Seeing Self-Directed IRA Loan Rules from All Angles

Written By: Daniel Gleich

Key Points

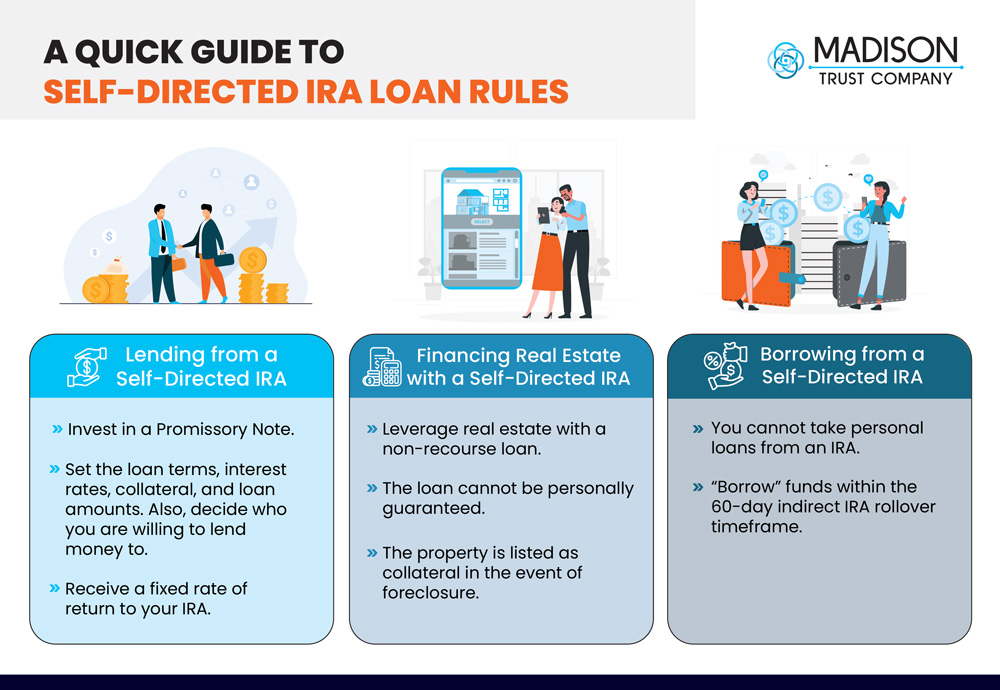

- The way to finance real estate with a Self-Directed IRA is usually with a non-recourse loan in which the property is the collateral.

- Investing in private loans (aka promissory notes) can be a predictable and secure way to grow your retirement savings by providing loans to qualified borrowers and receiving interest.

- An account holder can borrow funds from their IRA under the 60-day and once-a-year rules for indirect IRA rollovers.

Investors have many questions regarding Self-Directed IRA loan rules. Whether you’re looking to leverage your Self-Directed IRA for borrowing, investing, or lending, it’s important to understand how certain Self-Directed IRA loan rules might influence how you decide to use your Self-Directed IRA. Let’s look at the potential scenarios:

Financing Real Estate with a Self-Directed IRA

One of the most popular assets allowed in a Self-Directed IRA is real estate. The simplest way to buy real estate with a Self-Directed IRA is with cash from the IRA, but that may not always be enough to cover the purchase. While you can’t use a traditional mortgage for a Self-Directed IRA real estate purchase, you can use a non-recourse loan.

When using a non-recourse loan, the loan is not personally guaranteed, and the property being purchased is usually listed as the collateral in the event of a foreclosure. Read more about non-recourse loans as they relate to Self-Directed IRAs.

Lending from a Self-Directed IRA

Real estate is just one of the many alternative assets that you can hold in a Self-Directed IRA. A potentially lucrative opportunity you might consider is the ability to invest in promissory notes. A promissory note is the legal contract that accompanies a loan. So, instead of discussing borrowing from or with your Self-Directed IRA, we’re flipping the script and explaining how you can become a private lender using your IRA!

Investing in promissory notes with a Self-Directed IRA can be an exciting way to start building wealth. It’s similar to being the lending division of a bank. You set the loan terms, interest rates, collateral, and loan amounts—and you decide who you’re willing to lend money to. Receiving interest and installments on loans can be less speculative than other assets such as stocks and bonds. Being a lender can also be rewarding if you’re helping to fund the next great startups or small businesses. Learn more about the Self-Directed IRA loan rules for investing in promissory notes.

A Self-Directed IRA can enable portfolio diversification, hands-on investing, and greater financial freedom on the road to a rewarding retirement. See why Madison Trust is the Self-Directed IRA custodian of choice for investors of all experience levels and open your account today!

Borrowing from a Self-Directed IRA

In general, Self-Directed IRA account holders can’t take personal loans from their IRAs like they can from 401(k)s.

It’s possible to “borrow” funds from your Self-Directed IRA for a short period of time under the 60-day rule for indirect IRA rollovers. An indirect rollover involves completing the withdrawal of the desired amount of money from your Self-Directed IRA in the form of a distribution check. Then, your Self-Directed IRA custodian will assist you in depositing the exact same amount into your Self-Directed IRA (rather than a different retirement account as a rollover otherwise suggests) within 60 days. For more information on indirect rollovers, go to our Self-Directed IRA Rollover Guide.

Do you have any questions regarding Self-Directed IRA loan rules?

Disclaimer: All of the information contained on our website is a general discussion for informational purposes only. Madison Trust Company does not provide legal, tax, or investment advice. Nothing of the foregoing, or of any other written, electronic or oral statement or communication by Madison Trust Company or its representatives, is intended to be, or may be relayed as, legal, tax, investment advice, statements, opinions, or predictions. Prior to making any investment decisions, please consult with the appropriate legal, tax, and investment professionals for advice.