Overcoming Self-Directed IRA Pain Points and Discovering Solutions

Written By: Daniel Gleich

Key Points

- Madison Trust’s Self-Directed IRA Specialists complete thorough, rigorous training and are prepared and qualified to address your concerns.

- Madison Trust’s flat-rate fees allow you to skip asset-based holding fees that are typically associated with SDIRAs.

- Prioritizing response time and customer satisfaction is our mantra. You will never wait in limbo, unaware of the state of your investment.

Self-Directed IRAs allow investors to directly manage their retirement savings. This provides freedom of decision-making and leaves investors enveloped in placidity, knowing control is in their hands. Due to regulations established by the IRS, all SDIRAs must be held by a custodian.

Some investors have expressed bones of contention with previous investing experiences. This includes delayed responses from Self-Directed IRA experts, specialists with lack of knowledge, and expensive administrative fees. Madison Trust has constructed a system around investors’ pain points. Our ambition is to make investing and saving for your retirement a simple and potentially bountiful endeavor. Here’s how we get it accomplished:

Employing Expertise: We’re Fluent in the Self-Directed IRA Language

Self-Directed IRAs must adhere to a plethora of rules implemented by the IRS. When investing, you want to feel ensured that your Self-Directed IRA custodian possesses the wherewithal to inform you of IRS codes, prohibited transactions, disqualified persons, and other important regulations.

Madison Trust’s Self-Directed IRA Specialists complete extensive training so that they obtain the highest degree of knowledge. From a deep understanding of different asset classes to IRS documentation, our Self-Directed IRA Specialists are here to help you all the way from account set up to placing your investments.

Rapid Response: Moving Things Forward and Preventing Stagnation

Another common pain point in the industry we aim to solve is the lull time between correspondences. When a concern arises regarding your retirement savings, knowing what’s going on is certainly important.

Madison Trust’s top priority is customer care and maintaining outstanding customer service, which is evident through our rapid response time. Our Self-Directed IRA Specialists are readily available to help you with any sudden problems or answer any sudden inquiries. With our knowledgeable in-house support staff, you’ll always be able to speak to a live representative.

Stabilize Savings: Don’t Pay to Save

Your Self-Directed IRA custodians are crucial to the entire SDIRA investing experience. Therefore, you typically will incur administrative and transaction fees to those who facilitate transactions on your behalf. Here’s the kicker: some companies will charge extra for their custodial fees, based off the total amount of funds existing in your retirement savings account. This indicates the more you save, the more you pay.

This ideology doesn’t seem conscionable. That’s why at Madison Trust we have instituted a low-cost, flat-rate fee schedule for all our account holders. The price always remains the same, regardless of the funds in your savings or the number of years your IRA has been operating. This permits you to potentially accumulate money and successfully save more than your wildest dreams - without paying for it.

Conquer Control: If Being a Do-It-Yourselfer is Your Preference

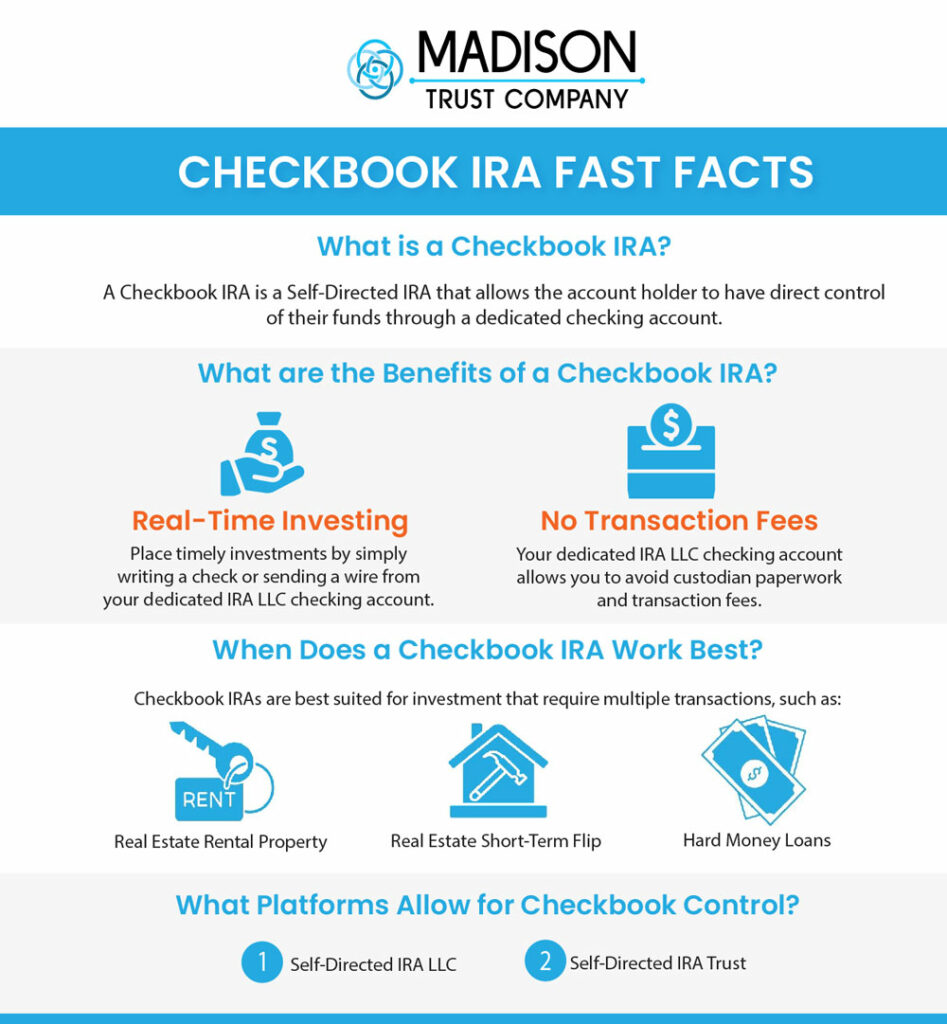

Perhaps your chosen alternative investment type relies upon swiftness and speedy purchasing. Some Self-Directed IRA investors are concerned they won’t be able to access their funds or direct their custodian to place an investment in the required timely manner. There’s a work-around that grants account holders the freedom and flexibility to make their everyday transactions on a whim, absent of custodian involvement.

Upgrading your SDIRA to an IRA LLC lets you utilize checkbook control. You can write a check or send a wire at any given moment and at the rise of any investing opportunity. This is ideal for extraordinarily active accounts which regularly perform transactions. In addition, this option allows investors to save as they typically no longer owe transaction fees.

Conclude in the Possible Culmination of Cash

While there is a potential for risk with any investment, there is equally the potential for grand rewards. Prospective investors may harbor pain points pertaining to Self-Directed IRA stereotypes and common concerns. Madison Trust offers as much guidance as needed to help you embark on your self directed investing journey with ease. Experience the Madison Trust Advantage: a combination of clear communication, reliable support, informative resources, and readily available assistance.

Our company delights at the prospect of providing you with a pleasant sojourn of investing for your retirement. We enjoy sharing our knowledge on SDIRAs. To learn if a Self-Directed IRA could fit you as an individual, schedule a free discovery call with us today.