education Savings Account. The work you put in now can help create a robust financial plan that encompasses savings for education and retirement.